Where is the Emerging Space Opportunity?

Buzzwords such as New Space, Space 2.0, Emerging Space, applied to new, nimble, innovative, and atypical activities, encompass companies grouped together due to their approach. Fueled by the Silicon Valley-mindset and PR, the distinctions between these players and their investment can be a challenge to identify. Yet it is within these distinctions that lay the trends, directions, and ultimately the opportunities of emerging space activities.

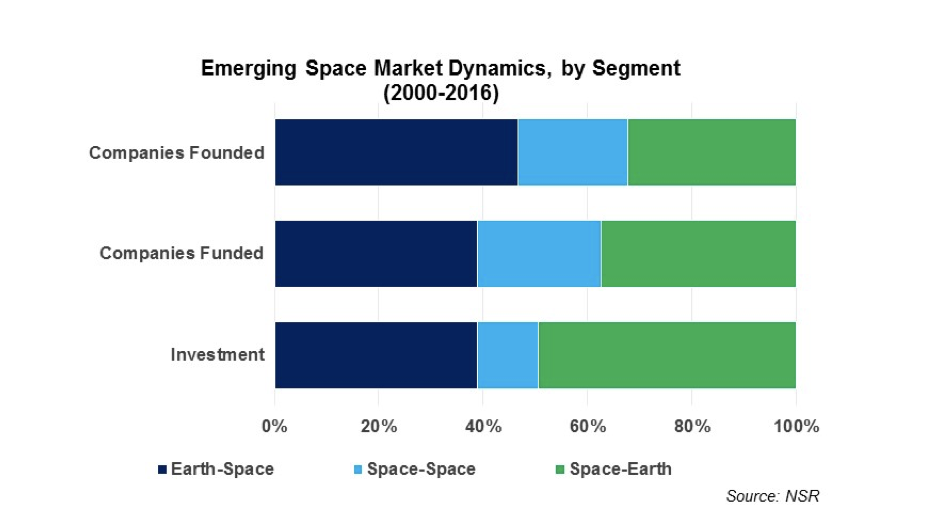

NSR’s The Emerging Space Market Opportunity found that the market falls into three broad segments:

- Earth -> Space: Infrastructure & Services provided on Earth to facilitate use of Space (e.g. Launch, manufacturing)

Where is the Funding?

Earth -> Space activities encompass diverse enabling products and services at the beginning of the value chain. At nearly half of all emerging space companies founded, Earth -> Space is a robust market. Yet its share in total companies funded and amount of investment is weaker – with 75% of investment attributable to Blue Origin and SpaceX alone. Only a third of companies were funded, compared to the almost half funded in the other two segments. This is not a black mark in itself: some companies remain in the R&D phase and do not yet have a workable prototype (often key for securing funding) while others have been able to successfully bootstrap growth and leverage government innovation grants and support, such as SBIRs/STTRs.

In the space industry at large, manufacturing, launch, and other ancillary space services often operate with low margins – a characteristic more detrimental in investor eyes within Emerging Space due to the low-cost targets of potential customers. Earth -> Space is a complementary investment, as players across the segment are the building blocks for success of satellite operators and downstream service providers.

Space -> Space comprises the least developed and smallest piece of the Emerging Space pie across all metrics. Space -> Space activities remain largely unproven in commercial use, requiring significant R&D alongside customer development before reaching market. Wealthy founders and angel investors have been attracted by the novel ideas and potential impact of Space -> Space services, willing to invest despite the risk and long payback period. Yet funding is limited: aside from Virgin Galactic and Bigelow Aerospace, who represent two-thirds of all investment, funding has been won in small increment Seed and Phase A rounds. The average investment is half that of other segments. The segment overall underperforms in total investment, with only 12% of funding despite nearly a quarter of companies founded and funded.

Space -> Earth activities, dominated by satellite constellations and analytics services, have generated strong entrepreneur engagement and the most investor interest. Attracted by the potential of small satellite-based constellations to deliver global coverage with a high revisit and spurred on by the rise of connectivity dependence and Big Data, new aspiring operators are a fixture of Emerging Space. The services targeted are not only approachable to investors due to their similarity to today’s satellite-centric landscape, but present the large addressable markets, mid-term payback period, and potentially sizeable returns that investors seek. OneWeb, O3b, and Skybox/Terra Bella dominate total investment, but many other players have secured Phase A and Phase B funding. The Space -> Earth segment demonstrates the greatest percentage of funded companies and the highest average investment, as well as the most sizable exits to date.

Where is the Opportunity?

The challenge for budding entrepreneurs is that many emerging space markets are saturated with would-be competitors, even while those same competitors have yet to deliver on promises and bring a product to market. Across Earth Observation, communications, M2M/IoT, and AIS markets, as well as manufacturing, dedicated smallsat launch, and downlink services, the number of aspiring emerging space players exceeds what the market will support. Yet until any one company delivers compelling value and consolidates market share, the opportunity for better services to emerge remains. Novel applications provide a less competitive opportunity, but present added challenges in identifying and securing a customer base and distribution network.

Emerging Space players depend on an ecosystem of companies. Despite saturation at many points in the value chain, new players able to identify downstream services such as tailored analytics or upstream niches like specific component manufacturing – all pain points for integrators, launch providers, and operators – may increase their chances of winning funding and advancing in development.

The Bottom Line

Activity in the emerging space market is diverse, and the desire of entrepreneurs to deliver a novel and innovative value proposition spans many segments. Given the variety of services required to support Space -> Space and Space -> Earth endeavors, the Earth -> Space sector will continue to lead in number of companies in the near term. As the market matures and traditional players become more interested in emerging space capabilities, the potential for an exit via acquisition is increasing – which should only reinforce investor interest and entrepreneurial aspirations across the emerging space market. Ultimately all Emerging Space segments present opportunities for new entrepreneurs and investors, if they can learn to avoid what have thus far been attractive “me too” plays in already saturated applications.