| |||||||||||||||

|

| |||||||||||||||

|

‘Big Data’ Leap in EO Markets

Oct 1st, 2016

by Prateep

Basu, NSR

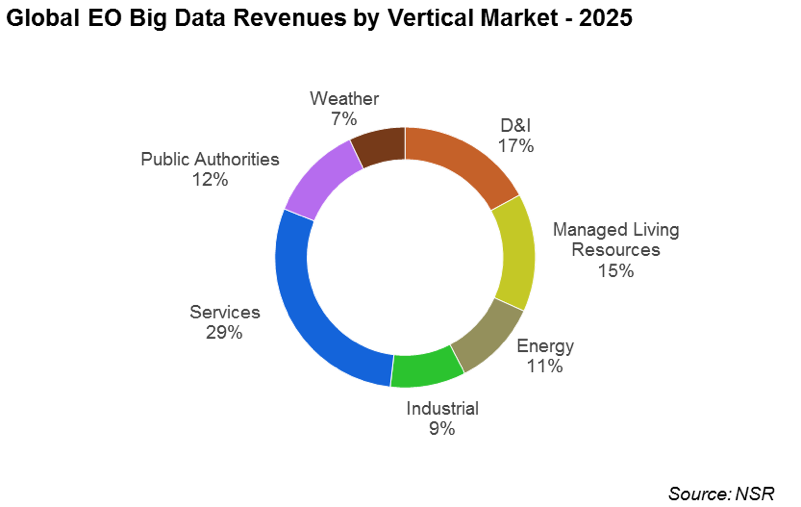

Five years ago when Skybox and Planet announced plans to image the Earth with unprecedented revisit, many observers wondered what data applications these new platforms would unlock. Back then, the industry standard in satellite Earth Observation (EO) was large satellites that provided high quality images at high prices for lucrative government and defense markets at relatively low revisit rates. Fast-forward to 2016, thanks to the emergence of Big Data analytics, the same people are left wondering what applications can these small satellite platforms unlock that would help the industry make a giant leap forward. NSR’s Satellite-based Earth Observation, 8th Edition report brought the first forecast for Big Data from EO images, projecting a cumulative revenue opportunity of $6 billion over the next ten years. Big Data analytics provides the satellite EO industry with means to engage with customers more insightfully, and NSR expects Services, Defense & Intelligence, and Managed Living Resources verticals to be its biggest vertical markets. The success of Big Data analytics in the satellite EO industry will not be defined by just volume and velocity of data, which can be achieved by adding more sensors in orbit, but more so by the variety and veracity of the datasets being consumed to build the final product. It is not cost-efficient for a single satellite operator to provide all these ‘4 Vs’ required for the EO Big Data business, which is where EO data aggregators such as CloudEO and PlanetOS come into picture, especially to add the required variety and veracity in data.

Emerging companies in this space such as Orbital Insight, RSMetrics, and Descartes Labs have developed interesting analytics products such as indices providing information on retail store traffic, global oil storage and agricultural yield. Such innovative products also call for business model innovations, as their customers (mainly the Wall Street hedge funds, commodity traders, and investors) are more concerned about the depth of information that can be derived from these indices rather than the petabytes or exabytes of pixels that have been used to arrive at those trends, for driving data-based interventions in their business processes. Satellite operators such as DigitalGlobe, MDA Geospatial, Airbus Defense & Space and Planet have been quick to jump on this new wave of EO Big Data analytics through industry partnerships that helps them access markets otherwise difficult to crack by traditional means of selling satellite EO data. The promise of EO Big Data is massive, but getting into this business is not going to be an easy task as scaling up requires large investment in infrastructure for storage, computation, and acquisition of data. NSR believes the success of this emerging industry will not only be driven by large organizations who can run parallel software on thousands of servers, but also by small ones through collaboration around a distributed ecosystem of ‘small data analytics’, or what NSR designates as Information Products. Boutique firms like SatSure are aiming to become players in the global EO Big Data world by taking this ‘small data’ route and focusing only on one market (agriculture in this case), making use of the freely available datasets through various government programs like the Landsat, Sentinel, MODIS, and EUMETSAT, while partnering with giants like ESRI and SAP to gain customer access by using the visualization layer of these established platforms and integrating with their technology stack as the corresponding data layer. Growth in EO Big Data analytics has the

potential to make use of the

impending

oversupply

situation facing the EO satellite data market,

largely owing to a flurry of mega-constellations

coming online.

NSR

observed new markets warming up to the potential

of geospatial services, such as the recent

announcement by the e-commerce giant Alibaba

from China that plans to use EO for monitoring

vegetables and getting better harvest. The fact

they want to launch a satellite instead of using

existing and upcoming satellite data leads

NSR to

believe the EO industry is faltering in

‘ground-up’ market development,

especially in Asia

where revenue is predicted to be a fifth of the

global EO Big Data analytics market size by

2025,

making new investments in the space segment a

risky proposition

as supply continues

to outpace demand. The Bottom Line NSR expects the EO Big Data industry to play a large role in democratizing satellite image-based insights, but caution must be exercised in trying to develop this emerging market by understanding well the underlying economics of it. NSR sees collaboration, either through partnerships or M&A as the way forward for the EO Big Data industry, and the recent acquisitions (The Weather Company by IBM, OpenWhere by BlackSky Global) follows the trend started by Google, when it purchased Terra Bella for $500 million and sowed the seeds of cross-industry consolidation. It might have been a small step for Google, but that acquisition could turn out to be a giant leap for the satellite EO industry. |

| |||||||||||||