|

|

talksatellite

EMEA |

|

|

|

|

|

|

|

Daily news

|

Turbulent Satcom market prepares for

decade of expansion after substantial infrastructure

investments

Satcom revenues and capacity

demand are expected to show significant expansion

over the next decade with key growth opportunities

arising in universal broadband access, mobility

(aero, maritime, land), and defense/security

applications. Fixed Satellite Service (FSS) revenues

are anticipated to rebound as global satellite

capacity supply rapidly increases. In a

competitive and increasingly data-focused market,

vertical integration is crucial for recouping

investments in evolving technology.

September 25, 2023

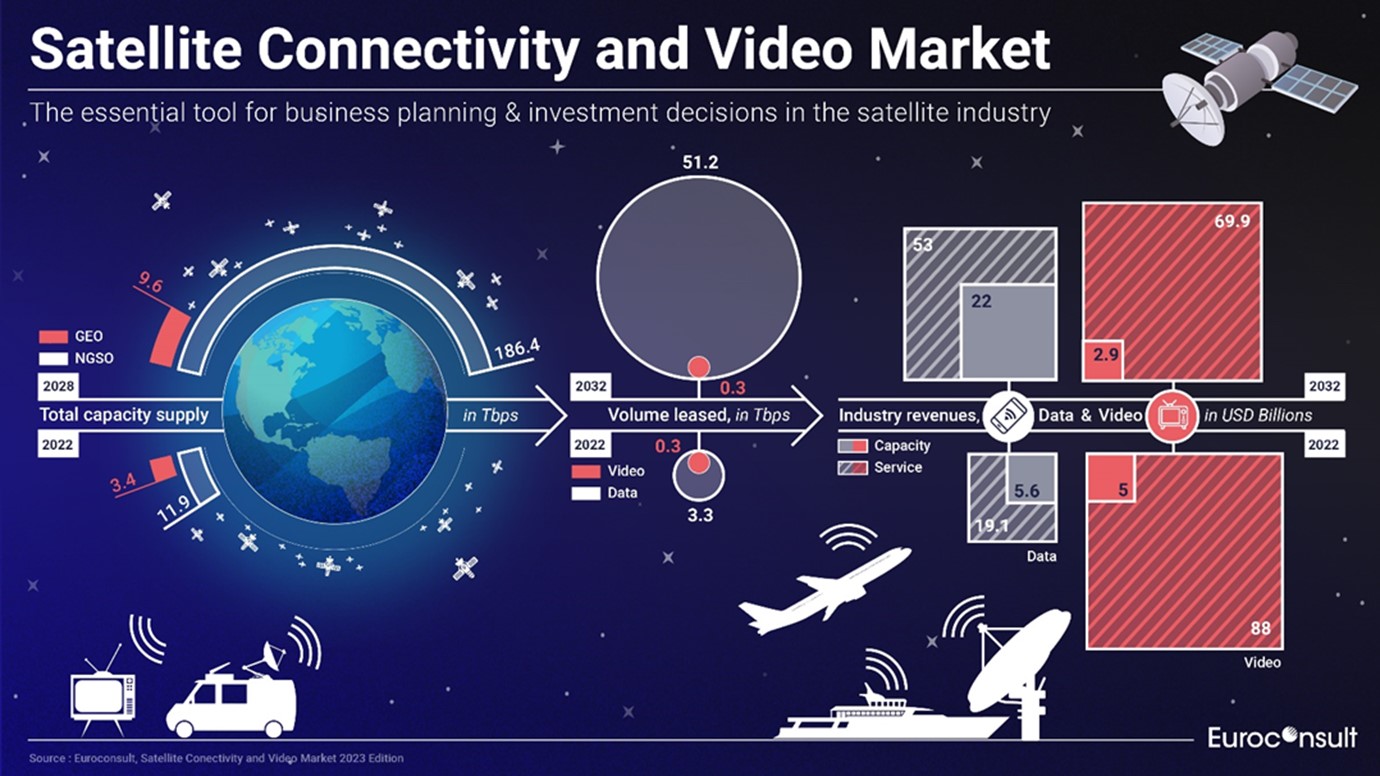

The satellite communication

landscape is poised for a transformative decade of

growth as satellite capacity demand is projected to

surge from 3.6 Tbps (TeraBytes Per Second) in 2022

to 51 Tbps in 2032, representing a 31% CAGR (compound

annual growth rate), with all data segments

expected to observe exponential growth in the next

10 years.

Euroconsult’s latest ‘Satellite

Connectivity & Video Market’ market

intelligence report unveils three major growth

prospects for the satcom industry: universal

broadband access, mobility (including aero,

maritime, and land mobility), and defense and

security applications. Additionally, Satcom service

revenues are set to rebound starting in 2023

following several years of negative growth, with

revenues predicted to rise from $108 billion in 2023

to $123 billion by 2032, totalling an estimated

$1.15 trillion in cumulative revenues over the next

decade.

Furthermore, the global

satellite capacity supply is on the brink of a

dramatic increase, with a 62% rise in 2022 alone,

reaching 15 Tbps, primarily driven by Starlink.

Anticipated to reach nearly 200 Tbps by 2028, this

expansion coincides with the introduction of new

non-geostationary orbit (NGSO) constellations,

particularly in the low Earth orbit (LEO), including

Telesat Lightspeed and Amazon Kuiper, alongside Gen

2 constellations for Starlink and OneWeb, and Very

High Throughput Satellite (VHTS) deployments like

Viasat-3, Jupiter-3, and Satria-1. Consequently, the

share of NGSO in the total supply is forecasted to

surge from 76% in 2022 to over 95% post-2026.

"The satcom industry finds

itself in a dynamic phase following substantial

investments in satellite infrastructure, presenting

both fresh opportunities and heightened

competition," said Dimitri Buchs, Managing

Consultant at Euroconsult. "The forthcoming wave of

new satellite infrastructure will herald a

transformative era for satellite operators,

necessitating strategies to recoup investments. This

entails a focus on vertical integration to optimize

costs and scale, coupled with value-added services

that enhance proximity to customers and end-users,

alongside a concerted drive toward emerging and

high-growth market segments."

In recent years, satellite

operators have adapted to the shift from a

video-centric market to a more data-focused market,

resulting in substantial investments in network

expansion and service diversification. Consequently,

vertical integration has gained ground in recent

years characterized by the acquisition of service

providers, satellite manufacturing and investments

in user terminals. Market dynamics continue to

evolve, with recent months seeing notable

consolidations, such as the completion of the

Viasat-Inmarsat merger and the Eutelsat-OneWeb

merger soon expected to be approved.

New satellite technology is

acting as a catalyst for improved economics,

including lower capacity pricing and the capacity to

provide higher provisioning rates per site and

expanding availability of unlimited data plans.

These advancements will be pivotal in meeting the

burgeoning demand for satellite capacity,

particularly in segments like enterprise networks

with cloud applications and the largely untapped

land mobility market.

|

|

|

|

|

|

|

|