Changing Gears in UAS

Ever since the new U.S. Administration came into office, it has often been embroiled in media controversies, while some geo-political foreign policy strategy shifts, especially pertaining to usage of unmanned aircraft, have gone unnoticed. Along with the uptick in use, the role of drones in the battlefield is further changing gears with the introduction of Artificial Intelligence (AI) based algorithms assisted ‘hunting’ operations.

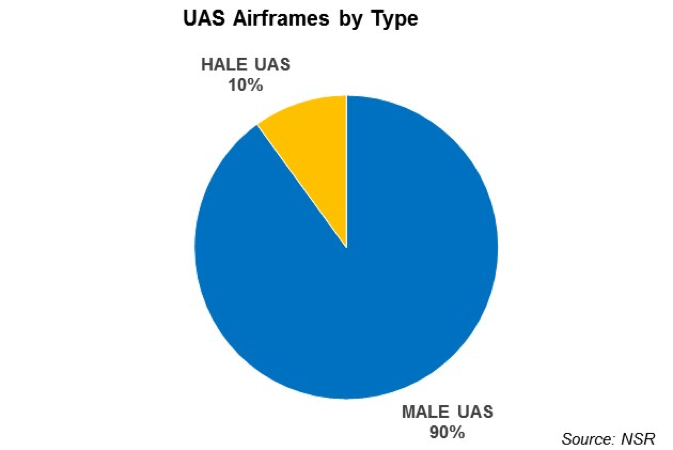

The places of man and machine on the battlefield are being reordered by drones in the same way ordinary lives were transformed via the introduction of PCs 40 years ago. NSR’s UAS Satcom & Imaging Markets, 3rd Edition took a deep dive into these machines, which need Beyond-Line-of-Sight (BLOS) communication capabilities, provided by secure communication satellite links. The report found most the current global UAS fleet are of Medium Altitude Long Endurance (MALE) airframe type, as the lower complexity of building these machines has enabled countries like Turkey, China, Italy, and India to develop their own indigenous vehicles.

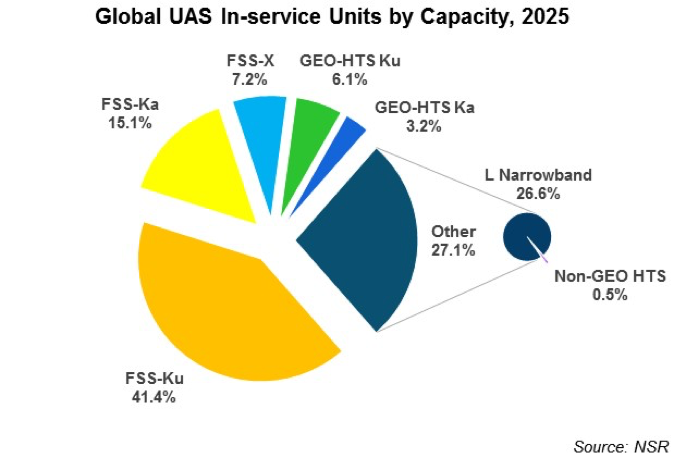

MALE UAS can carry out both ISR and strike missions currently, with satcom links being primarily provided by commercial satellite operators. The addition of mission complexity such as real-time pattern recognition from videos and images captured by these UAS and its adoption as a proven military tactics can drastically increase the bandwidth requirements for BLOS communication data links, which would be difficult to meet in a pure FSS Ku-band satcom ecosystem.

NSR expects the dominance of FSS Ku-band capacity to reduce as a result, forcing the defense industry to ‘patch-up’ existing UAS designs for accommodating such retrofits, or move to HTS systems faster than previously expected. Demand for L-band based communication data links is also expected to increase by the turn of this decade, as they offer a cheaper alternative for Command & Control operations, as well as a ‘fallback’ option when the primary broadband satcom link is unavailable.

While both the global peace and security situation could be further impacted if these drones continue to proliferate at the current rate, NSR’s forecast shows the commercial satcom industry reaches more than $2 billion in annual revenues by 2025. A good bulk of this satellite capacity allocation will continue to be over the Middle-East and North Africa, as the new U.S. President makes drones more pervasive. Moving forward, a potential market restraint could arise from a blowback if more civilian casualties are caused by the increasing use of UAS.

Bottom Line

NSR sees the demand for commercial satcom capacity to only increase as battlefield operations become more network-centric, as indicated by new policy statements.

As technology evolves and collides, the scope of what a UAS can do on the battlefield will also change. Adding political and military will to use these machines only makes them more potent and bandwidth-hungry, presenting opportunities for satellite operators in the near to mid-term future in the capacity leasing market.