Dim Light at

the End of the Tunnel?

Jun

19th, 2017 by

Carolyn Belle, NSR

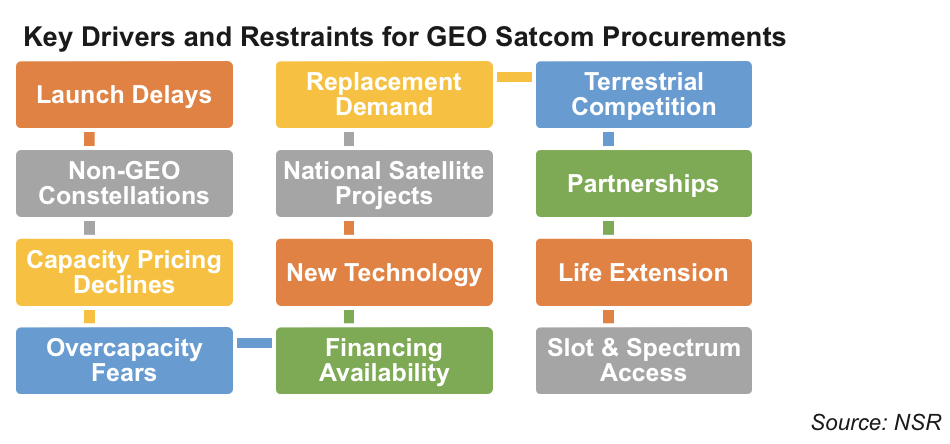

For the last three years, satellite

manufacturers have struggled to win

orders and generate revenue in a down

market. Headwinds that emerged in 2015 –

launch access, financing availability,

insecurity about demand evolution, and

the threat of non-GEO systems – have

endured and intensified during 2016 and

2017, with few operators finalizing new

orders despite high RFP activity. While

satellite orders are expected to

increase, the evolving shape of demand

precludes a return to the ~25 satellite

orders average.

Ongoing Market Pressure

Pressure to optimize and (in many

cases) reduce CAPEX due to low capacity

pricing will not dissipate, limiting

orders to those with a robust business

case. Emerging solutions such as life

extension may become relevant for some

assets, particularly those serving

strong video neighborhoods, as operators

seek to lengthen CAPEX cycles. Yet as

the shape of data-driven demand

clarifies, operator confidence in ROI

should improve and alleviate this

restraint on contract finalization.

Lower Replacement Rate

The addition of HTS payloads and

increasing efficiency in transponders

per satellite, supported by advanced

platform design (e.g. power, payload

fraction), has significantly increased

per satellite capacity. Combined with

the implementation of electric

propulsion for orbit raising, a highly

capable satellite can be placed into

orbit for a fraction of the cost

feasible a decade ago. For operators

with multiple assets in the same or

clustered slots, it is possible to

replace multiple satellites with a

single new bird. With the greater cost

efficiencies of larger satellites, this

presents a compelling value proposition

for streamlined replacement – even if a

slot must be relinquished to

competitors.

While a prior concern with

concentrating capacity onto a single

bird was the risk of trapped capacity in

the face of evolving demand, advances in

flexible technology are helping

operators plan procurements with the

potential to adapt to a changing market.

The balance between capacity,

flexibility, and CAPEX will be unique to

each operator and each satellite

business case – we will not see every

bird going up with Tbps thoughput – but

overall trends point to a growing Mbps

per satellite moving forward: NSR

forecasts that HTS and hybrid HTS/FSS

satellites will grow to 70% of GEO

comsats ordered by 2026, a big jump from

53% in 2016.

Capacity Diversity- As MEO

constellations expand and LEO-HTS

constellations are developed, the GEO

market is adjusting to not being the

only game in town. For growing

applications like consumer broadband and

wireless backhaul, non-GEO will be in

direct competition with GEO. In many

other cases, this new capacity is

complementary to GEO, with SES,

Intelsat, Telesat, JSAT, and ViaSat

looking to cross-sell non-GEO and GEO

services to address diverse customer

requirements. With the surge in non-GEO

increasing competition as well as

filling out capacity portfolios, growth

in GEO demand is restrained.

