Dealing with Fickle Consumers Markets

Jan 24th, 2017 by Claude Rousseau, NSR

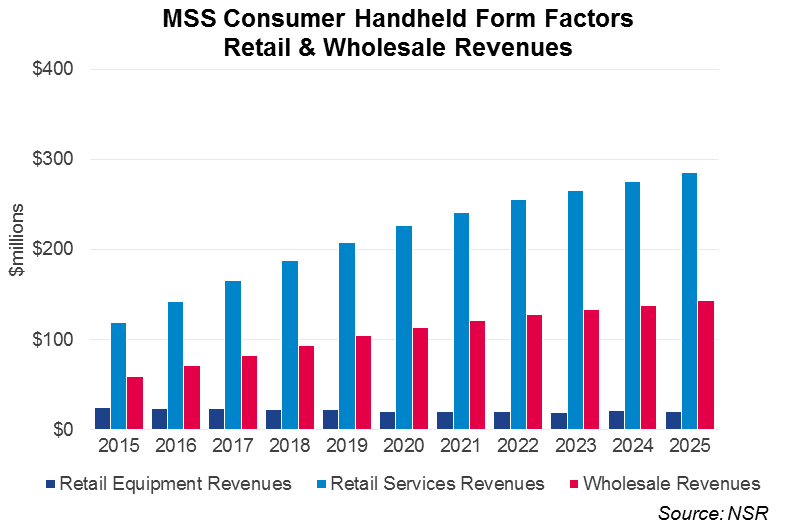

NSR’s Land-Mobile via Satellite, 4th Edition report noted consumer handheld markets (SatSleeve, SPOT, InReach) are expected to reach more than 1 million in-service units and bring retail revenues for equipment and services greater than $300 million annually by the end of 2025, representing a $2.6 B opportunity in the next decade. A key aspect for these volume consumer-oriented markets to reach these figures requires one of two strategies: sell equipment at a higher price or grow ARPU levels.

These devices are targeted at outdoor enthusiasts, remote workers and emergency services (plus locations where no or little connectivity exists such as ships and offshore platforms). But by reaching farther into new verticals, a key aspect for these volume consumer-oriented markets requires that the equipment has more features, thus is priced higher or that ARPU levels grow far more than where they are today. Because when it comes to getting the cost-volume equation right, the direction equipment and services revenues take in a market where (relatively) low ARPU levels and churn go hand-in-hand is a tough balance. This may mean more than just consumers; the target market/s must diversify to enable faster growth in what will be very dynamic markets.

Land mobile via satellite is concentrated in North America where these devices are more established, but outside that region, whilst operators are seeing faster growth starting from a low base, they are also likely to expect lower ARPU at first. As more diverse consumer-oriented handheld products help reach deeper into the confines of various verticals to provide mass-market density, the key to generate the sizeable revenue growth on one hand is to increase ARPU in the face of symptomatic high churn.

When Globalstar’s U.K. reseller Global Telesat Communications announced it sold 10,000 Globalstar SPOT devices earlier this month, the list of its end-user segments seemed longer than usual with not just adventurers but also security firms, forestry organizations, mariners, sports event organizers, and other business travelers. It is clear the B2B market is on the radar of operators and resellers if end-users are to expand in both numbers, variety and region. The trend in terms of region was evidenced by a rise from 17% to 20% of subscribers outside of North America in the SPOT and Simplex product lines. But Globalstar’s strategy to lower SPOT equipment revenues had the effect of concurrent higher ARPU (+15%), which was up to around $11 per month from $10.

For its part, Garmin, the mapping and location-based service company that bought DeLorme and its Iridium-based InReach, expanded its offering when it announced at CES in Las Vegas in early January a new version of both the SE and Explorer available in the first quarter of 2017. These two-way communications devices will have additional features and services but also a higher equipment price. The reasons for the hike were not spelled out by Garmin but clearly, the additional maps and imagery could be behind what amounts to a $100 more for the SE+ and $70 more for the Explorer+ in order to grow revenues. It seems hefty but service plans for the InReach start at a reasonable $12 even though heavy user plans are $80. These will certainly drive overall market ARPU more than Globalstar will, and NSR forecasts overall consumer handheld ARPU more in the $25 range (not including activation) for the next few years and dropping after that with volumes growing. On the equipment side, higher priced units such as the InReach SE+ and Explore+ will help stabilize annual revenues in the $24 M range, decreasing to less than $20 M later as the strong position of Globalstar influences the market with lower retail price products.

Bottom Line

Globalstar is still the largest provider of consumer handhelds with its SPOT devices, averaging 253,000 subscribers. The InReach (Iridium) and the SatSleeve (Thuraya) also have seen growth, and both target retailers or consumer-oriented distribution networks that will enable these devices to be the only other segment (other than traditional handhelds) to reach the 1 million in-service unit mark by 2025. This is a very healthy prospect and one that compares favorably with all the other land-mobile markets, with close to 10% CAGR for unit growth rate and 8% for total revenues.

However, there is some certainty that to reach these numbers in the next decade, revisiting equipment price upwards or growing ARPU will be part of the two-pronged strategy.