Shaking the Space Industry from the Ground (Segment)

The satellite industry is innovating at an extraordinary pace with satellites hosting orders of magnitude more capacity each generation and at much lower bandwidth prices. This is certainly opening new opportunities but, at the end of the day, it is not bandwidth that matters but what can be done with that connectivity. VSAT platforms, and in particular Baseband equipment, conforms the brain of satellite networks, and it must evolve to facilitate the requirements of future applications.

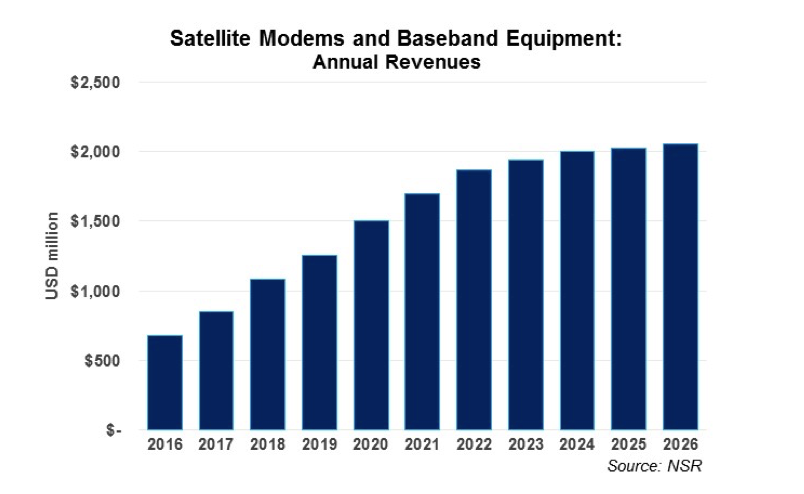

VSAT platforms (modems + baseband) are the fastest growing element in ground equipment. According to NSR’S Commercial Satellite Ground Segment 2nd Edition report, the market will expand at a double-digit CAGR to offer over $2 billion in annual revenues by 2026. How must VSAT platforms adapt to the new networking requirements to capture a portion of this opportunity?

Networking is increasingly complex and plays a growing role in the satellite communications ecosystem. Platforms need to respond to a number of key trends in the industry like the transition to Tbps satellites, the advent of global mega-constellations, new satellite features like beam forming or new business architectures (VNO). At the same time, customers are becoming more demanding with data requirements exploding, a full range of new applications proliferating and the ubiquitous need to be connected everywhere with the highest levels of quality. This is of course a tremendous opportunity for the industry, but only if the industry, and in particular, ground segment vendors, can evolve to economically serve these requirements.

Scaling to (Very) VHTS

Space assets are improving dramatically. From satellites hosting tens of 36-MHz transponders distributed in a couple of beams with a throughput of a couple of Gbps, today’s satellites carry new payloads illuminating hundreds of beams of much larger GHz transponders generating 100s of Gbps or even surpassing the so-called Tbps barrier. The ground segment must meet all these new technical requirements managing wider and more numerous carriers dealing with a booming number of terminals generating upwardly scaling throughputs. All this without forgetting the cost considerations as CAPEX investment cannot scale with performance if it must stay within reasonable limits.

The adoption of HTS is also triggering new business models. Satellite Operators now integrate investment in the ground segment to facilitate the adoption of their services. This sets new requirements for VSAT platforms in terms of creating the networking ecosystem for resellers to be able to integrate their value-added services through virtualized networks. Furthermore, each service provider has a very different customer profile meaning that the ground segment must be able to serve a wide array of applications from the same platform.

Differentiation Is Moving to Upper Layers of Communications

Bandwidth efficiency used to be a major differentiator among VSAT platforms, but with all major platforms incorporating DVB-S2X (which is approaching the physical limit), the battle is moving to higher layers of communications. Cellular Backhaul, a key vertical for growth in the future, is one of the most demanding applications in this sense. Making mobile protocols work efficiently via satellite is not an easy task, and platforms must incorporate multiple techniques such as traffic acceleration or header trimming. With traffic becoming bursty, sharing bandwidth resources among multiple sites is critical for minimizing operating costs. Video is clearly the driver behind the capacity boom such that vendors are developing local cache solutions to minimize the traffic that actually needs to be sent through the pipe.

Network management is also gaining relevance as one of the most important aspects in VSAT platforms. And here, mobility is arguably the most demanding vertical in this sense. Ensuring the SLAs for individual aircraft and fleets of aircraft migrating among multiple beams, satellites and regions, all this with different layers of priority for data is a challenge of massive complexity. This will only get more labyrinthine with the arrival of flexible satellites and multi-orbit constellations.

Ground and Space Coupling

HTS requires a much higher investment in the ground segment and, in order to facilitate the lease of capacity to service providers, satellite operators are now incurring those investments. In parallel, payloads are becoming more intelligent with increasingly popular digital payloads and flexible satellites. These new attributes require deep integration between Ground and Space segments. Gone are the days when Satellite Operators were simply managing Space assets. Today, payload and ground segment must be designed in tandem to obtain the necessary synergies to stay competitive.

With capacity pricing in freefall, the ground segment needs to increase its role in the Satellite Operator’s strategy roadmap. On one hand, it is critical to unlocking verticals that will generate the greatest value for the industry facilitating the applications that each targeted solution requires. On the other hand, the ground segment must progressively integrate monitoring capabilities which will eventually generate actionable insights that, in coordination with flexible payloads, should boost asset utilization.

Bottom Line

The satellite industry business environment is under profound transformation, and VSAT platforms must evolve to meet the future technical and business requirements. This will also unlock a generous market opportunity for the fittest solutions.

From booming throughputs to the multiplying number of carriers as well as managed services, ground platform requirements are becoming more complex. Focusing on the physical layer to obtain the best Mbps/MHz figure of merit is no longer enough. Acceleration, compression, virtualization and other applications today are critical to stay competitive.

The Ground Segment has a critical role to play in achieving cost-efficiencies in the current degradation of capacity pricing but also should be leveraged to unlock key growth markets by generating greater value.