Two Paths to Satellite Broadband Growth

Jan 31st, 2017 by Lluc Palerm-Serra, NSR

Beyond media broadcast services, the satcom industry has been relegated to serve niche applications capturing a tiny proportion of the global telecom markets. However, the new, lower cost per Mbps opens a window of opportunity to get to the promised land of mass markets. What is the way to get there, and should satcom fight its own battles or find allies along other sectors of the telecom industry?

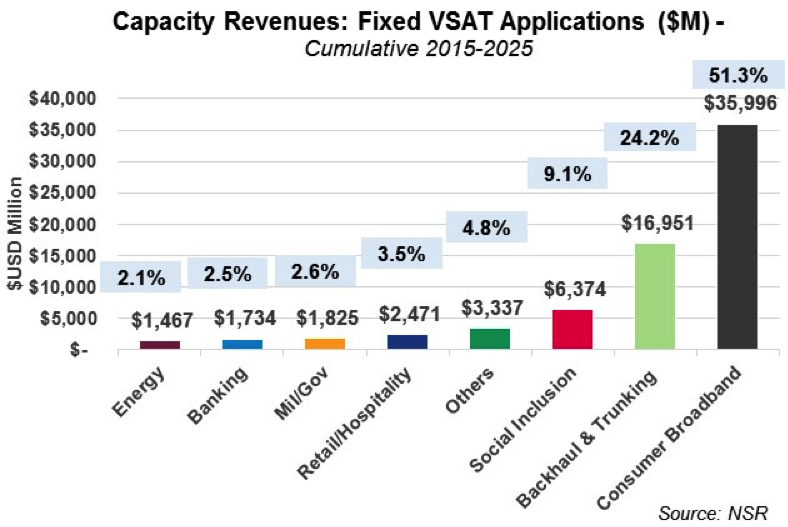

NSR’s VSAT and Broadband Satellite Markets, 15th Edition report forecasts over 75% of cumulative capacity revenues in the 2015-2025 timeframe for fixed VSAT applications to come from consumer oriented offers, either directly or through partnerships with cellular and telecom operators. What then are the conditions for each model to thrive?

Conditions for the Consumer Broadband Market to Flourish

After several years of availability of cheap HTS Ka-band capacity, multiple models for commercializing satellite Internet have been tried. What these experiences have proven is that it is absolutely necessary to develop a strong retail presence for the market to flourish. The “build it and they will come” approach does not work, and the market requires significant effort for demand stimulation. The comparison of the European and the North American markets provides good insights in this direction. With comparable levels of available income, rural population, penetration of Internet… the North American market has grown spectacularly while Europe has lagged. It hasn’t been until very recently, after the emergence of stronger retail players in a consolidation process, that the European market started to meet high growth expectations.

Affordability has been the other major barrier for satellite Internet. While it is now possible to offer packages priced at similar levels as DSL (of course with much more stringent data caps), the focus on rural areas that feature lower available income compared to their urban counterparts as well as the high cost of the terminal, limits service take-up. Financing the terminal often requires long-term contract commitments that are not attractive for end users and presents high risks for the service provider. This is a serious barrier even in middle-income countries and has deterred growth in areas such as Latin America and Eastern Europe.

While there is still plenty of room for growth in developed economies and satellite Internet is still just scratching the surface of the total addressable market, the majority of the 3.9 billion people who are still offline are in the lower-income economies, and replicating the model from developed markets will fail.

Mobility as the Primary Means for Accessing the Internet

With prices of smartphones plummeting, mobility is the primary (if not the only) way for accessing the internet in emerging markets. At the same time, expansion of ground networks is slowing down and satcom can now offer a very valid solution for 3G and 4G backhaul. The combination of these elements is creating a tremendous opportunity for satcom to play a bigger role in the cellular infrastructure.

However, entering this market presents its own challenges. Mobile Network Operators (MNOs) have their own internal dynamics, and it is usually very hard to remove the old beliefs of satellite being an expensive, inconvenient and low-speed solution. Fighting invalid and old stereotypical beliefs as well as influencing MNO investment priorities (network densification vs. network expansion) are some of the stronger barriers for satcom in this promising vertical.

In order to keep higher degrees of control over the service, some satellite actors have developed demand aggregation offers independent of Mobile Operators. These solutions usually involve Wi-Fi hotspots in unconnected and underserved locations like the proposed Eutelsat-TamTam, Avanti-ESA-Newtec or SES-Facebook-Gilat initiatives. NSR forecasts a big portion of the consumer broadband demand for satellite services will actually come from these demand aggregation points, especially in developing markets. These services have the potential to stimulate demand at a faster pace and reach areas ignored by mobile operators. However, the challenge will be back to developing strong retail arms and offering affordable solutions.

Bottom Line

The new wave of competitively priced capacity is opening a vast opportunity for satcom to serve mass consumer markets. However, to reach these mass markets, the right business models need to be developed. Adapting the product to each market segment is essential, and this means putting a great emphasis on sales channels, partners and product architecture.

Both directly marketing to consumers and going through mobile operators will present opportunities and challenges. When deciding the strategy, each actor should factor in considerations such as the target market segment, available income, existence of partners, the core competences in-house or that could be developed and the willingness to take risks. The more traditional actors will tend to prefer to reach end-users through partnerships with mobile operators, sacrificing independence but moderating exposure to risk. On the other hand, the most expeditionary players might prefer directly reaching customers with greater control over the ecosystem and the possibility to capture the bigger margins available closer to end-users. However, this approach will require investing heavily on distribution channels and developing new skills with the higher risks involved in the move.