The Hidden Risks of Verticalization

Jan 2nd, 2018 by Lluc Palerm-Serra, NSR

In these transformational times for the satellite industry, the value chain is contracting, creating new tensions in the ecosystem. Factors such as the emergence of HTS, the severe pressure on raw capacity pricing or the growth in new verticals like mobility are only accelerating this trend. Multiple Service Providers are already complaining about Satellite Operators ‘poaching’ their customers, but beyond the short-term contractual preferences for these networking companies, the long-term implications of this verticalization are critical, and operators must ponder how to create sustainable market conditions.

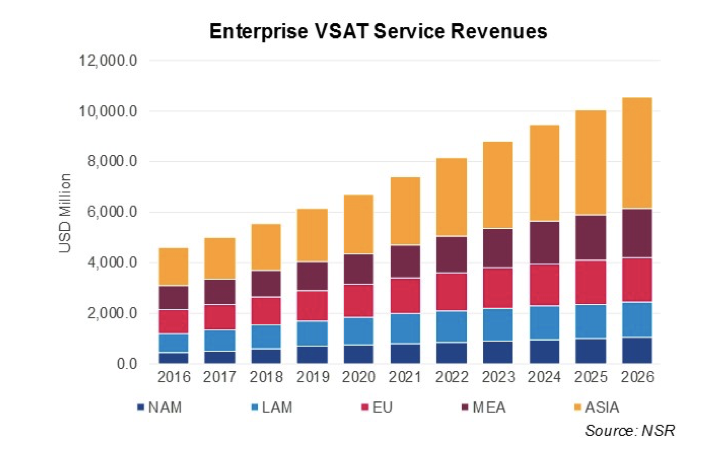

In a market with tremendous pressure on pricing and margin cannibalization, Satellite Operators are desperate to capture additional sources of revenues. Furthermore, if we consider that NSR’s VSAT and Broadband Satellite Markets, 16th Edition estimates Service Revenues for Enterprise VSAT to expand to $10.5 billion by 2026 growing at 8.7% CAGR, one can easily understand why operators are moving to pick the low-hanging fruit. To what extent is this contraction putting the ecosystem at risk?

Technology Evolution Influencing New Business Models

HTS is very CAPEX intense for ground equipment if multiple beams must be illuminated. In parallel, new networking capabilities like flexible capacity allocation are driving Space and Ground Segment to couple and work closer together. Satellite Operators are now investing in ground platforms to stimulate adoption by Service Providers while achieving the highest levels of asset utilization.

This translates into operators now offering deals in Mbps rather than in raw MHz and having better visibility over traffic and key end-customers requirements. Some operators are taking advantage of this new situation to leapfrog Service Providers and target end users directly.

CAPEX Is Not Enough

Spending money on CAPEX is the easiest part of any business, but too many projects in the Satcom industry reliant on the old motto of ‘Build it and they will come’ have failed. To truly develop a competitive service offering, operators need to develop last-mile sales teams and a customer care infrastructure they lack today.

The current model might work for high-end and sophisticated customers with in-house capabilities, but to expand the model to widespread markets, operators must ask themselves if they can land a technician in the middle of the Sahara to carry unexpected maintenance works to maintain service levels.

A Domino Effect

In this highly contested environment and with end-users becoming more sophisticated, Service Providers are integrating new layers of services such as encryption, content management, end-to-end integration, premium Quality of Experience, advanced network management and many others. These new services help counterbalance the effect of lower capacity pricing, but ARPUs are staying flat.

The contraction of the value chain also has tremendous implications for equipment vendors. With Satellite Operators integrating investments in ground platforms and the Space and Ground Segments coming together, demand is aggregating into fewer, larger deals augmenting the risk (but also the reward for the few winners) for VSAT platforms.

All in all, with bandwidth commoditizing, service providers under extended pressure and fewer deals for equipment vendors, the different layers of the satellite industry appear to be approaching a consolidation period.

In addition, not all verticals are equal. Some verticals are more prone to verticalization and present smaller risks for Satellite Operators. Factors like pricing sensitivity, bandwidth requirements, customer skills or lack of local partners favor verticalization. Actors like O3b or ABS have succeeded in offering Trunking services directly to ISPs. At the same time, Intelsat is putting a lot of efforts into creating a platform to attract demand in the Backhaul market.

Bottom Line

Factors ranging from raw bandwidth pricing degradation, a new technological paradigm or the emergence of new markets are contracting the traditional Satcom value chain. This obviously sets new `rules of the game’ for the entire industry from Satellite Operators, Service Providers and even equipment vendors.

When a Satellite Operator directly targets an end-user circumnavigating the Service Provider, it must consider a list of factors, some of which might not be obvious in the short term. Needless to say, the conflict of interest is clear and the Operator might lose future, bigger deals with upset Service Providers. The cost structure of end-to-end services is different from the traditional financial metrics shown by Operators, and investors might not be willing to accept them. Furthermore, Satellite Operators do not have the sales and support structure to carry last-mile sales. Last but certainly not least, when a satellite operator directly competes with a Service Provider, it must consider the long-term harm it is making to the ecosystem by attacking the revenue base of what traditionally have been the pollinators for the Satellite Industry, who find new market opportunities and generate revenues for the entire value chain.