|

|

What’s Special About V-band?

Jan 14th, 2018 by Jose Del Rosario, NSR

Apart from being lightly licensed and allocated, very little

in-fact. Being in a higher frequency range

compared to Ku-band or Ka-band, V-band is more susceptible to rain

fade, presenting technical and market challenges compared to current

solutions. More importantly, apart from

experimental payloads and systems on the ground to support such

trials, ecosystem development in terms of equipment on the RF and

antenna side have not been fully developed.

So why does NSR forecast cumulative 2023-2030 revenue streams of

over $12.6 billion for capacity sales and leases as well as $23.8

billion in service revenues from the global Enterprise VSAT,

Consumer Broadband and Backhaul markets?

The answer is simple – it’s not about technology, it’s about

spectrum availability and dramatically improving the end user

experience via a cost-competitive offering.

Such whopping numbers, if one estimates a LEO constellation costs

roughly $3 billion on average, would lead entrepreneurs, “New Space”

proponents and investors to launch and support V-band programs

immediately given the attractive revenue prospects.

The thing is, it may already be starting to happen.

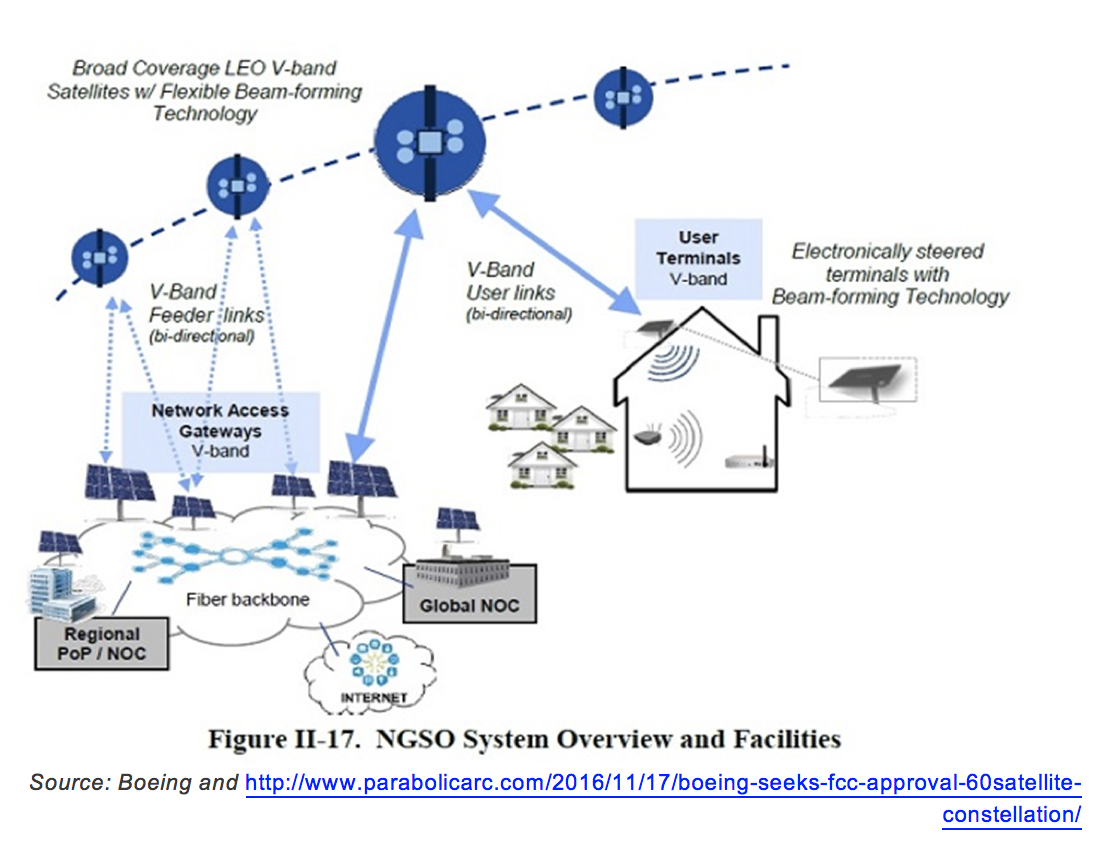

Filings from around the globe and in the U.S. Federal

Communications Commission (FCC) have SpaceX, Boeing, OneWeb, O3b,

LeoSat and Telesat Canada (among others) planning to launch over

10,000 satellites either for standalone V-band programs or as

complementary satellites to primary plans for Ku-band and Ka-band

HTS systems.

