State of the Satellite

Industry – The NSR FSS Index

Apr 15th, 2018 by Gagan Agrawal , NSR

Much has been commented about the current state of the

industry: capacity oversupply, declining capacity prices, a

shift to service businesses to strengthen top-line revenue,

partnerships with end-customers, and consolidation necessity

to future-proof. After a careful study of the past few

years, it is certain that most trends are true - reflecting

operator strategies as 2017 financial results show. Though,

less quantified is the effect on the FSS industry due to

these unanticipated changes in recent times. From FSS

wholesale price decline as analysed in NSR’s Satellite

Capacity Pricing Index, 4th

Edition, revenue and market cap erosion, to changing IRR

estimates of fleets older than 7 years, and eroding asset

value – the FSS industry definitely is in a state of

transition.

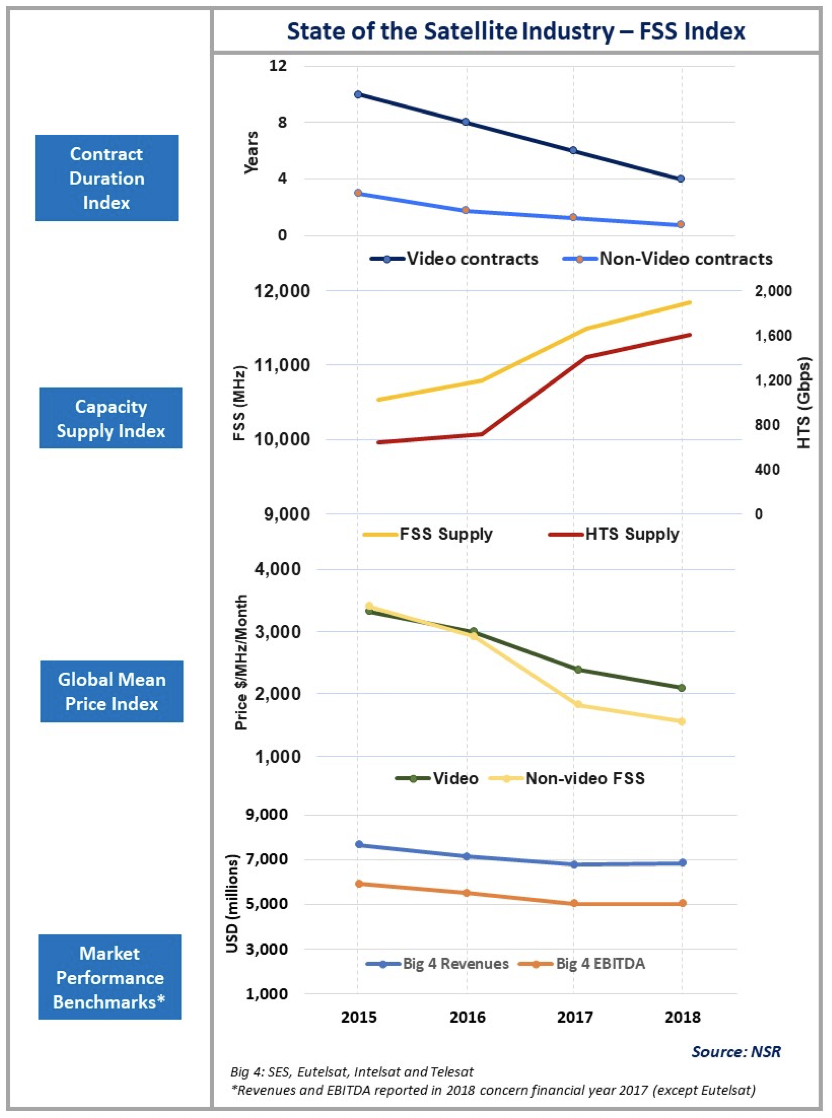

The chart below mentions 4

critical parameters defining industry progress. From 2015 to

2018, impact of contract duration, capacity supply, Global

Mean Price, and financial parameters such as revenues and

EBITDA are compared to build an “FSS Index”. The decline in

both video and non-video contracts is sharp and closely

mirrors the price decline over the same period.

