|

Meaningful Smallsat M&A

Jan 16th, 2018 by

Carolyn Belle, NSR

The smallsat manufacturing and components market has developed somewhat

haphazardly – a combination of post-university projects, commercial

start-ups, and established companies growing into the smallsat business –

producing a multitude of players in an increasingly competitive market. M&A

is the natural consequence for this young market as it matures and companies

seek to consolidate market share. Recent deals provide an understanding of

what players are hoping to accomplish by aligning their interests, and what

this might mean for the smallsat industry at large.

-

In December 2017,

ÅAC Microtec acquired Clyde Space

in a deal that will see Clyde Space owners take a 49% stake in the new

entity. This end of year deal, coming mere months after Clyde CEO Craig

Clark noted efforts to raise additional funding for expansion that

included an openness to acquisition, unites two subsystem and end-to-end

manufacturers. The combined company has a

broader portfolio and enhanced ability to

pursue new opportunities,

building on their mutual experience, resources, and distribution

networks.

-

General Atomics acquired the U.S. assets of

Surrey Satellite Technology

in November 2017, following the latter’s decision to close its U.S.

subsidiary. With only limited cubesat experience, this move

provided GA with a means into the broader

smallsat manufacturing market

without investing the time and effort to build capabilities from the

ground up. GA will be able to leverage the SST-US facility and trained

personnel alongside its own strong position as an incumbent defense

contractor to compete for ~1-500 kg projects.

-

Late 2016 saw end-to-end manufacturer

GomSpace

acquire NanoSpace,

a propulsion subsystem provider. This step towards

vertical integration controls costs and

brings an increasingly sought-after capability under GomSpace’s control,

providing a competitive edge not only in general demand, but

particularly for upcoming constellation RFPs likely to require advanced

maneuvering capabilities.

-

While more partnerships than formal M&A,

the mid-2017 agreements between

Lockheed Martin & Terran Orbital

and

The Space Alliance (Thales Alenia

Space/Telespazio) & Spaceflight Industries

highlight the growing interest of traditional prime manufacturers in the

smallsat sector. Both plays

enable established primes to expand their

know-how in the budding

smallsat market without requiring significant internal R&D, while

allowing the younger partners to benefit from their deep pockets and

expertise. Such arrangements also open opportunities for cross-marketing

and unique proposals that leverage the niche skills of each partner.

While instances of such M&A and partnership

activity are limited considering the vast number of component and platform

manufacturers active in the smallsat industry, its

importance within the lens of expanding demand

for smallsats is meaningful.

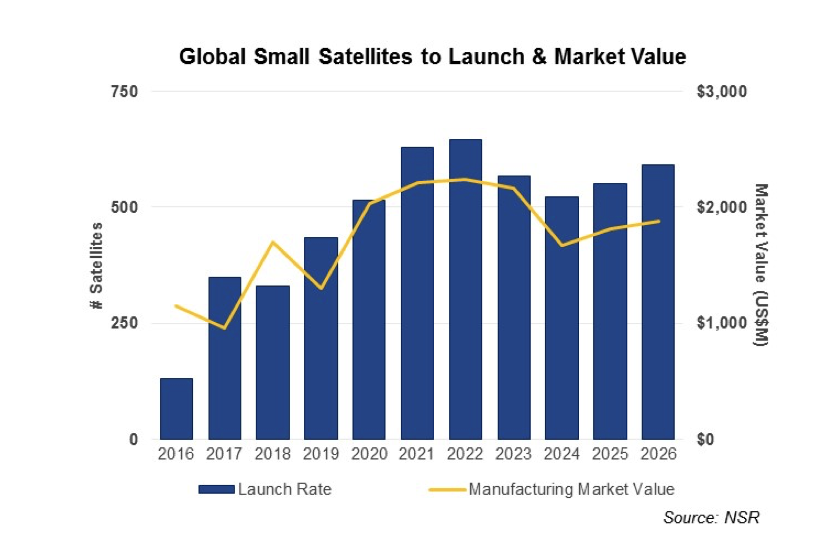

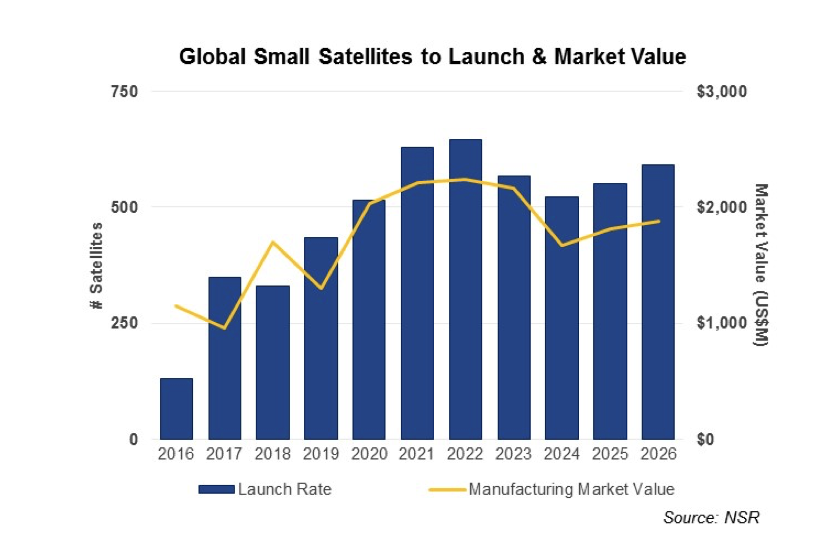

NSR’s

Small Satellite Markets, 4th

Edition, found the

annual launch rate will approach 600 satellites by 2026, a more than

four-fold increase over 2016.

This level of activity will generate a total $17

billion in manufacturing revenue. As the market will progress towards fewer,

bigger contracts alongside consolidation within the operator space,

each win is high stakes for manufacturers.

The Bottom Line

The smallsat manufacturing market is in the early

stages of what will be an increasingly active M&A period as competition

heightens.

The consolidated manufacturing landscape that

results should be beneficial to smallsat operators,

as each combined entity will have a

broader portfolio of solutions

and the enhanced engineering team to solve complex requirements. In this

environment smallsat manufacturers and component providers must be

aggressive in securing market share – or otherwise leave themselves open to

acquisition, or being squeezed out of the market altogether.

|