Pricing the Satellite Markets

Satcom markets have traditionally been defined through DTH and remote connectivity use cases, along with an oligopolistic value chain and an upstream B2B lease market where-in the EBITDA margins of satellite operators can be the envy of many markets. The past 3-5 years have seen High Throughput Satellites and ambitious entrants leading an inquiry into the possibility of mass market penetration of satcom services, either competing with terrestrial networks or creating blue ocean opportunities. Certain opportunities enable connecting the unserved regions through consumer broadband/cellular backhaul and equipping devices with broadband at air and sea to pivot the market; while certain technologies such as cheaper supply of Gbps (5-6 times more efficient in Throughput/CapEx ratio) and highly efficient ground systems help to accelerate execution of the business model. Amidst these trends, acquiring market share at the quickest pace becomes the priority for new entrants, while incumbents must leverage existing customer relationships against ageing fleets and shareholder obligations for growth into newer demand verticals.

Key Factors for Discount in Prices

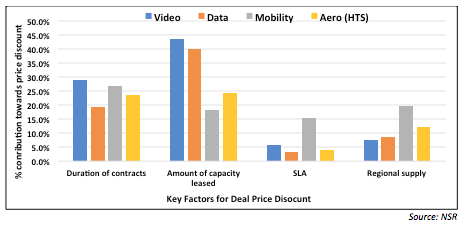

This tussle has led the industry to an inflexion point, wherein pricing becomes the key variable in executing the above respective strategies, behaving to be the primary driver for a business to exist or consolidate among the value chain to achieve economies of scale. And with operators and service providers focusing on volume business in data and mobility verticals, pricing has plunged over the past couple of years from a high $3,000-$4,000/MHz/month to a sub $,1500/MHz/month, with data/backhaul deals consistently clocking sub $500/Mbps/month prices in 2017. As discussed in NSR’s Satellite Capacity Pricing Index, 3rd Edition, there are several factors contributing to this decline, and dissecting them can be key to forecast pricing strategies in the future. In total, 13 factors can exert influence over pricing depending on a company’s growth strategy and sales positioning, consolidation in its value chain vertical (operator, service provider or anchor customer), customer relationships and deal contracts. The impact of a few prominent factors on future reduction in pricing can be viewed in the exhibit below:

As seen from above, duration of contracts and amount of capacity leased are most instrumental in deciding the deal contract price over rate card price, as is emblematic of satellite leasing contracts historically. Though, other factors such as SLA (premium vs. frugal maritime customers), regional oversupply and HTS fill rates below 40%, high spectral efficiency leading to low per Mbps pricing and bargaining power are becoming more important leading to large retail/wholesale discounts. Some of the most prominent examples of the deals include backhaul capacity leased at sub $400/Mbps/month in Western Europe and Africa, aero capacity leased at sub $700/Mbps/month in Southeast Asia, and video capacity at sub $2,000/MHz/month in North America.

Economics of Satellite Value Chain

Given the current ecosystem, pricing is expected to further decline on the back of volume deals, bets on long term gain in market share and impending maturity of demand verticals like consumer broadband and aero. Sub $400/Mbps/month backhaul pricing has come quite close to sub $100 fiber pricing, and with volume uptake, satellite operators and telcos can be expected to partner for economies of scale on HTS satellites.

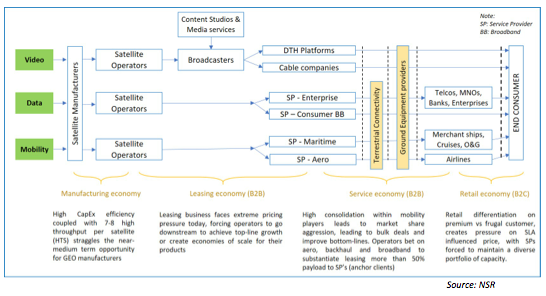

Thus, it is important to understand which players in the ecosystem may be the most affected. As shown in the above satellite industry value chain, the size and volume uptake in the retail economy directly affects the portfolio of service providers and capacity leased from operators. In a bi-polar economy within near-medium term, it is expected that only premium retail business and the terrestrially competitive data wholesale business would survive, thus begging the question on both choice and sustainability of leasing business models.

