Adjusting HAPs Ambitions

In announcing last month that it would downsize its Loon project, internet search giant Google actually moved a step forward towards its goal of providing connectivity via high-altitude balloons. The reset tapers the fledging project’s ambitions but sends the message that ‘business is business’ and making profit comes first instead of long-term R&D for wide-scale, global efforts without a focus. And for these HAPs, balloons are where the most of the revenue-generation potential exists.

The analysis in NSR’s recently-released High-Altitude Platforms (HAPs) report describes how the most operational HAPs are balloons, as these represent hundreds of launches of zero and super pressure balloons every year.

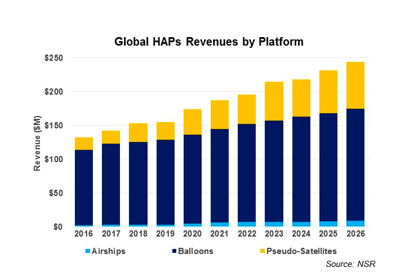

What is interesting is the proliferation in recent years of almost as many new balloon programs in the testing stage. NSR identified 5 countries with zero- and super-pressure balloons manufacturing and integrating capabilities for roughly a dozen or so active and planned programs that reach a few hundred launches every year, mostly in the weather, scientific research, technology testing and media domain. It is noteworthy that of these projects, more than half are in operation today due in large part to the lower cost compared to airships and pseudo-satellites (the other HAPs) but also to the simplicity of deployment. NSR forecasts revenues from manufacturing of and services from balloons to grow to over $165 M annually by 2025. The advent of super pressure balloon units, with designs allowing for higher up-mass capabilities, will also be a revenue booster for applications such as communications, remote sensing and persistent surveillance and monitoring.

With software and machine-learning, Google claimed it can better ‘control’ these unpowered and non-reusable lighter-than-air structures and thus deploy fewer of them over the same spot to provide connectivity, in much the same way that competing airships such as Avealto are planning to do. It is this rationalization exercise that lead Google’s management to design a network with what appears to be a significant decrease in the number of these communications platforms to get into a revenue-generation mode that they claim will offer profitable service. Even if they are far from the duration record set in the 1960s (744 days), with some methods to rationalize the overall footprint of the deployments, one can estimate they will cut their operation costs significantly and offer a market solution much faster in areas where demand for connectivity exists.

EE, a UK-based mobile operator has taken a page from this story and is providing ad-hoc and more persistent coverage over regions of high-demand in quick-deploy mobile communications scenarios. And these can be up in the air for a month with coverage of 5 km in radius. So, it seems there is room to grow and provide connectivity services sooner via balloons with a simpler and cost-competitive model.

Bottom Line

The high-altitude balloon industry is operational and well active compared to other HAPs markets today and going forward. With a growing number of players and launches in many regions, especially North America, Europe, and Asia, balloon markets will prove to be the strongest revenue generator of all HAPs which is perhaps a reason why players like Google adapt their ambition to build towards revenue.