Limited Customer Pool- Few new

players are expected to emerge in the

GEO space, generating only minimal added

demand. All GEO start-ups to date are

targeting data-centric, Ka-band HTS (and

moving forward, Q/V band) applications –

Kacific in 2017, Global IP in 2016. Some

may be successful and become regular

customers, while others (NewSat, 2011)

may fail to reach orbit.

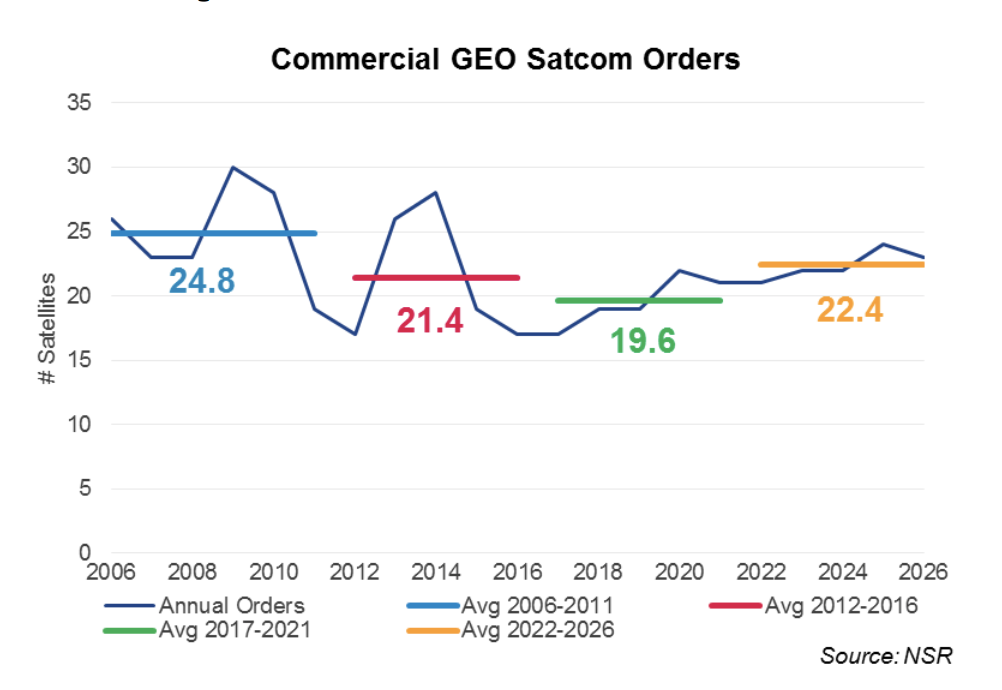

Overall, NSR’s

Satellite Manufacturing and Launch

Services, 7th Edition

report found these factors culminate in

an average annual order rate of 20

satellites for the 2017-2021 time

period, growing to 22 satellites between

2022-2026 – both lower than the 24

satellites per year average before 2015.

This smaller addressable market will

challenge a growing set of manufacturers

looking to win contracts and fill their

factories.

For manufacturers able to win bids,

the more advanced capabilities and

flexible technology sought by operators

add a premium on average satellite cost,

compensating for the lower number of

orders when assessed from a macro market

size perspective.

The broader satellite marketplace

offers other opportunities to

manufacturers pinched by declining GEO

satcom demand, with the Science &

Technology Development and Non-GEO

Communications markets promising the

most revenue growth. While non-GEO

markets are still speculative as pieces

fall into place for mega-constellations,

they offer potential for a steady stream

of business due to faster replenishment

rates.

Lower order rates clearly have a

knock-on effect for launch service

providers; while still working through a

backlog of satellites ordered during

strong, pre-2015 years (a process

prolonged by several failures and

delays), lower order rates will heighten

already intensified competition as LSPs

aim to fill their manifests.

Bottom Line

The 2015-2017 dip in commercial GEO

satcom orders was largely a result of

temporary challenges; as operator

confidence in the market improves and

the launch environment stabilizes,

orders are expected to increase. Yet

ongoing market pressure, increasing per

satellite capabilities, and the

emergence of capacity diversity across

non-GEO and GEO imply that operators

will nonetheless procure fewer GEO

satellites than the historic norm. For

manufacturers, this means a light at the

end of the low order tunnel – but one

less brilliant than when they entered in

2015.