Non-GEO Game

Plans and

Financial Play

Jun 14th,

2017

by

Gagan

Agrawal, NSR

The

satcom market is

rife with innovative

ideas and

constellations

targeting backhaul,

mobility, consumer

broadband and

government

verticals. In

response to this

proliferation of

business models,

traditional

satellite operators

are getting involved

in various

capacities to tap

into the demand

landscape, which can

be accessed through

LEO or MEO fleets.

These GEO-MEO-LEO

tie-ups occur while

operators are

already undertaking

aggressive GEO

capacity expansion

plans, leading to

highly complex and

speculative business

models, and

uncertain impact on

company financials.

Given this,

it’s important to

review the latent

demand verticals,

cost and CAPEX

scenarios for the

Big 5 (Intelsat,

SES, Eutelsat,

Telesat, and JSAT,

accounting for 60%

of global satcom

revenue) and finally

the impact of supply

and competition on

the winning

strategy.

To summarize the

current play for Big

5:

-

SES absorbed the

remaining 50.5%

of O3B for a

$1030M in 2016,

projecting

incremental

revenues of up

to ~$750M mostly

from O3B till

end-2021, with

focus on

verticals such

as trunking,

backhaul and

mobility.

-

Intelsat

invested $25M in

OneWeb in 2015

for exclusive

distribution

rights towards

aero/maritime,

government, oil

and gas, and

cellular

backhaul

markets. Though

the deal with

Softbank may

have fallen off,

Intelsat may bet

revenues on

GEO-LEO

synergies and

via a OneWeb

partnership.

-

Telesat has bet

on developing

its own LEO

constellation

focussing on

global

broadband,

possible

Canadian Govt.

programs, and

mobility

applications,

aiming to deploy

the full

constellation by

2021.

-

JSAT recently

invested an

undisclosed

amount in LeoSat

to become an

anchor investor

in the strategic

partnership.

With possible

realization of

investment

towards the

Series A $100M

funding round,

both bet on

verticals like

backhaul,

secured networks

for

banks/enterprises,

upload bandwidth

for

energy/maritime

operations,

emergency comm.,

and remote

connectivity.

-

Eutelsat is the

only major

satellite

operator to not

have disclosed a

non-GEO plan;

rather its

sticking to a

GEO-HTS/FSS

strategy and is

keen on vertical

strategic

partnerships

like with

Facebook for

broadband and

with ViaSat for

aero

connectivity,

while also

optimizing its

video business.

