The Satellite Capacity Price Conundrum

Mar 26th, 2018 by Gagan Agrawal, NSR

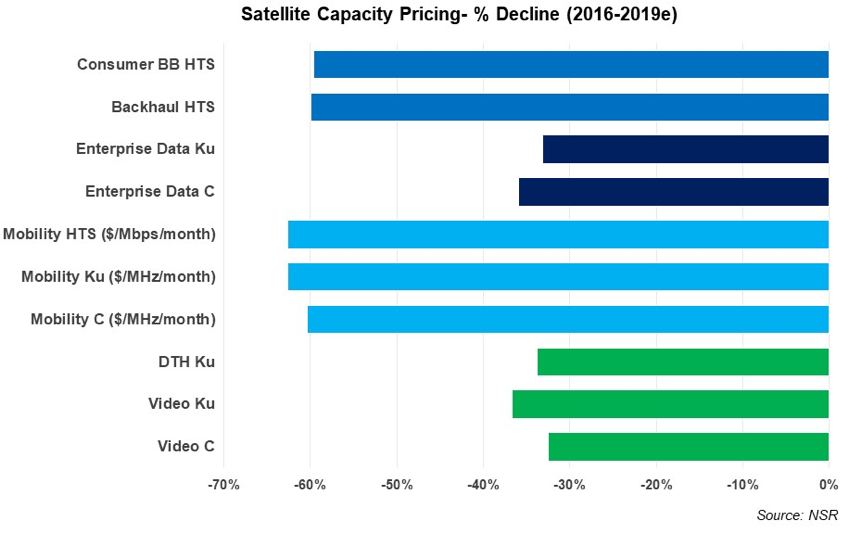

The satellite industry has witnessed a meltdown over the past few years

with capacity prices falling over 30-60% across most verticals. This

decline doesn’t just stem from increased supply and competition, but

also from critical intertwined factors: increased bargaining power of

service providers (SPs) as operators dilute their market positions for

aggressive selling and a correction for high-throughput capacity to

account for CapEx/Gbps cost proportionate to end-lease price. These

drivers essentially mark a sharp transition in the satellite industry,

one that shifts from premium lease models (barring Government segment)

towards a telecom or service industry ARPU-influenced requirement. This

fundamental change due to price declines underpins the question on

sustainability – which we answer by looking at both historical price

drivers and the modus operandi available to satellite operators.

As described in the figure above, NSR’s

report sheds light on the Global Mean Price Index and the performance of

individual verticals over the past 3 years. As with any industry,

buyer-seller dynamics play a strong role in influencing price changes

along with supply-demand, though the current industry faces key

challenges on several fronts. Key changes to price drivers over

the past 2 years include:

-

Decreased focus on duration of lease contract period, and much

higher focus on the bulk amount for lease

-

Plateau in video demand, increase of discounts in backhaul

influenced by low fill rates and increased market share competition

in mobility

-

Price declining not only due to high regional competition but

also from impact of OTT in developed countries, higher efficiencies

for selling Mbps and extensive fiber deployment programs in unserved

areas

These changes indicate the industry must counter the over reliance on

FSS capacity attributes of fill rates, large contract periods and

associated backlogs, regional rivalry on ‘similar’ capacity, and selling

MHz on legacy satellites that are not CapEx/Gbps competitive anymore.

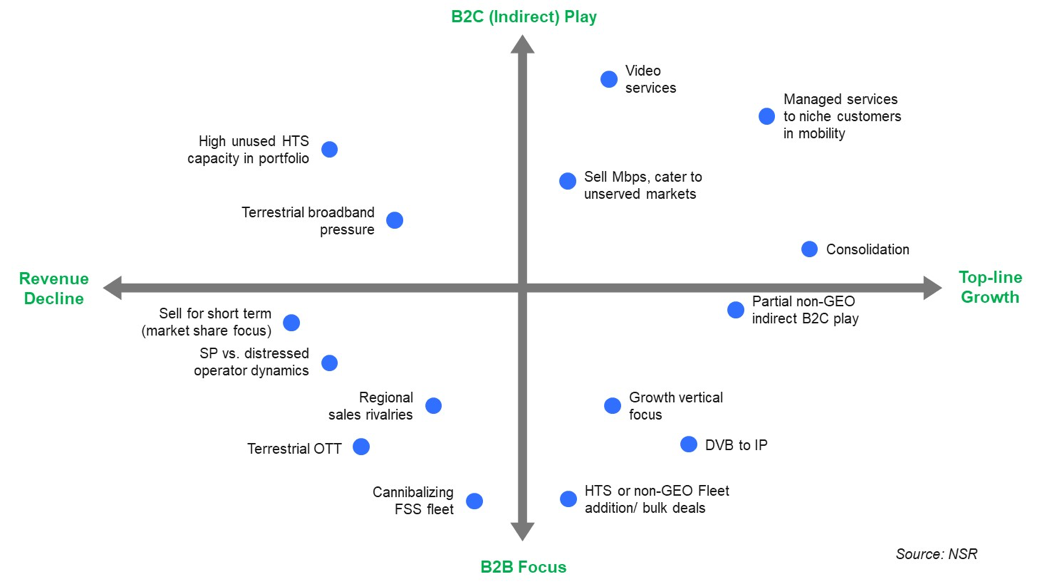

There have been strategies proposed and deployed to counter this, which

are apportioned to a Growth vs Business model exhibit (as below) to

gauge sustainability from a birds-eye point of view.

The need for sustainability stems from both aggressive future price

decline predictions and the induced forced shift in business models. The

inflexion point appears still far away with the industry awaiting more

GEO bulk leases and competition intensifying with pre-anticipation of

LEOs. Dissecting the exhibit above, key points start to emerge:

-

Industry conundrum on operator-service provider dynamics – does a

clear winner here create additional value for the satellite industry

amongst the wider telecom business? Selling Mbps or managed service

or selling severely low-cost CapEx/Gbps seems to be the winning

criteria – business models that both plug the gap in connectivity

demand through satellite architecture and can elastically scale.

-

If the above is true, how sustainable are

FSS operators, as there seem to be more revenue decline factors for

a pure B2B play compared to top-line growth. Cannibalizing legacy

fleets is no more a distant dream as it continues to happen with

C-band in the data vertical; and with tight sales positioning, short

term strategy guidance for regional operators and high bargaining

power with SPs, prices are tumbling faster than expected.

-

If the B2B strategy is not fool-proof, then

do operators have the bandwidth, experience or willingness to go

downstream and fundamentally change their organizational structure

to a service-centric business? With a shift towards indirect B2C

play and LEOs, high EBITDA margins will increasingly become passé

for the industry, as both operators and service providers grapple

with high costs of network management on under-utilized capacity.

Bottom Line

Some options appear more satisfactory than others, and many apply to

regional and global operators differently based on a variety of

strategies. Though, where it seems that an indirect B2C play may

be a winner in the longer term, the question is whether operators are

doing enough and fast enough to move to the top right quarter of the

graph and embrace this fundamental shift? The long-term sustainability

hinges on integration – IP for video, ground equipment for broadband and

mobility, retail play via own satellites to save OpEx, or consolidation

(back-end video services or front-end verticals addition) to create

scale. With prices falling, the industry will be harsh on laggards, and

will reward those who innovate both on fleets and a fluid organizational

structure to adapt to the ‘new customer’ and survive in the next phase

of competition.