Joining

Together with the Band(s)

Oct

5th, 2016

by

Blaine Curcio, NSR

Over the past few weeks, we

have seen top satellite executives

seemingly coming to terms

with the fact that

lower

prices are here to stay,

and that the evolution of the satellite

telecom business model from FSS towards

HTS—at least in terms of the best growth

opportunities—is well underway. While

NSR does not dispute that video will

remain a beacon for steady growth and

long-term contracts in developing

countries, and a bastion of stability in

developed ones,

we have noted

for some time that GEO-HTS will provide

the best opportunities.

When looking at

NSR’s

Global Satellite Capacity Supply &

Demand, 13th Edition,

it becomes clear that not all

GEO-HTS capacity is created equal.

As some industry insiders have recently

discussed, the promise of Tbps

satellites worldwide should not

unequivocally signal the downfall of

traditional FSS—and should by no means

close the door on the GEO-HTS systems of

tomorrow that are being launched with a

decidedly more modest payload of dozens

of Gbps, rather than Tbps. Indeed, when

looking at these future GEO-HTS

payloads, we can in many cases divide

them into

C-band/Ku-band HTS payloads,

such as the SES-12/14/15 system,

Intelsat Epic, IPSTAR, and so on, and

Ka-band HTS

payloads,

such as ViaSat-1/2/3, Jupiter-1/2, and

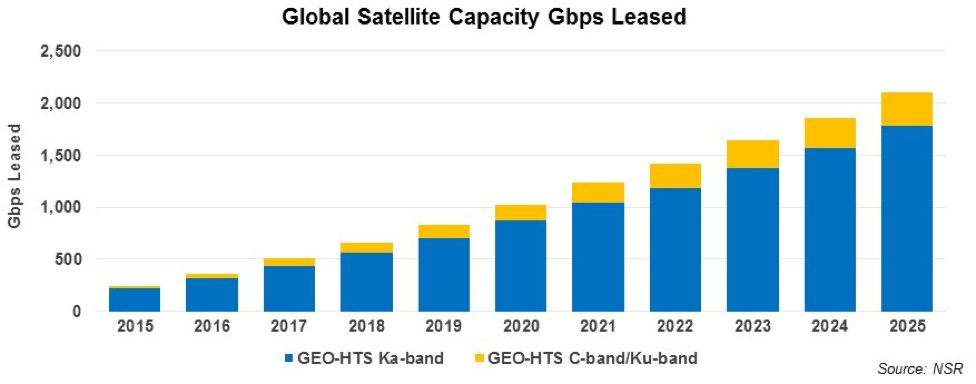

Ka-Sat. As the chart below shows,

clearly GEO-HTS Ka-band

wins outright

as it relates to capacity leased,

with

around 87% of the GEO-HTS market by

leased Gbps by 2025.

When looking at future GEO-HTS

payloads, the first point to keep in

mind is that

GEO-HTS

Ka-band capacity will see lower prices

on a per Mbps basis.

This comes

about due to two factors, namely 1)

GEO-HTS Ka-band tends to primarily

target consumer broadband, which is

lower price capacity, and 2) there

remain, in some regions and for some

applications, doubts about the

suitability of Ka-band for high-SLA type

requirements, and there is in general a

“new product bias” associated with

Ka-band in some cases. In short, many

customers are generally happy with what

they have, and thus will stick with the

path of least resistance, which in some

cases is a slightly higher per-Mbps

backward migrated C-band/Ku-band GEO-HTS

service, particularly when this service

ends up being cheaper than a comparable

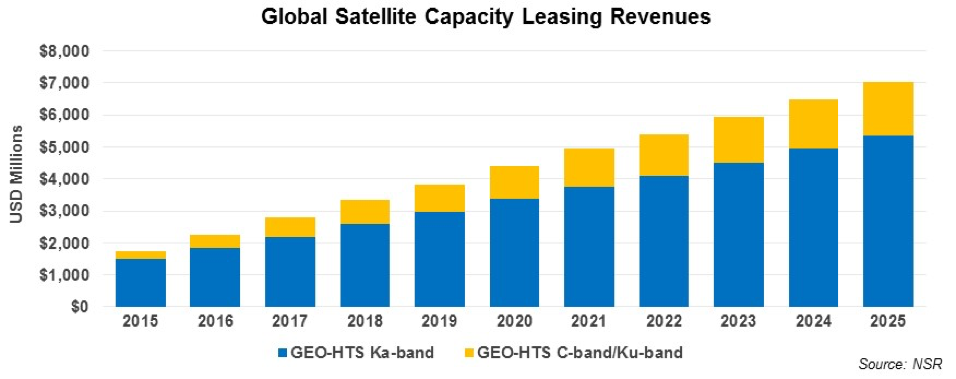

FSS service. As such, and as the chart

below indicates, GEO-HTS C-band and

Ku-band combined will comprise around

25% of GEO-HTS revenues by 2025, or

around $1.7 billion.