By 2023, NSR in its latest research study, V-band via Satellite

Markets, assumes a V-band venture will be launched in LEO and

another one will be followed some years after. Market hindsight

would have been established where pricing, partnerships, and

vertical targets would point to a compelling market offering and the

establishment of distribution mechanisms and partnerships. The

hindsight will not come from V-band given that it’s the new kid on

the block, but from the experience and lessons learned from the

missteps and successes of other HTS offerings in C-band, Ku-band and

Ka-band in GEO and Non-GEO orbits.

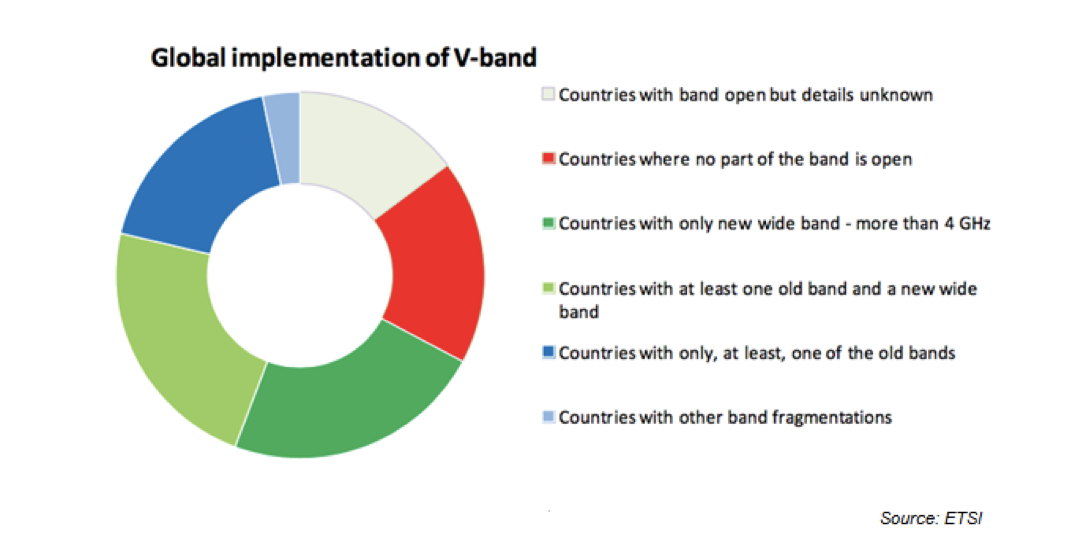

By 2023, NSR assumes a V-band player would have resolved

licensing, landing rights in key country markets, equipment/antenna

development, the technical challenges of rain fade and crafting a

distribution mechanism, which all lead to a better offering in terms

of end user experience and price points. A key

part of the ecosystem that must be developed is lowering equipment

pricing. And here, NSR assumes a V-band player will have to take the

risk of ordering a high volume of terminals to achieve economies of

scale and thus lower the per unit price. Risk-taking in launching a

system in the sky as well as risk-taking in terms of high volume

orders for equipment on the ground will be key areas for success.

One without the other is a recipe for failure.

Bottom Line

Given the total market opportunity for satellite capacity and

services until 2030, V-band will not take over the Enterprise Data,

Broadband Access and Backhaul markets as well as other verticals

that have still not been speculated upon such as the Mobility and

Military segments. But V-band will enter or should enter the fray

with a competitive price offering, higher bandwidth per unit feature

and key partnerships, which will enable a market player or players

to take a decent amount of market share from existing and planned

Ku-band HTS and Ka-band HTS systems. In terms of the total market

opportunity, V-band is expected to account for less than 10% market

share in the three verticals cited above but still translate to a

healthy cumulative revenue stream validating the business case for

launching at least one V-band system.

|

|