With Smallsats, Can 1 + 1 = 3?

Mar 21st, 2018 by Carolyn Belle, NSR

Attendance at last week’s SATELLITE 2018 in Washington, D.C.

demonstrated the expansion of the traditionally GEO communications

focused satellite industry to a more diverse collection of players and

applications. Discussions of broadband connectivity, the potential of

Big Data, and cost reduction involved established and emerging players

alike, with smallsats entering the dialogue more than ever before. Given

the challenges and opportunities facing the satellite industry today,

can more capable smallsats enhance architectures and add value?

Multiple commercial projects point to a resounding ‘Yes’. Last month

start-up Astranis announced a $13.5M Series A to fund development of

~300 kg GEO satellites, targeted for operations in partnership with a

GEO telecommunications operator. Eutelsat publicized the new ELO

program, starting with technology development cubesats from Tyvak to

build out capabilities in the IoT marketplace to complement existing

video and data business. The ELO announcement continues the series

of established GEO and LEO satcom operators looking to diversify their

fleets with non-traditional assets: Intelsat + OneWeb, Telesat’s LEO,

JSAT + LeoSat, Thuraya + Astrocast, and Iridium + Hiber (ex-Magnitude

Space), etc.

On the military side, U.S. DoD news in recent months highlighted the

rising importance placed on resiliency and the risks of relying on few,

high value assets in a more contentious world. Projects such as DARPA’s

Blackjack, SMC’s ongoing Space Enterprise Vision, evolved SBIRS, etc.

support an overall aim of more diverse architectures that can better

address a range of requirements and operational contingencies.

NSR’s Small Satellite Markets, 4th

Edition forecasts $25B in manufacturing and launch revenue over the next

decade – a significant figure, but one dwarfed by the impact of services

that is truly driving this market. Some of this will come from unique

services offered by smallsats alone, but NSR finds growing potential for

smallsats to create value when operating alongside larger birds in

integrated systems.

NSR sees potential for an outsized impact on both the communications and

the remote sensing sides of the market, as well as in growing demand for

situational awareness. Commercial developments incorporating smallsats

are not simply bids to expand revenue streams via adding new services,

nor can their value be reduced to only lower cost or often-cited rapid

technology refresh possibilities. There is no one solution, no killer

app, no single benefit to come from smallsats. The advantage is that

smallsats expand the scope of capabilities and flexibility available to

operators, providing new tools to improve overall system efficiency and

value proposition that can be leveraged as needed.

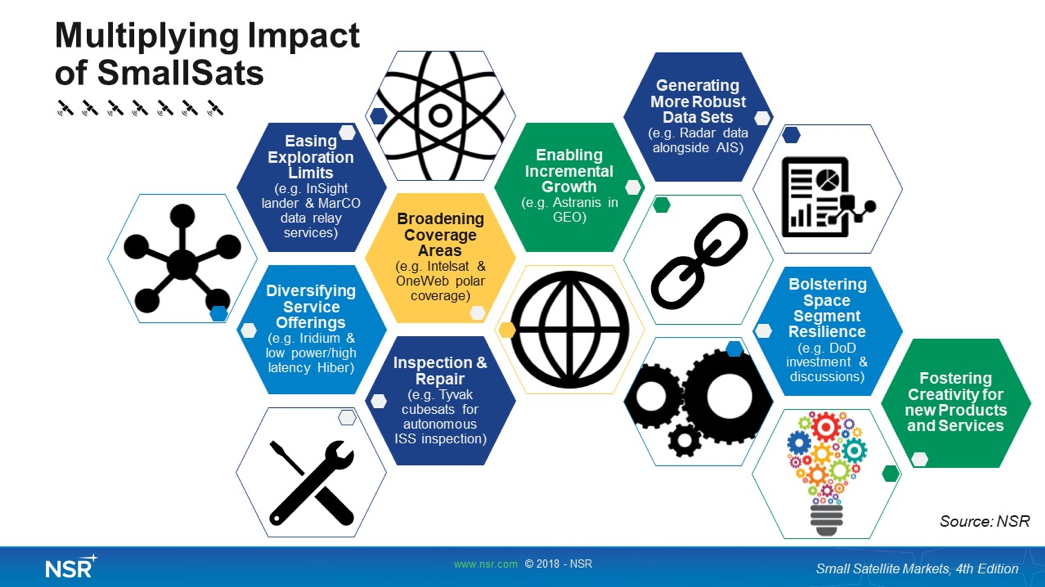

Smallsats are thus simply another piece to the value creation puzzle:

from facilitating rehabilitation of damaged satellites via inspection to

enabling incremental build-out of services to providing multiple

additional data layers for decision makers, smallsats open the door to

new CONOPS and more optimized systems. This can help operators balance

CAPEX, timing of asset deployment and expansion, service capabilities,

and addressable market.

Ultimately, smallsats help to foster a creative approach to delivering

space products and services, a mindset towards innovation that might

pull the industry out of the traditional paradigm that constrains both

cost cutting and market growth.

The Bottom Line

As many attendees realized last week in D.C., for the satellite industry

to move forward and be competitive in the global marketplace, it needs

innovative solutions and a more open approach to addressing demand.

Acting in tandem with larger satellites and diverse assets, smallsats

open the door to enhanced operational potential. A balanced use of

nimbler LEO and GEO smallsats alongside highly capable, larger

satellites provides a flexible way to address the evolving consumer,

enterprise, and government requirements of a more interconnected world.

In some cases, 1+1 really can = 3.