Traditionally a shorter contract would mean a higher price,

although the corresponding increase in supply every year has

ensured the price correction upwards couldn’t occur.

While FSS capacity increased at ~14% over the past 3 years,

HTS capacity more than doubled during the same period. This

had an outsized influence over both relevance of FSS

capacity (barring certain maritime segments) and wholesale

pricing as shown in the Global Mean Price Index. Both

video and non-video pricing declines had direct influence

over top-line revenues of the Big 4 operators in the same

period. Simultaneously, HTS prices corrected sharply as

well, owing to lower CAPEX/Gbps capacity introduction, and

with operators starting to embrace a services model, the

EBITDA margins have started to come down as well. Thus, the

industry grapples with key questions on future growth.

As the graph shows, from 2015 to 1Q 2018, contract duration

decreased from an average 10 years to 4 years for video and

to less than 1 year for non-video. Global FSS capacity

supply increased by 14%, while HTS capacity increased almost

100%. Prices dropped by more than 50%, though revenues

for the Big Four dropped by only 10-11%. Most capacity deals

signed during the 2016-17 price decline period reflect

future revenue guidance for operators, thus only partly

affecting top line revenues from 2015 to 2018 reported

results. In the same period, demand for backhaul, broadband,

trunking, maritime, aero and high priced Gov/Mil sectors

increased, while video distribution and DTH in developed

markets lagged. Along with this demand uptake, there has

been a surge in managed services revenue for SES and

Intelsat side as well, covering video, maritime and Govt/Mil

sectors. The anticipation was always that this increase in

demand uptake, along with forays into managed services,

would propel top-line revenue (at least 5% growth), while

simultaneously checking the erosion of capacity pricing by

un-commoditizing it. This anticipation hasn't come true, and

capacity prices have fallen sharply due to competition,

resulting in this 10% revenue decline for Big 4.

Analysing 2018, the industry (for all purposes of growth and

stability) views HTS as the new messiah, whereas several

strategies have been touted by the industry to overcome the

slump. Prices for HTS capacity may still have more room to

decline, adjusting to bulk buying from service providers,

but FSS capacity appears to have reached precariously low

levels. Barring high SLA corporate networks and high-value

Energy segments, most capacity is sold at just above

break-even levels, with C-band going below break-even in

many cases. The future of the FSS market thus remains

non-sticky and unstable as capacity supply reaches beyond

12,000 36 MHz equivalent transponders in 2020. A few

critical factors are analysed below to ascertain the

buyer-seller dynamics in the past couple of years, and what

can be expected in the future:

-

Competition and Customer Retention: This is single

biggest influencing factor for the drop in aero and

backhaul prices in 2017, as there is an easing of

horizontal market share takeover and more focus on

downstream market share. Thus, customers are more

stable, ready to sign framework agreements for yearly

price negotiations and learning to differentiate between

value of ‘premium’ and ‘cheap’ capacity.

-

Value Chain Effect: PayTV subscriptions are bound to

have an adverse effect on Video Distribution and DTH

prices in developed markets, more recently witnessed

with the 5% fall of Western European hotspot pricing in

2017-18. Meanwhile, any service provider consolidation

is expected to further place pressure on wholesale

prices.

-

Technology Efficiency: Increasing spectral efficiency

will force operators to sell more Mbps, which in turn

will cannibalize less efficient FSS capacity. Expect the

data vertical to be the worst hit, both on pricing and

consequently on recovering break-even costs

Bottom Line: What to Expect in

the Future

Satellite markets inevitably are moving towards an

integrated approach, and it wouldn’t be surprising to see

falls in the contract duration index, Global Mean Price

Index and revenue/EBITDA margins further until 2020, before

a revenue rebound occurs. To understand the impact on FSS

and HTS markets, do reference NSR’s 2019 forecast prices.

Further, market cap and share prices are precariously placed

in the next 1-2 years, whereas dividend pay-out has sharply

decreased. Future CAPEX investments have also put some

operators on the brink of investment grade. Whether the next

generation of HTS and non-GEO satellites boosts top-line

revenues for the operator industry remains to be seen,

though certainly it is a tough road ahead for the FSS

segment.