|

Regulatory Barriers Limiting Cellular Backhaul

May 2nd, 2018 by Lluc Palerm-Serra, NSR

Satellite Backhaul has historically relied heavily on coverage

obligations to attract demand. Consequently, regulators were the

primary driver for demand in this vertical. However, if satcom

is to capture the massive opportunities in this vertical while

bridging the digital divide, it should be able to serve

commercially-driven sites. In this new paradigm, legacy

regulations and excessive protectionism is setting tremendous

barriers and, in many occasions, raising costs to uneconomical

levels.

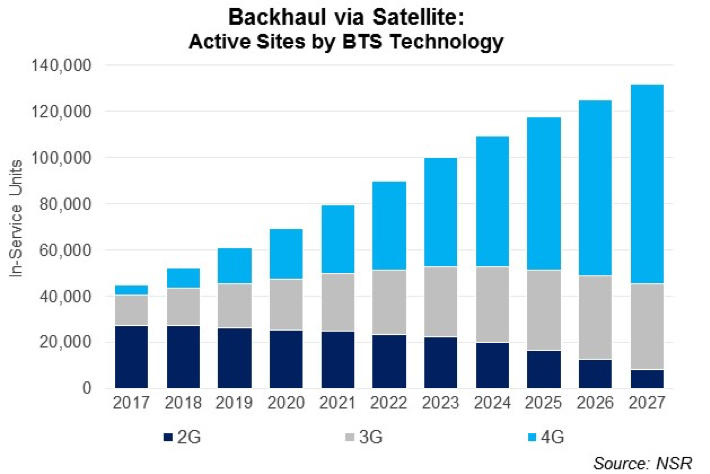

Cellular Backhaul over satellite is a

key enabling tool for bridging the coverage gap that leaves 1

every 6 people outside any mobile coverage. According to NSR’S

Wireless Backhaul via Satellite, 12th

Edition report, satellite will serve over 130,000 mobile base

stations by 2027. Or put in another way, 100s of millions of

todays’ unconnected will rely on satcom to reach the Internet.

Regulators should acknowledge the potential of satellite to

bridge the digital divide and, consequently, create a favorable

environment to facilitate development of this market.

The Good Old Days

Satellite has been traditionally used by mobile operators to

serve the most remote sites to meet the coverage obligations set

by regulators during licensing or spectrum auction processes.

Most commonly, these are 2G sites consuming relatively small

amounts of bandwidth. Consequently, satellite capacity cost was

a controlled element from the mobile operator’s point of view as

other fronts such as construction and operations of the tower at

very remote locations contributed significantly to the Total

Cost of Ownership (TCO). In this scenario, Satellite Operators

were able to enjoy generous margins on the capacity sold as MNOs

had no other alternative, and the incentives for them to put

pressure on pricing was scarce. Regulators used to be the best

allies for the satcom industry as the level of demand was mostly

dictated by USO obligations.

However, internal pressures and technology evolution in the

satellite industry have led to drastic readjustments in price

levels. Regulatory-driven deployments are no longer enough to

sustain growth, and the industry needs to activate

commercially-driven projects to participate in the boom in

IP-related market growth. Now, satellite needs to be much more

price efficient, and regulations are many times a barrier for

market development.

Unfriendly Regulations for Satcom

Satellite has done a tremendous job in increasing its

competitiveness in this vertical with innovative technologies

both in space and on the ground. However, it still encounters

important barriers in multiple fronts. Some of the biggest

markets for Cellular Backhaul over satellite present very

stringent regulations. China is essentially a closed market,

India presents very rigid conditions for international actors,

and many other countries in regions such as Africa or Southeast

Asia have tough conditions like the requirement to land traffic

locally. Given the new HTS architectures, many times with

pre-defined gateway beams, this condition lures away the cost

benefits of the new generation of satellites.

