Pricing the Satellite Markets – Part II

Sep 19th, 2017 by Gagan Agrawal, NSR

Satellite business models have traditionally relied on incumbent technology and DTH demand. The advent of satellite broadband demand, rush for acquiring market share in aero and backhaul verticals and instances of rapid price deterioration of satellite capacity - indicate a shift in these business models. Today’s growth model signifies a fluidity between the lease and service economies, where capacity building leads to a strenuous pricing environment, paving the way for bulk wholesale deals to direct customers (pseudo-lease economy) as a winning strategy for many operators. As explained in the preceding article, a pseudo-lease economy is a direct consequence of discount pricing for bulk capacity leasing and satellite infrastructure collating to anchor customers.

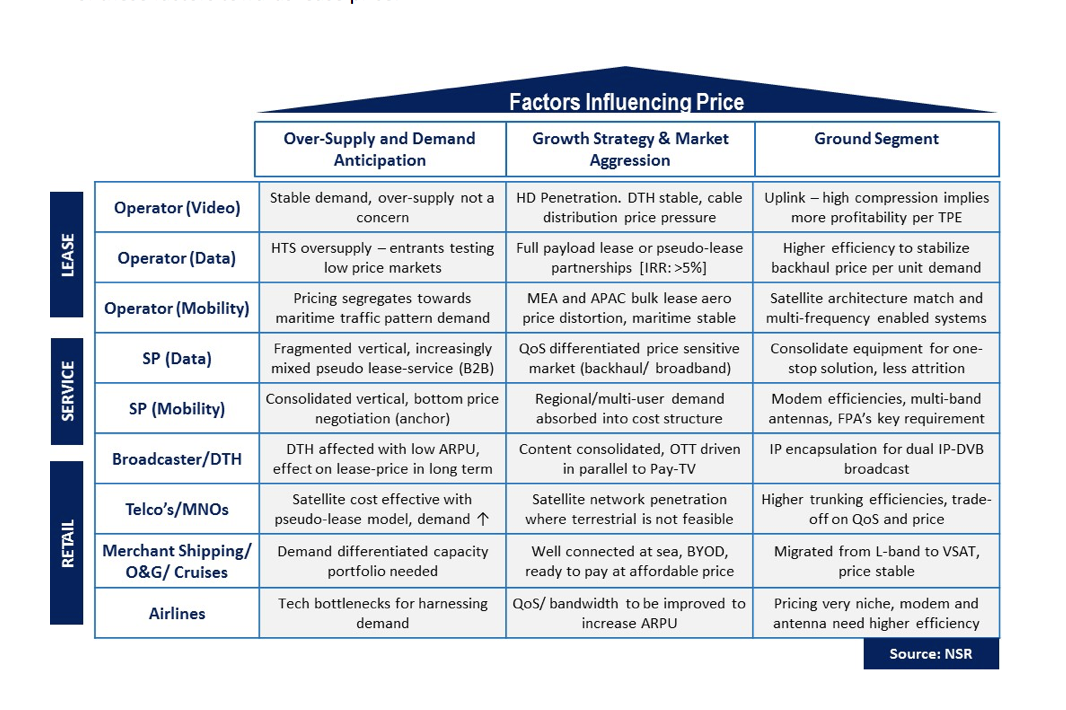

The latest market share growth model is one of the key factors impacting price, not restrained to the satellite operator vertical alone and quite interdependent along with other factors like supply-demand, ground technologies, deal volume and duration, etc. Thus, an assessment of these factors on the value chain economics becomes essential to determine the impact of the current growth model on forecast pricing. Consequently, we list this assessment in the exhibit below and further examine possible reaction strategies from players across the value chain emanating from the impact of these factors towards lease price.

Pricing Environment Analysis

NSR’s Satellite Capacity Pricing Index, 3rd Edition analyses the impact that ~13 factors have on price, and three of them are dissected here in detail with respect to the value chain. Different players are expected to evolve different strategic pivots in response to these factors. The consequent impact from these factors is evaluated through developing maximum influence scenarios, in-line with different local market conditions seen in the past year. The pricing environment analysis given below for each of the three factors highlights the most sensitive factor and helps in dissecting the impact of growth strategy.

