Pumping the Brakes on the Connected Car

Apr 4th, 2018 by

Dallas Kasaboski NSR

The connected car is one of the most talked about opportunities

for satellite-based flat panel antennas, yet it remains elusive

and still many years away from being realized. With millions of

vehicles entering the market every year, the successful

deployment of the connected car via satellite could be very

lucrative for FPA manufacturers. However, NSR and

others

remain quite critical

and conservative on its potential, viewing

the value chain as fragmented, the

use-cases poorly defined, and the

technology and price points not yet

suitable

for widespread adoption. These factors have pumped the brakes on

the connected car, but the indirect effect of trying to develop

this market has developed other uses cases such as connected bus

and trains.

Driven by enterprise-focused

applications, such as M2M/IoT and passenger connectivity, the

last year saw considerable progress for land-mobile FPAs, with

announcements from Caterpillar Machines and Penteon (both

through hiSky), Satcube, Pivotal Commware, and even Kymeta..

Safety, autonomy, and the need for analytics have driven the

successful deployment of commercial land-vehicle FPAs.

So, does that mean it could have a

positive and shift the satellite connected car market into high

gear as well?

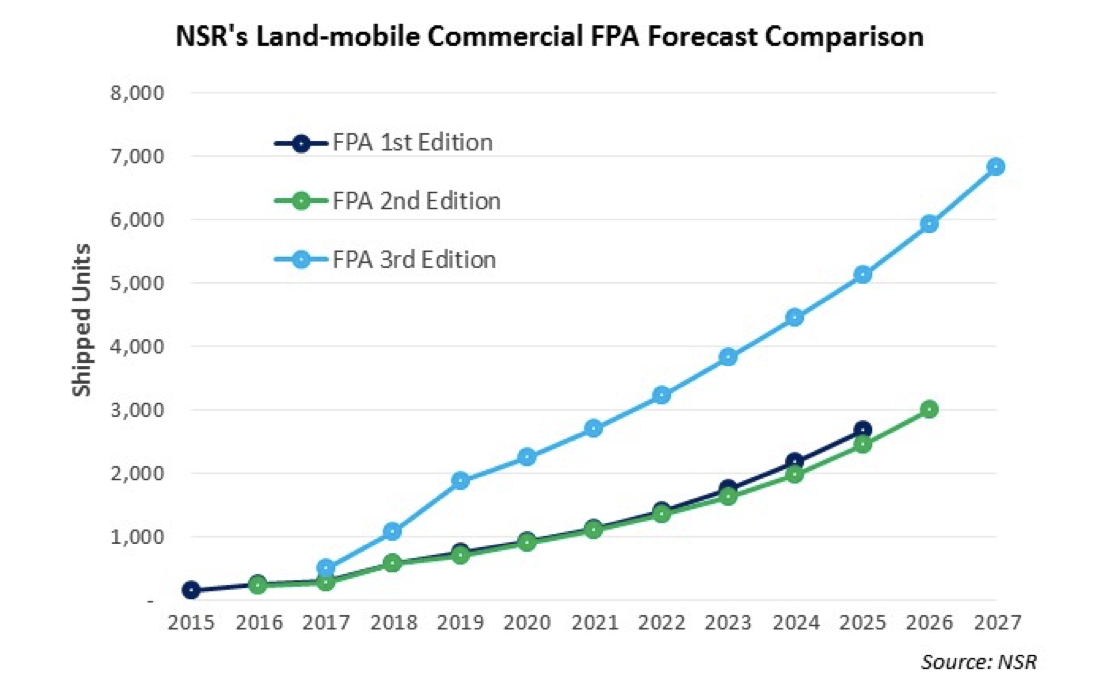

In NSR’s

Flat Panel Satellite Antennas, 3rd

Edition report, the

cumulative equipment revenue opportunity for

land-mobile FPA applications is

projected to grow to $94 million

over the next decade, at a CAGR of 14.8%. North America will

take the lead, responsible for 39% of the market opportunity

over the next decade, due to an established panoply of FPA

manufacturers with a land-mobility focus. Enterprises looking to

monitor engines, vehicles, and cargo are turning to flat panel

antennas for their low profiles, while equipment manufacturers

are finding the generally lower bandwidth requirements an easier

means by which to enter this vertical.

These factors led NSR to adjust the

land-mobility forecasts upwards.

However, with only 6,800 units expected to ship by 2027, it is

clear the satellite connected car is not expected to drive the

land-mobility FPA market.

Several challenges remain for the

satellite connected car.

Price and performance are key obstacles, compounded by

line-of-sight issues and complicated value chain relationships

between OEMs, equipment providers, and drivers.

More so than any other market,

terrestrial competition is of primary

concern, as the ubiquity of mobile connectivity detracts from

the value proposition of satellite.

Indeed, while there is a strong focus for the connected car in

China, it is not for the

satellite

connected car, with many cellular mobile telecoms partnering

with Chinese automotive manufacturers.

The Bottom Line

The connected car market is sure to

become a reality.

From autonomous vehicles, software

updates, and passenger connectivity, demand is growing.

Partnerships along the value chain are working to meet this

demand, by ensuring that the next generation of consumer

automobiles comes standard with always-on connectivity.

Hybridization is where satellite fits in, a fact recently

endorsed by Intelsat. Satellite/cellular hybrid solutions would

allow the unique value propositions of both technologies to work

together, taking advantage of wide-area coverage, high speed,

multicast delivery, everywhere, all the time.

Going forward, land-mobile FPAs will be better suited for the

connected bus and train, monitoring fleet operations and

providing valuable insights through low bandwidth M2M/IoT

solutions as competition, price, and performance will be key

challenges stalling the prospects of the satellite connected

car.

|