Crunching the

Numbers

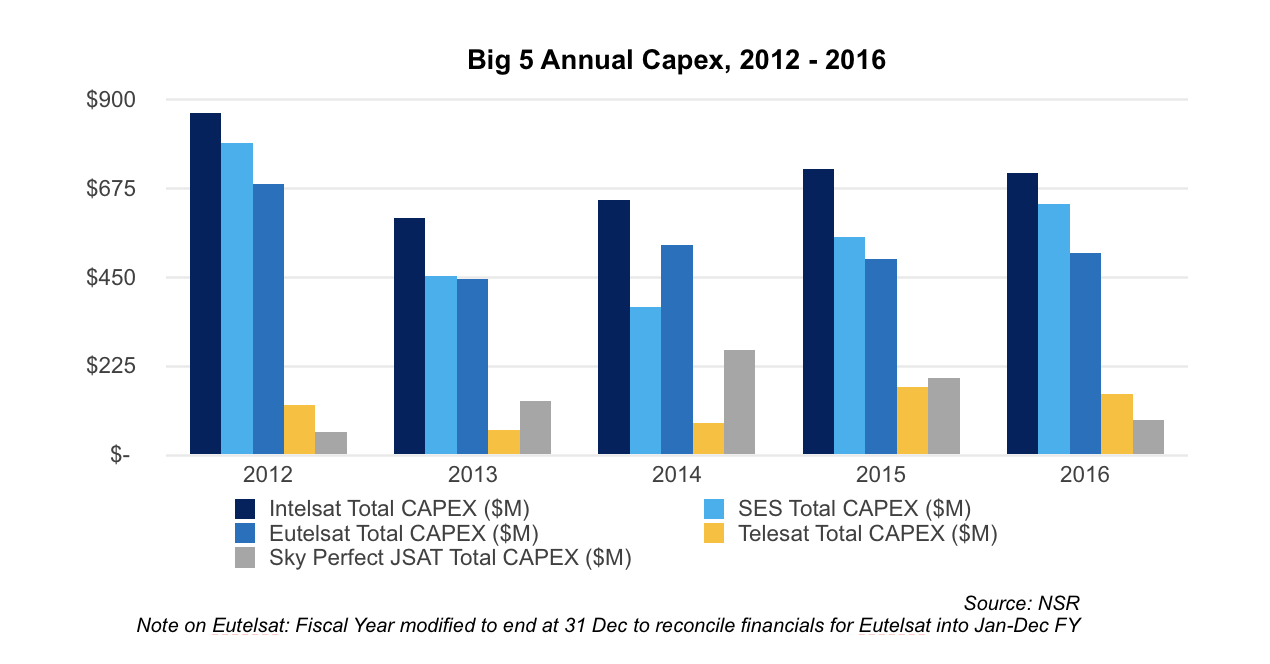

Assessing CAPEX

intensive LEO plans

with respect to the

existing risk

appetite, and with a

nominal lifecycle

cost of $2.5B to

$3.5B for a

constellation, it is

understood that

significant uptake

of CAPEX would be

needed to deploy the

complete system. It

is assumed that all

each of the three

constellations (O3B,

Telesat LEO and

LeoSat) may cost

approx. between

$2.5B and $3.5B.

Spreading a

conservative cost of

$2.5B over 5 years

gives a $500M CAPEX

projection for each

year. Now, given

that LEO fleets

essentially target

data/mobility/government

type of

applications,

non-video CAPEX can

be considered for

appropriate

correspondence.

Assuming CAPEX

linearly varies with

revenues and that

non-video revenues

generally account

for 70% for most

global operators,

non-video CAPEX

would theoretically

be 30% of the total

CAPEX. Consequently,

it is derived that

each operator spends

considerably less on

von-video CAPEX than

the required CAPEX

($500M annually) for

building a LEO

fleet. Thus, even

with a cut in CAPEX

up to 20% using

organic measures, an

operator would find

it difficult to

absorb/raise an

extra $500M of CAPEX

per year (almost

tripling the spend

for SES/Eutelsat,

and 10 times for

Telesat), unless

there is specific

latent vertical

demand that can’t be

tapped through

existing (GEO) HTS

fleet investments.

But What About

Supply?

Analysing the supply

landscape, currently

less than 40% of

global GEO-HTS

capacity is

currently in use,

with demand lagging.

This will continue

to be the case with

current and upcoming

launches of HTS

payloads such as

SES-12/14/15, EpicNG

fleet, Telstar 18/19

Vantage, Ka-Sat and

Eutelsat 172B,

ViaSat and Hughes

satellites along

with regional HTS

capacities over

Latin America and

Asia regions. Most

of these HTS

satellites target

aero and maritime,

cellular backhaul,

mobility and

government markets;

e.g. similar to the

LEO systems—and

differentiation

becomes increasingly

hard for multiple

upcoming LEO fleets,

with corresponding

ground systems still

in question.