Forecasting lease price trends, NSR in its Satellite Capacity Pricing Index, 3rd Edition, expects mobility and data pricing to drop between 5%-15% and 10%-30% globally in the next year. For a leasing economy to maintain/grow top line revenues, operators would need anchor customers in the aero, backhaul and broadband businesses for their upcoming satellites and, in addition, thwart off competition from new entrants to maintain relevance of the ageing FSS fleet (>7 years old). Consequently, in a bid to succeed in a market with highly contested customers and terrestrial competition, capacity prices are expected to plummet. Notable though, is that video pricing remains stable to slightly decreasing with ever increasing compression ratios, auguring well for operators who otherwise are constantly speculating on fixed data business.

Winning Strategies

Amid questioning long-term leasing sustainability, there are few pivots or pricing strategies employed in the data vertical to create value in the lease capacity price drop. Operators partnering with telcos in a service like business (eg. SES or Intelsat) or leasing entire payloads for consumer broadband (eg. Telesat-Hughes) or partnering with Government in a B2G model (eg. IPSTAR) seem to be gaining steam in a low risk, higher revenue per satellite, lower EBITDA margin, lease business. Telesat’s entire payload lease certainly reflects a positive ROI at current consumer broadband specific capacity lease prices, while SES and Intelsat would have to prove this strategy by garnering a high fill rate at backhaul prices for positive ROI. For mobility verticals, future anticipated uptake in IFE and crew entertainment could provide similar higher revenue per satellite to win a lease based end-game, though inclined orbit satellites and MEO-LEO systems (maritime) could bring the price further down, demanding over-reliance on wholesale lease business.

As the current market price decline dynamics would dictate, satellite operators can’t win through retail dominated play (unless one is a vertically integrated operator and a service provider like ViaSat), they can’t win without anchor customers or strategic partnerships in a wholesale play (matching satellite architecture with anchor customer’s target application), can’t win from reliance on ageing fleets and fail to grow/stay relevant if they don’t venture into network applications HTS segments such as backhaul or broadband or aero.

Service providers currently dominate the market when it comes to serving premium retail segments through efficient modular management of satellite and terrestrial capacity across the globe, and are horizontally integrating to retain maximum bargaining power on price. Thus, a right to win for operators in network applications seems to be contingent on the 2nd and 3rd case given below, both indicating the shift from a lease dominated economy to a pseudo-lease or service dominated economy as follows:

-

- Current case where service providers deal directly with the end-customer and control the value chain - with operators, equipment providers and ISP’s providing the necessary B2B support.

- 2nd case where operators lease capacity but with B2B partnerships with Telcos/MNOs, thus forming a pseudo-lease business model directly dealing with the end-customer in a wholesale deal (to offset declining prices). This model would be potentially aided through addition of MEO/LEO fleet synergies.

- 3rd case where operators and service providers offer managed services with dedicated application portfolios towards enterprise data clients or merchant shipping/O&G, in effect splitting the customers according to application. Operators may have an outside chance in this scenario if they are able to recognize fleet synergies, able to form strategic partnerships with equipment providers and ISPs to give competitive managed network/service solutions.

Bottom Line

While pricing remains relatively stable for video applications garnering significant consumer numbers from hotspots and ARPUs from cable operators with revenue shield against OTT so far, operators face threats around network applications and must choose one of the last two cases to stay relevant and close to the end-customer. The retail business at a super $2,000/MHz/month price-point will be a passé soon in addition to growing HTS supply from regional players and threat of Non-GEO constellations.

Given these price drops, wholesale business with a pseudo-lease or mixed lease-service model could be some of the winning strategies for operators. Application specific fleet consolidation and downstream customer consolidation strategy is yet to be seen in the market, and strategic partnerships matching wholesale distribution network to HTS satellites architectures have the potential to support the pseudo-lease model. A near to medium scenario with a large fund backed telco (eg. Softbank) merging the lease and service economies for a particular region can’t be ruled out. Similarly, a mixed lease-service business on the operator’s end or upstream vertical integration on the service provider side has potential to grow top line revenues for either of the players in the value chain. Ultimately, the companies which pivot early based on efficient fleet consolidation and customer matching stand a chance in winning the pricing battle.