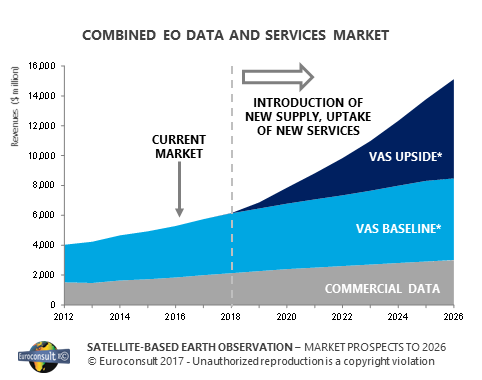

Earth Observation Data & Services Market in 2016: $8.5 Billion with Potentional to Reach $15 Billion

October 26, 2017

According to Euroconsult's report, Satellite-Based Earth Observation, Market Prospects to 2026, the Earth Observation (EO) data and services market should reach $8.5 billion by 2026 based on current growth trajectories. An alternative value-added services (VAS) model also presented has a combined market potential of $15 billion. This upside model considers the implications of new supply solutions being able to open further markets. As well, advances in artificial intelligence and deep learning are expected to benefit the sector, acting as enablers for new solutions based on change-detection analytics.

According to Euroconsult's report, Satellite-Based Earth Observation, Market Prospects to 2026, the Earth Observation (EO) data and services market should reach $8.5 billion by 2026 based on current growth trajectories. An alternative value-added services (VAS) model also presented has a combined market potential of $15 billion. This upside model considers the implications of new supply solutions being able to open further markets. As well, advances in artificial intelligence and deep learning are expected to benefit the sector, acting as enablers for new solutions based on change-detection analytics.

The growth drivers for data and services are distinctly different. Defense still dominates the market for commercial data, with the sector alone responsible for over $1 billion in data sales with a focus on very high resolution and high accuracy data sets. Data prices to support defense applications are expected to remain high, a drawback for services development in the civil government and private sector. VAS' largest markets remain infrastructure and natural resources monitoring, however in order to build these solutions often lower-cost or free data solutions are utilized. This creates a disparity in the value-chain in which high-cost, precision data sets make up most of the defense-driven commercial data market, whereas more services are being built from less expensive, more competitively-priced solutions.

"Companies (both operators and new service providers, such as Orbital Insights, AllSource Analysis, etc.) are building algorithms to detect changes in multisourced data to detect patterns and build predictive analytics," said Pacome Revillon, CEO of Euroconsult. "Bringing higher-frequency collected data into these models, the so-called 'Big Data' environment will further aid developments, with the potential to open new services areas based around location-based systems such as financial intelligence and site monitoring, among others."

Euroconsult has identified approximately 20 companies that have announced intentions to develop lower-cost constellations to collect data at a high rate of revisit based on smallsat and cubesat technologies. As of 2017, these new operators have attracted more than $600 million in venture capital to fund their initiatives. None of the newly announced initiatives have yet reached full capacity; for these constellations to come to fruition, additional investments will be required.

Competition is expected to be fierce on the supply side, as companies must differentiate themselves in the marketplace and bring innovative solutions to maintain market share. Consolidation (such as MDA and DigitalGlobe, OmniEarth and EagleView, Terra Bella and Planet) could linger as companies refine business models and continue to seek investments. DigitalGlobe, for example, is aiming to add a lower-cost satellite constellation (Legion) to its portfolio to counter the probable impact of low-priced solutions entering the market. Airbus will also develop its own very high resolution (VHR) optical system, given that the next generation French defense system will not be commercialized.

From 2007 to 2016, 181 EO/non-meteorology satellites were launched; the cost to develop these satellites generated $17.4 billion in manufacturing market revenues. Over the next decade more than 600 EO satellites (50kg+, non-meteorology) should be launched to support EO applications. Nearly fifty countries are expected to launch satellite capacity, and over half should be from the private sector; this is expected to generate over $33 billion in manufacturing market revenues. Cumulatively, developing programs could represent $4 billion in market value (12% of the total). This figure remains significant, as the majority of export opportunities are to be found with emerging programs, as opposed to more established government EO programs, which remain captive.