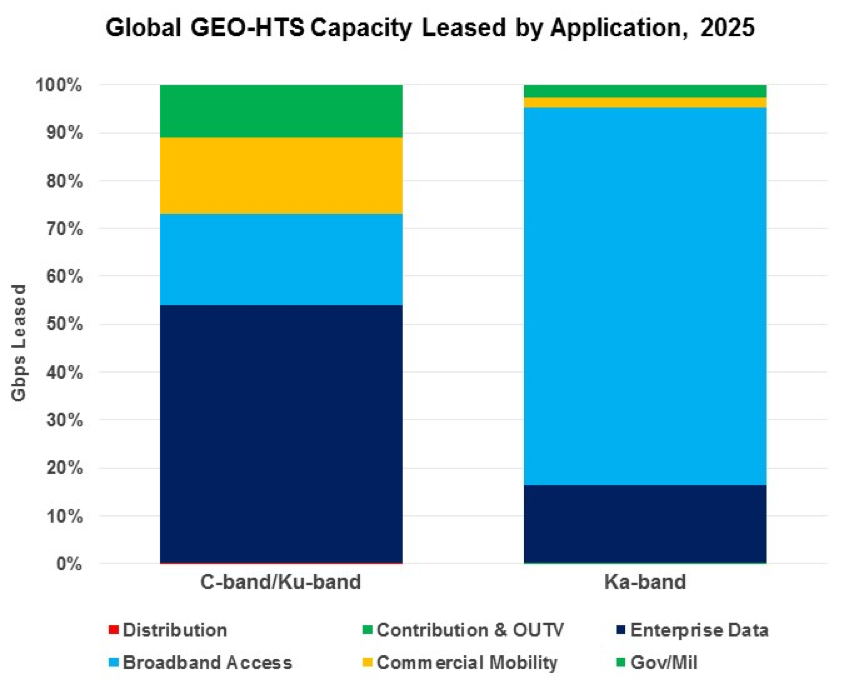

Ultimately,

GEO-HTS

C-band and Ku-band will have a far more

balanced demand profile than GEO-HTS

Ka-band,

with the

former seeing stronger demand from

applications such as Enterprise Data and

to some extent Commercial Mobility and

Gov/Mil. As the below chart shows,

around 80% of GEO-HTS Ka-band capacity

demand will come from consumer broadband

access, compared to around 20% for

GEO-HTS C-band/Ku-band. While NSR does

expect the price advantage, as well as

the

sheer volume

of GEO-HTS Ka-band capacity

to

cause some customers to migrate, we have

thus far not

seen this as being the case

in

instances that may have otherwise

dictated migration. For example,

Avanti Communications has been present

in Africa for some time now with

low-cost Ka-band HTS capacity,

yet

the company has not been able to

capitalize on lower prices and has been

brought the point of potential

acquisition due to cash requirements in

the UK.

Bottom Line

Moving

forward, it is vital to understand that

not all

GEO-HTS capacity is created equal.

While there may be

orders of

magnitude more GEO-HTS Ka-band capacity

being launched in all/most regions,

this will not necessarily be able to

convert all customers from all

applications solely due to the promise

of lower bandwidth costs. While there

will

certainly be

pressure on pricing in all frequency

bands and all capacity types,

NSR does not expect GEO-HTS Ka-band to

be the end-all, be-all solution. Moving

forward,

a more

nuanced picture will emerge,

with

GEO-HTS Ka-band being able to convert

and build new markets in areas such as

consumer broadband—and in many cases,

Enterprise Data—but with GEO-HTS C-band

and Ku-band being able to command

a

significant market of legacy customers

migrating to lower-cost GEO-HTS, as well

as new verticals ranging from backhaul

to aero.

In a

multi-band world, NSR expects

each

band to present unique value

propositions to unique customer bases.