Ground Segment:

The Forgotten

Link of

Satellite

Mobility

Nov 13th,

2016

by

Prateep

Basu, NSR

The rapid pace of

change in the

satellite industry

has consistently

pushed operators to

pivot their business

models, be it via

declines in capacity

pricing, more

competition, and

more recent growth

markets such as

aeronautical and

maritime. As the

industry and

end-users struggle

with arguments such

as Ku- vs. Ka-band

or GEO-HTS vs.

LEO-HTS, an

important and often

neglected part of

the success equation

is the ground

segment technology.

NSR’s Commercial

Satellite Ground

Segment report took

a deep dive in

assessing the

revenue opportunity

these changes in the

space segment bring

to the ground

segment industry.

The report found

that while mass

markets like DTH

drive overall

industry revenues

and equipment

shipments,

advancements in

satellite mobility

ground equipment –

end-user terminals

and antennas - form

critical steps

for the

industry to move

forward.

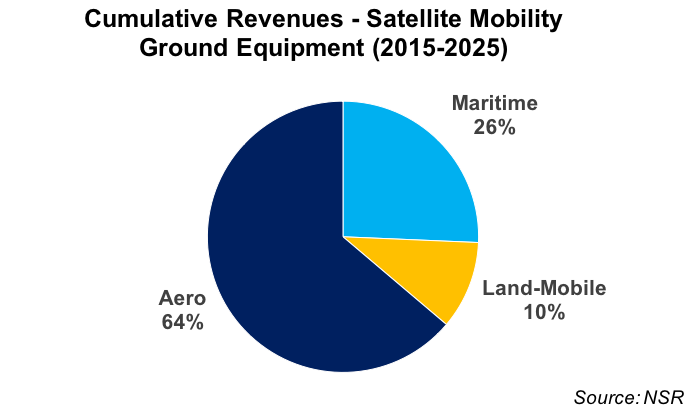

In the report,

both fixed and

mobile satellite

services were

studied, and NSR

found the

cumulative revenue

generation

opportunity for

satellite mobility

ground equipment by

the end of 2025 is

$14.1 billion.

An

interesting dynamic

noted in this study

(and in a previous

article) was that

despite contributing

only 0.5% of

cumulative equipment

shipments within the

global satellite

ground equipment

industry,

satellite mobility

ground equipment

will account for 14%

of cumulative

satellite ground

segment revenues

from 2015-2025.

Aeronautical VSATs

and equipment will

be the major

contributor to

satellite mobility

ground equipment

revenues, due to

their higher pricing

and the high rate of

market penetration

observed by NSR,

assisted largely by

the ‘need to be

connected’

attitude of flight

passengers driving

the demand and cheap

capacity in

abundance feeding

the supply.

The

challenges for the

satellite mobility

ground equipment

manufacturers are

however manifold,

with the technology

and economics curves

mostly not matching,

with the shelved

Boeing-Panasonic

being an example

where a Panasonic

top official quoted

the reason for this

decision being

airlines not

currently willing to

pay for the higher

cost of more

efficient antennas.

The onslaught of

satellite capacity

in different orbits

and frequency bands

is compounding the

problems for ground

equipment

manufacturers as

they grapple to

design precise

antenna pointing,

dynamic tracking

capabilities,

dual-band terminals,

fast beam switching,

gain stability, loss

in efficiency due to

oversaturation of

beams, and

trading-off on

issues like size,

weight, power and

heat, to name a few.

The problems

compound when these

units need to be

certified, and also

standardized in case

of Ka-band due to

the wide bandwidth

and different

frequencies of

operation, which

increases the lead

time to market and

henceforth becomes a

pivotal factor for

the market success

of current and next

generation HTS

systems.

But the satellite

industry has been

proactive lately in

accounting for

ground equipment

availability when

assessing their

technology-market

fit, as seen through

many industry

partnerships and

especially in the

case of emerging

flat panel antennas

for

communications-on-the-move,

with

Kymeta-Panasonic-Intelsat,

Phasor-Intelsat, and

Thinkom-GoGo being a

few notable

partnerships. As

managed services

become a central

part of business

strategy due to the

higher margins on

revenues through

value-adds and

offsetting of

depreciating

capacity costs,

NSR believes such

ground

equipment provider

partnerships for

co-development of

products will be

pivotal for closing

the business case in

emerging and new

market verticals in

satellite mobility.

Bottom

Line

New technology

calls for more new

technology, and the

satellite ground

equipment market,

being upstream

technology driven,

acts as a critical

support system for

the overall

satellite industry

ecosystem. NSR

research show this

opportunity is

massive, and

partnerships are

expected to pave the

way for faster

product development

to capitalize on

this opportunity.

One must however

not forget the

learning from past

experiences of the

satellite industry,

that the

fate of billions of

dollars invested by

satellite operators

globally effectively

lies in the timely

success of

technologically-economics

fit of the ground

equipment, making it

the unsung hero of

satellite mobility,

as it

undergoes

transformation, both

on the technological

and business model

fronts.