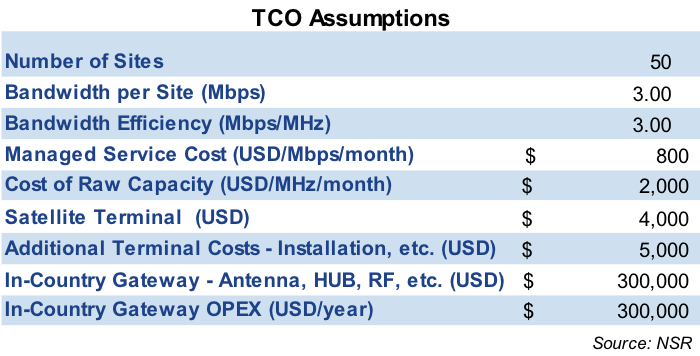

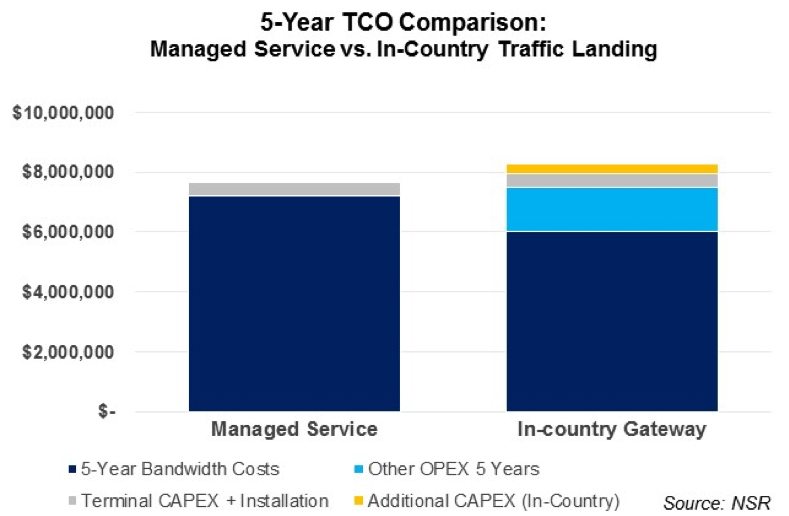

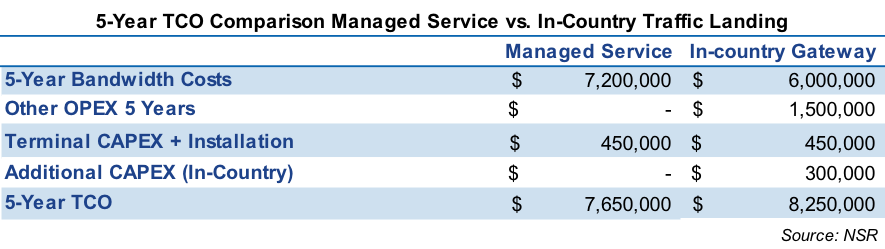

Running a use case scenario with 50 sites and a bandwidth

consumption of 3 Mbps per site (industry standard for a 3G

network) and comparing a fully managed service (bandwidth fully

managed from the HTS gateway) with an In-country gateway (needs

to develop a local landing spot with HUB, antenna, network

management team, etc.), one easily finds the extra cost

generated when this kind of requirements are in place.

Furthermore, developing the capabilities to run this kind of

network, finding the talent, etc. are not easy tasks. Many of

the new HTS satellites are not even able to support this kind of

network as the entire traffic needs to pass through one of its

predefined gateways.

Not all Capacity is Equal

In view of these requirements and with an eye on this growing

vertical, some satellite operators are deploying HTS systems

that have greater flexibility to support in-country landing of

traffic. This is the case for Intelsat’s EPIC with its digital

payload supporting any beam to any beam communications. Others

like Avanti are designing and setting up In-Country gateways in

key markets like Nigeria.

In order to respond to these requirements, equipment vendors are

also adapting their offer with a range of low-CAPEX baseband

equipment. Some like UHP are even going one step further,

offering remote cloud-based network management systems for

in-country networks.

Bottom Line

The satellite industry has progressed in becoming a competitive

solution in the Cellular Backhaul ecosystem. However, there are

still multiple barriers somehow outside the control of the

industry, ranging from awareness, perception and the regulatory

ecosystem.

Regulators have long been allies driving demand for the satcom

industry in the form of USO requirements and coverage

obligations. However, in this new business environment in which

satellite wants to play a bigger role in commercially-driven

deployments, some aspects of the regulatory ecosystem are

dragging industry growth.

Some actors are adapting to the legal requirements to serve the

backhaul market gaining an advantage in the form of customized

capacity with traffic landing flexibility.

|