FPAs Place in the Blame Game

About a year ago, NSR first wrote about flat panel antennas (FPAs), and their place among the seismic technological shifts occurring in the satcom ecosystem. The article discussed previous satellite industry failures due to expensive and inefficient terminals, and highlighted a troubling trend wherein satellite operators were simply pushing more bandwidth to market to compensate for what is seen as a roadblock to better end-user equipment performance.

FPAs were touted as the HTS “White Knight”, the ground segment industry’s innovative answer to satellite mobility market demands due to increased HTS capability. However, despite increased promotion and technological advancement, FPAs remain expensive and under-developed and are often criticized as the bottleneck in overall systems’ performance and expected improvements in cost and efficiency. Though it is easy to rest the entirety of blame on the shoulders of FPA manufacturers, NSR believes the problem is more widespread throughout the ecosystem.

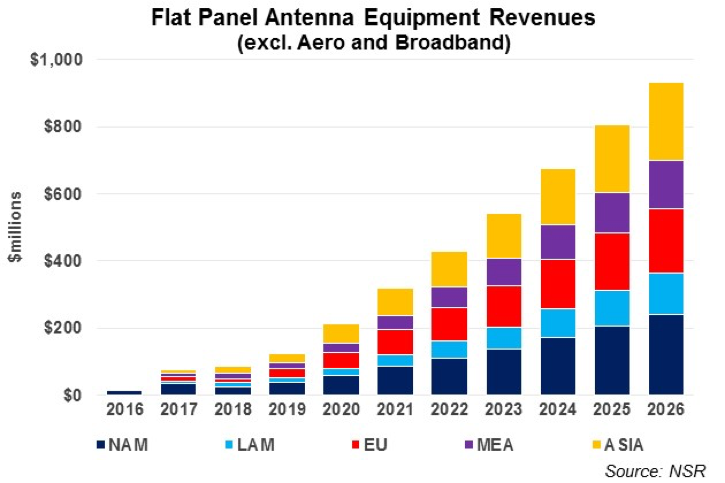

While NSR’s Flat Panel Satellite Antennas, 2nd Edition report further expands this analysis and forecasts strong long term equipment sales in the Aero and Broadband verticals, the rest of the forecast features growth limited by many factors. With just over 260,000 units shipped globally by 2026, FPAs will still generate roughly $933 million in cumulative equipment revenues. NSR’s report dug deep into the aforementioned trends and looked thoroughly at the technological and market challenges involved with FPAs, alongside an analysis of all the major antenna manufacturers and their products’ maturity level.

What came out was that several FPA performance issues, namely lower G/T compared to parabolic antennas, lower efficiencies at higher latitudes, and costly, yet-to-be proven electronically-steered technology were seen as the main barriers to their greater market adoption. For example, comparing several traditional Ku-band parabolic VSATs made for maritime customers, with mechanically and electronically-steered FPAs of comparable aperture size, it was found that the FPA G/T was, on average, 14% lower, with half of the available range of elevation. While some cases feature better FPA performance, many cases paint a more pessimistic picture of FPA performance. However, in order for FPAs to succeed across various verticals, several design parameters should be considered, so as to optimize not just the antenna, but the entire system.

With ever-increasing demand and HTS capability, the next generation terminal must be able to consistently deliver higher throughput, more efficiently. Starting with the antenna, pointing accuracy, side-lobe levels, and beam steering are of initial design concern. Straying too far from accepted levels not only makes for an inefficient antenna, but risks non-compliance with FCC and ITU regulations. While the majority of mechanically-steered FPAs have low complexity, their moving parts often bring a lower reliability, higher weight, and slower steerability; however, there are exceptions and the technology is more mature than electronically-steered FPAs.

These factors have delayed FPAs coming to market in several verticals, and continue to be a concern regarding design for upcoming LEO HTS systems. Pointing to fast-traveling, low-orbiting satellites requires stringent precision, and obviously poses a greater challenge in mobility markets, operating under dynamic conditions. Going forward, many believe that electronically-steered FPAs will address these issues and disrupt the market, offering lighter, more reliable, more accurate antenna solutions. NSR expects the challenges to be more easily addressed and overcome in Fixed Application verticals, such as Broadband and Backhaul, and expects high volumes of shipped units, with more than 1,000 annually in Backhaul alone by 2026.

Concerning the terminal (read: antenna and modem), spectral efficiency is a key figure of merit, as it pertains to both the cost and performance of satellite networks. Spectral efficiency can be affected by choice of modem and the design of the satellite network. Losses in the modulation and encoding of the signal in the modem limit the spectral efficiency of the entire terminal. Software-stability issues in modems have been shown to delay the commercial launch of some HTS services, while new breakthroughs in modem throughput help push the industry forward. Modems, like antennas, must be designed and tested to work within the satellite network, and delays in either technology delay the entire market.

The satellite itself can impose design constraints on FPAs, defining their efficiency. Higher broadband frequencies, such as Ku and Ka-band, are more sensitive to rain fade issues, constraining terminal spectral efficiency. While different networking techniques (TDMA, SCPC) can compensate, the cost and effectiveness of these techniques is affected by the satellite network, as well as by the terminal.

The Bottom Line

The satellite industry is experiencing growing pains due to major changes happening both in space and on the ground. Satellite operators are launching high-capacity networks, aiming to meet growing demand, while service providers are looking to better corner the market, and make better use of their purchased capacity. The ground segment industry, despite working hard to meet these expectations, is facing many technological challenges, not the least of which is performance in more efficiently using scarce spectrum resources. Lacking integration and design coordination, the open market is limiting FPA potential, placing blame for service delays on antenna technologies.

Delays cost the entire industry, and it will require collaboration to find the best market fit to leverage FPAs going forward. While air-drag constraints have necessitated a flatter profile for Aero terminals, the collaboration among designers has led to healthy take-up rates and growing throughput in this vertical, resulting in expected Aero FPA equipment revenues to completely dominate the market over the next decade. Antenna manufacturers, RF equipment developers, and satellite operators who design “use-case” specific solutions will help maximize FPA throughput and adoption. Partnerships such as Phasor’s work with OmniAccess for the superyacht market, Thinkom’s partnership with GoGo for the 2Ku service, and Gilat’s high-speed broadband-to-trains project, show promise as they focus on the specific challenges inherent to the targeted vertical. Besides growing demand, collaboration, not blame, and specificity of design are essential to the success of FPAs.