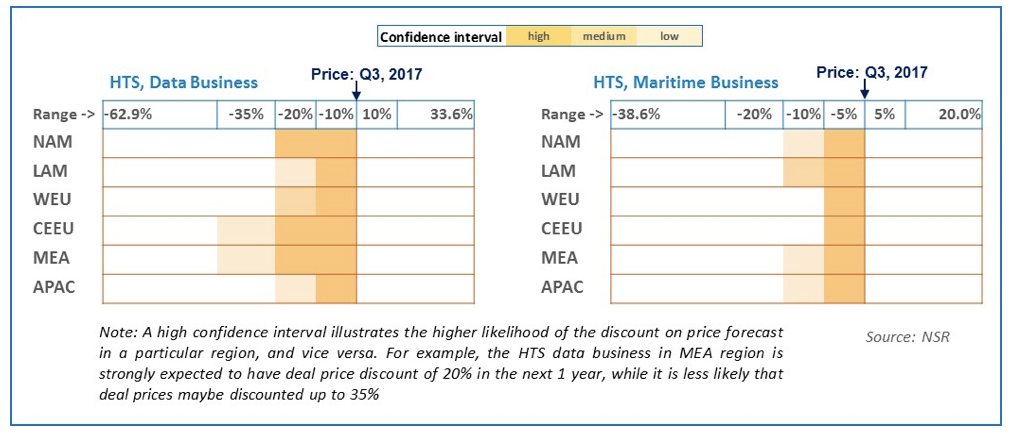

1. The first factor - capacity oversupply (increase of 25% owing to launch of 100’s of Gbps of HTS capacity) and lower demand anticipation (negative 5-10% compared to data and maritime forecasts) affects both the data and maritime HTS vertical pricing; however, it is in line with the range of NSR’s 1-year pricing forecasts as shown below.

Sensitivity on data vertical pricing indicates a higher potential downside, putting operator retail lease business at risk, though bulk leases should still enjoy a healthy IRR driven price. Maritime vertical pricing is moderately affected with a cap at 10%. Extra available capacity could be potentially absorbed by large SPs at a cheaper price fuelling a further lease price decline.

2. The second factor – growth strategy and market aggression of the satellite operator is the single biggest impact factor on price. This factor accounts for bulk lease capacity discounts (such as IPSTAR and APT deals in aero, Telesat-Hughes deal, Liquid Telecom- Intelsat deal), customer retention discounts (negative 20% offered by incumbents to stave off newcomers) as well as the new player market entry discounts (negative 15% in backhaul segments). The impact on the data vertical is adverse, and at almost negative 20-25% is emblematic of the above deals seen in the past year in Asia-Pacific, Latin America, Western Europe and Africa. This will be a death knell for many operators in the fixed-data business, due to absence of premium pricing (as demonstrated by Eutelsat moving away from fixed data towards consumer broadband and potentially backhaul), though SPs will benefit through vertical consolidation creating economies of scale. These indeed are desperate times where HTS tech and price plummets have led operators to pivot from fixed data towards more profitable/ bulk-leasable data verticals.

In the maritime sector, an impact of negative 15% over base price is unlikely and above the forecast level. Given the recent consolidation in the SP vertical, and VSAT maritime market taking off on requisite QoS levels, the aggression towards lowering lease price may be curtailed in the short term.

3. With respect to video, increasing compression ratios enable satellite operators to maintain stable revenues along with aggression towards HD penetration, where a stable to marginally declining overall retail ARPU hasn’t had a big impact on the lease price. Although, developments in IP technology for combined IP-DVB video will play a key role in keeping prices stable in the medium to long term. With respect to VSAT, increases in ground technology efficiencies on modem and baseband equipment, in addition to unlocking new demand from FPAs, will be critical in countering oversupply and market competition factors. These ground technology enhancements can arrest the deal price ($/MHz/Month) decline to an overall 15% (data) and 8% (mobility) for the next year, when combined with the other factors listed above.

Bottom Line

Anticipating the pricing dynamic is critical to survival for satellite operators, especially given that the tightly contested data and mobility markets will be the growth drivers moving forward. Operators can strengthen their revenue positions (through high IRR pseudo-lease or managed service retail data/maritime segments) or pivot from fixed data stagnant positions (using retail B2B strategic partnerships like ViaSat-Eutelsat or vertical integration like SES Maritime+) towards a more stable lease price economy. Synergies either towards upstream fleets (like SES-GS) or downstream distribution channels (consolidating end-consumers in premium data/maritime segments) bodes well in stabilizing prices as well.

The above analysis shows the sensitive nature of growth strategy, in conjunction with supply and ground segment price economics. With oversupply, commoditized sales positioning and lack of innovation in ground tech hurting spot prices in the short term, an aggressive growth strategy can lead to a pricing disaster, unless otherwise pivoted in-time. Notwithstanding the above pivots/synergies, vertical acquisitions & integration seem to be the most efficient and long-term approach towards stabilizing the lease price market.