Satellite

Backhaul ‘As a

Service’

Jun 21 2017

by

Lluc

Palerm-Serra,

NSR

Mobile

Infrastructure is

changing rapidly,

both technologically

and business wise.

Introduction of new

concepts like

SDN/NFV arrive with

new business models

in which

equipment and

infrastructure are

now offered “As a

Service”.

What are the

implications for

satcom, and how can

the satellite

industry capture

growth in this new

environment?

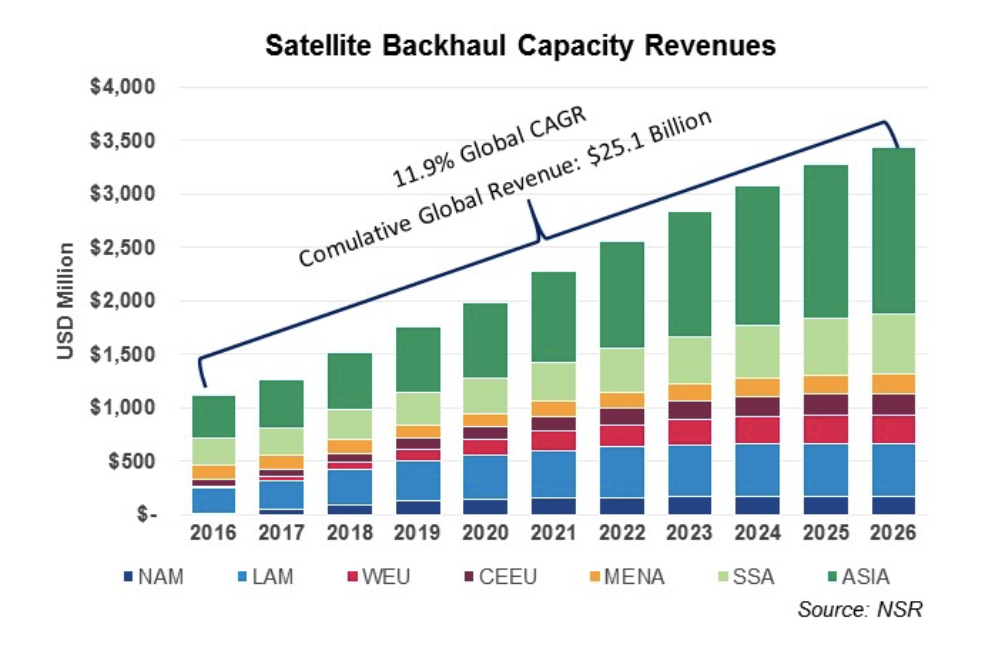

Backhaul will be one

of the key drivers

for satellite

industry growth in

the coming years.

Growth in the active

base, appearance of

new use cases or the

transition to

broadband services

all will boost

demand. According to

NSR’S Wireless

Backhaul via

Satellite, 11th

Edition report,

capacity

revenues alone will

grow from under $700

million in 2016 to

over $2.8 billion in

2026. More

importantly, mobile

operators are

willing to

externalize network

management services,

which multiplies the

size of the business

that can be

extracted from

deployments to

unprecedented levels

in the satellite

industry.

Everything ‘As a

Service’

Mobile operators

globally face

revenue growth

stagnation, and in

order to keep

margins, operators

are looking at

strategies to gain

efficiencies. At the

same time, several

factors such as

debt-heavy balance

sheets or the need

to be responsive to

recent technology

trends and market

dynamics make MNOs

more risk averse and

willing to

transform CAPEX

investments into

OPEX. This

has created entirely

new markets such as

the Towercos

businesses

(management of

mobile towers),

which in some

regions like Latin

America or Africa

own close to 50% of

the total towers.

This move towards

‘Everything as a

Service’ will only

accelerate with the

introduction of

innovative network

conceptions like

SDN/NFV. Services

are now penetrating

into the core

functionalities of

mobile operators,

for example, with

the recent deal

between Tigo Rwanda

and Ericsson to

provide BSS

functions ‘as a

Service’ (charging,

billing,

provisioning,

mediation, roaming,

etc.). All in all,

MNOs are

more willing to

outsource

infrastructure

management and focus

on the

customer-facing core

competences.

Satellite requires a

very particular

skillset.

Traditionally,

satellite was

relegated to a niche

role serving

government

obligations in rural

locations. Few

operators relied on

satellite to

backhaul traffic,

and those MNOs

generally deployed

and managed the

networks internally,

acquiring the

necessary equipment

and skills. However,

with the need to

continue extending

broadband coverage

to remote areas and

the emergence of new

use cases, satellite

is becoming another

tool in the backhaul

technologies mix.

If the

satcom industry

wants to play a

bigger role in the

backhaul ecosystem,

it needs to develop

a service offering

that facilitates the

adoption of

satellite backhaul.

Satellite End-to-End

Solutions

This trend towards

‘infrastructure as a

service’ is also

gaining momentum in

the satellite

industry. This

allows satcom to

offer services to

mainstream mobile

operators without a

background in

satellite

technologies.

Examples of such

deployments include

the Managed Rural

Coverage deal

between Ericsson and

MTN to provide

mobile coverage for

a set period

according to service

level agreements and

key performance

indicators, or the

recently announced

deal between

Speedcast and Wasel

Telecom for fully

managed

connectivity.

The revenues that

can be extracted

from these kinds of

deployments are much

higher than what was

seen in the past for

the satellite

industry. Not only

do new deployments

involve larger

capacity

requirements and

smarter terminals,

they also require

end-to-end

integration of RAN

equipment, energy

supply, towers,

etc.; growing the

total deal size for

system integrators.

The Role of

Governments

No one questions the

benefits of

connectivity for our

societies. One of

the latest studies

from The World Bank

highlights that a

ten percent increase

in broadband

increases GDP per

capita by USD13,036.

Governments around

the world have tried

to stimulate

broadband expansion

through USF/USO

programs with

diverse outcomes.

Most of the time,

the critical

challenge in these

programs is ensuring

the long-term

sustainability. Some

governments are

pursuing innovative

approaches to

incentivize private

investment in rural

areas to ensure

economic viability

and minimize public

economic burden.

One promising

example is the new

entity created by

the Peruvian

government, Rural

Infrastructure

Mobile Operator.

These entities do

not serve final

customers and do not

own radio access

spectrum but offer

backhaul and

infrastructure to

regular mobile

operators. These

rural operators have

certain obligations

in terms of quality

of service, but they

also have important

advantages to

protect their

investments like the

obligation from

Mobile Operators to

buy services from

them and some

protection against

MNO’s own network

expansion. While the

concrete results of

such implementation

are still uncertain,

the

satellite industry

must develop

wholesale offers

that can help mobile

operators achieve

their objectives of

network expansion.

Bottom Line

The way mobile

operators build

their networks is

changing radically

with the adoption of

concepts like

SDN/NFV and new

business models like

‘Infrastructure as a

Service’. This is

having an immediate

impact also in the

satellite industry.

As satcom attracts

more mainstream

mobile operators

without internal

satellite skills,

the industry needs

to develop wholesale

offers that can meet

the needs of those

mobile operators.

Furthermore, this

will have a positive

outcome for systems

integrators as the

size of deployments

is growing with

end-to-end

solutions.

Governments still

have a key role to

play in the

expansion of

broadband coverage.

While some USF/USO

programs have

long-term viability

issues, ensuring a

‘friendly’

legislative

environment that

incentivizes and

protects investments

can make a big

difference in

stimulating

broadband expansion.