IFC: Bubble or Boom?

Jul 25th, 2017 by Claude Rousseau NSR

Is the industry in the midst of an in-flight connectivity (IFC) bubble? Or is the market ready to boom without going bust? IFC service providers are far from profitable and their bottom line will remain in red ink for at least 2 to 3 years with only GoGo, the largest IFC provider by aircraft online, stating it will see positive free cash flow only in 2019. Where does this lead an industry that does not discuss doomsday scenarios or exit strategies in this high-growth satellite market?

On one hand, it is clear airlines with record profits on the heels of a 15% drop in fuel expenditures in their overall operation costs should have money to spend on amenities such as connectivity. Furthermore, all signs point to higher traffic loads and profits in 2017. And the argument of higher fuel costs due to antenna drag on the aircraft is losing steam fast. Yet, a majority of airlines fear the expenditure of an inflight entertainment and connectivity system, which they make for a 7 to 10-year horizon. Just take the fastest growing airline segment, low-cost carriers; they are loath to make the expense for IFC as exemplified by RyanAir’s CEO going so far as saying IFC is unattractive. Further west, the CIO of Sun Country Airlines noted recently “…there are formidable obstacles that have to be overcome” to offer inflight Wi-Fi.

So to alleviate fears of a large capital investment, SPs will probably have to bear the brunt of the costs of IFC equipment and installation and run the system while sharing a good portion of the revenues generated with airlines.

Buying Binge

But with SPs buying 20 year-old satellites, and large swaths of capacity on new high-power ones like SES-15/17, procuring dedicated HTS payloads and NSR predicting prices for capacity steadily declining, is there enough demand to escape a bubble from popping? If not, who is going to lose? The satellite operator betting the house on IFC (which they see as their biggest growth vertical moving forward)? The SPs who are taking on massive losses and huge capacity deals in what is a furious land (air?) grab phase? Both?

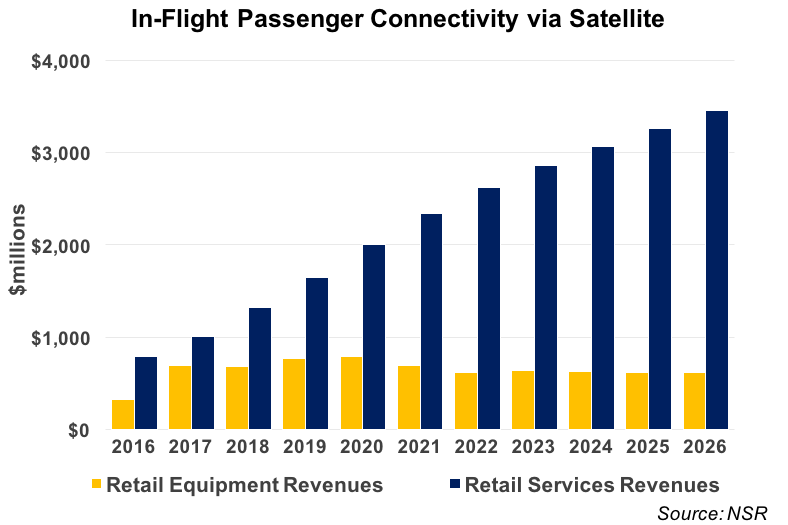

There does not seem to be a simple answer but as highlighted in NSR’s Aeronautical Satcom Markets, 5th Edition, one thing is certain: service revenues are increasing quickly. The dominance of equipment sales during the emerging phase of the markets is now giving way to fast increases in service revenues (24% average annual growth in the next five years), which is a sign of a maturing market.

With this maturity, comes passenger needs for uniformity and quality of service. Several recent tests by NSR showed limits on the value and performance of IFC on major airline flights. Complex login procedures, ‘relatively’ slow speeds and high cost (from $0.17/MB to $0.28/MB), despite a fairly quick connection but with contended bandwidth pointed to a deterrent for even ‘specialists’ looking for a much smoother IFC passenger experience.

HTS capacity, which is touted as the solution to this headache is in oversupply…for now, due to what NSR calls the ‘lag’ between demand and available supply. Simply put, passengers are just not able to use enough ‘good’ bandwidth, and it is impacting take rates (among other consequences). Still, solutions exist or are in development, and revenues associated with providing a connection to passengers on aircraft are expected to make a 27% annual jump in 2017.

The Bottom Line

The ultimate answer may not come for a while, but the uncomfortable sight of a bubble is looming. Many recipes will be put to use to avoid it from bursting, with some of the ingredients to look out for include (but are not limited to):

-

- Consolidation between aero and maritime markets players (to offload capacity)

- More managed services offerings by operators and/or vertical integration with SPs

- Higher integration between cockpit, cabin and operations communications systems

- Tiered session prices and sponsored offerings (to make-up for the “fear-of-paying-for-Wi-Fi”)

- Higher bandwidth to each passenger

- Smoother connection

Still, not all will be perfect and will run smoothly but coupled with more solutions that lead to higher takes rates, these could help the industry avoid a ‘pop’ and look forward to a ‘boom’.