L-band Driving the Connected Car

Dec 7th, 2017 by Alan Crisp, NSR

The Connected Car is a hot topic, with vehicles rapidly changing from internal combustion machines on wheels to computers on wheels. Connectivity requirements are increasing for the current generation of cars, and consumers expect greater levels of sophistication in the ‘digital car’ than ever before. With much of this connectivity currently served by cellular networks, what role will satellite communications play in the future of the Connected Car?

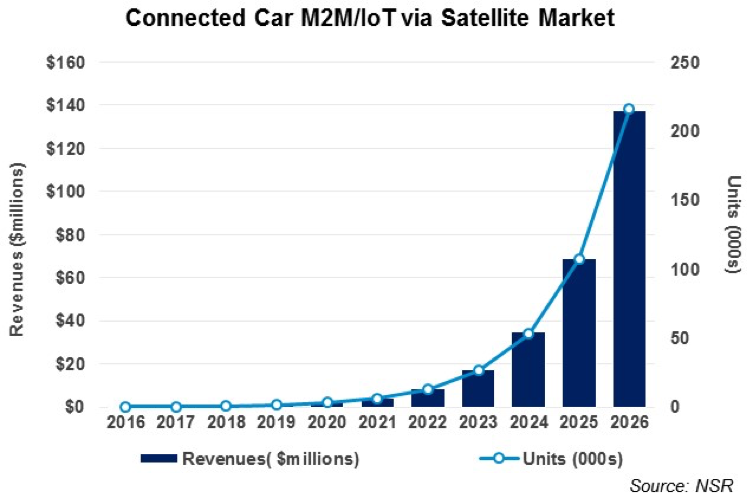

NSR’s M2M and IoT via Satellite, 8th Edition found that after a slow start over the next few years, the number of satellite connected cars will ramp up from 2019, with the vast majority utilising narrowband L-band solutions, as opposed to broadband Ka-/Ku-band connected vehicles.

There are three main types of connectivity applicable to Connected Cars:

Autonomous vehicles

Entertainment (e.g. in-vehicle broadband Connectivity and video streaming)

-

Industrial Internet of the car (e.g. managing subsystems remotely)

In NSR’s view, it is the third type of connectivity that will be most relevant to satellite within the next decade, with satellite typically augmenting cars that otherwise use terrestrial connectivity when they are out of range. Existing solutions almost exclusively use 3G or 4G LTE connectivity, with this including GM’s OnStar and Ford Sync, while investment in satellite connectivity by auto makers remains limited. In 2016, Toyota pledged to invest $1 billion in the connected car, artificial intelligence and self-driving technologies in the following 5 years. However by comparison, the automaker has invested $5 million into Kymeta for flat panel Connected Car antenna technology. In Toyota’s most recent Connected Car strategy, there was no mention of satellite connectivity, with only 3G/4G terrestrial networks, Wi-Fi and Bluetooth connectivity meriting discussion.

Nonetheless there remains longer-term potential for satellite Connected Cars, which will evolve towards narrowband communications. Ultimately, high-priority Connected Car applications like predictive vehicle diagnostics and maintenance, safety and security, and telematics do not consume much bandwidth. The premium for uninterrupted coverage via satellite is low enough to justify payment by the auto-owner as part of an annual contract.

Vehicle entertainment, a high bandwidth consuming application, is however a low priority application in the Connected Car world, and demand should thus be limited, if at all, to luxury vehicles as an ‘add-on’ option service.

Seemingly with this in mind, Inmarsat is making moves into the Connected Car market, although the company stated that it is entering the market more gradually, and is quite cautious about the level of demand they expect. This is because unlike other market segments, the value chain of the car is significantly more complex and will be in competition with other parts of the value chain, all of which are attempting to have a share of Connected Car revenues.

NSR expects the broadband Connected Car to remain a niche market, with flat panel antennas (FPAs) required (among other factors) for take-up of higher bandwidth Connected Car solutions. Longer term, this may drive down the price of FPAs, making pricing (somewhat) more affordable for consumers. For FPAs in the Connected Car to reach critical mass, thus accelerating the growth curve, a few requirements will have to come to pass:

A significantly larger uptake in FPAs in corporate markets to drive pricing down

Technological challenges solved with regards to space, power and radiation

A compelling need for consumers to demand constant broadband connectivity in addition to smartphones and personal hotspots, which are more versatile in nature and are not restricted to times driving

Those attempting to enter the satellite Connected Car market should note the failed Raysat experiment, which tried to bring a broadband Connected Car to the market in 2006 with a 2Mbps/128kbps Internet service. With a $7,500 price tag for equipment, in addition to monthly service fees ranging from $50 to $100 for 10 hours of peak hour usage, the service proved to be unpopular, made worse by spotty coverage with line of site issues. Line of sight issues continue to cause problems for Kymeta’s satellite connected car, with trees and buildings either side of roads causing dropouts with GEO satellites (LEO-HTS constellations may help solve this issue).

Bottom Line

Overall, the business case for Connected Car via satellite remains a challenge. A perceived lack of value add for 100% connectivity vs. 99% cellular connectivity for most consumers also means that most Connected Cars will remain connected solely via cellular, Wi-Fi or Bluetooth. Challenges presented through space requirements, costs, and various technical challenges will limit the overall growth of the satellite Connected Car.

Further, with smartphone penetration continuing to grow steadily, in many cases where connectivity is not built into the vehicle directly, vehicles can be tethered to smartphones to gain connectivity, which will grow to a significantly larger market share than that of satellite. OEM Integration of satellite solutions into vehicles is not expected to drive growth, however L-band solutions will be offered at the point of sale, unlike those on Ku-band and HTS. The best play for satellite operators will be to engage commercial industries, most notably Mining and Oil & Gas, to develop tailored solutions for high valuable applications, and partner with terrestrial network operators and focus on dual mode solutions.