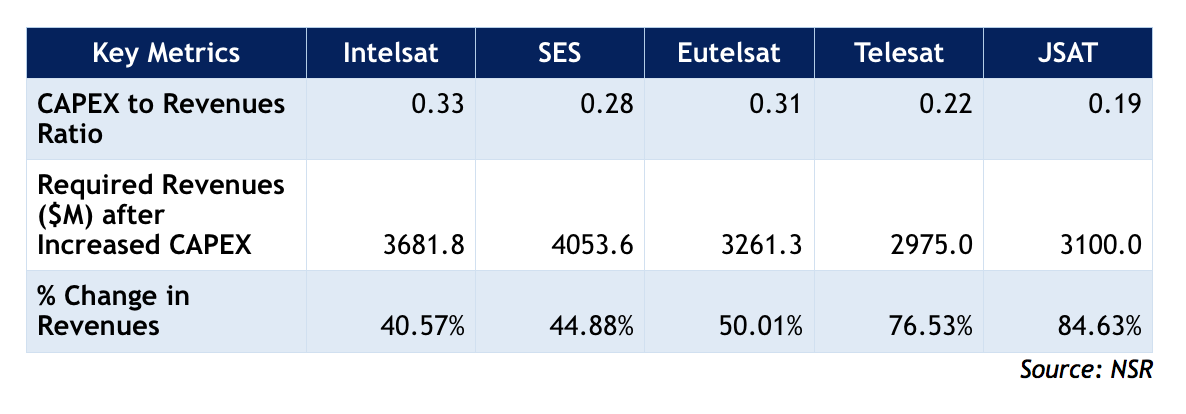

Thus, it becomes a

question of whether

anticipated demand

would materialize

within the payback

period, and if not,

what could be the

impact on the

finances of each

operator. Analysing

the CAPEX to

revenues ratios as

provided in NSR’s

Satellite Operator

Financial Analysis,

7th

Edition, with an

increase in CAPEX of

$500M, revenues

would need to

increase by as much

as 40% to 85% for

the Big 5 operators

for an assumed

constant CAPEX to

revenues ratio, as

shown in the table

below. SES, with a

$750M incremental

revenue forecast

till 2021, is below

the 40%-85% bar with

33% increase in

revenues (as of

2016), by having

executed a largely

cash-based deal to

nullify debt towards

long term CAPEX

(~$1.5-$2 billion),

maintaining the Net

Debt to EBITDA ratio

below 3 to maintain

its investment grade

rating. Thus, it

remains to be seen

whether a

cash-strapped

Telesat with EBITDA

of ~$570M can

achieve the same

CAPEX to revenues

ratio to maintain a

healthy turnover

ratio (~0.15-0.18)

with a Net Debt to

EBITDA ratio below

4, given the yearly

CAPEX investment is

almost 10 times

higher compared to

the non-video CAPEX.

Bottom Line

Intelsat and JSAT,

with strategic

partnerships, have a

very limited play in

this arena, low

upside, but are

essentially risk

free and on an

organic pattern to

their growth, while

simultaneously

developing a service

provider based

distribution

business that can

rival the other

three big operators.

Eutelsat, as well,

banks on a similar

strategy with

limited upside and

organic growth

through vertical

strategic

partnerships with

service providers

for its GEO-HTS and

FSS fleet. For the

first time, the

industry sees a

regional operator in

Telesat going

aggressive with LEO

plans with a launch

timeframe

competitive to

OneWeb and more than

50% increase in

revenues in the

medium to long term,

although with a low

ability compared to

Top 3 with respect

to EBITDA, and a

risk of high

exposure - in case

revenues don’t

materialize in the

payback period. SES

bet early with an

investment of $75M

in O3B and, with the

recent acquisition

(and low CAPEX

compared to LEO

fleet), has

materialized MEO-GEO

synergies into one

of the more

promising growth

areas in the near

term.

Questions remain

though, that had the

Softbank led

Intelsat-OneWeb

merger not failed,

and with cash

infusion of

$500-600M per year

towards CAPEX for

OneWeb, and an

improved debt

profile for

Intelsat, would that

have been a turning

point in the Big 5

play? Could

Intelsat with OneWeb

have mustered growth

(for a similar CAPEX

to revenues ratio)

through a well-built

distribution network

from the partners

associated, pushing

other operators out

of the game?

Ultimately Intelsat

and OneWeb playing

fragmented roles in

the industry may be

a win for other

global operators to

further their

LEO/MEO ambitions.