Feeding the

Broadband Revolution

Sep

21st, 2016 by

Lluc

Palerm-Serra, NSR

Much has

been said about HTS and how it is

changing the industry: disruptive

satellites with orders of magnitude more

capacity, plummeting costs per Mb,

reaching new markets… but very little

analysis is available on how these new

data pipes will be fed.

How do SatCom

Earth Stations and Baseband Equipment

need to adapt to the HTS world? Where

are the ground-based opportunities in

this emerging market?

NSR’s

Commercial Satellite Ground Segment

report looks into these newly forecasted

market segments,

which are

unavailable from any other source. The

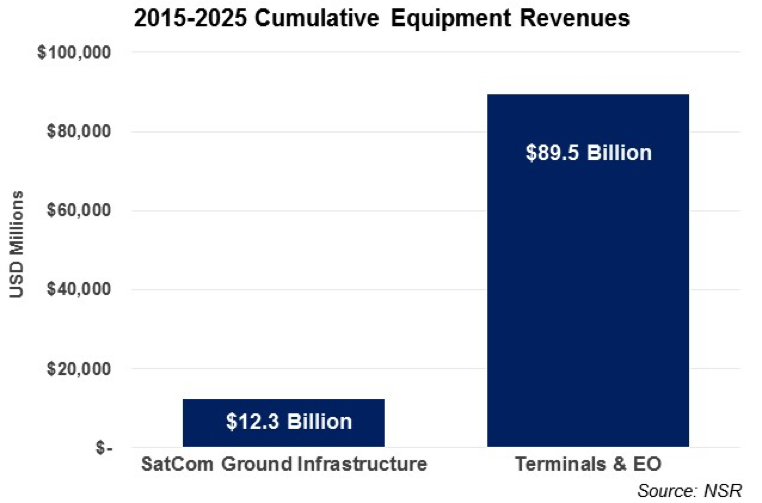

cumulative revenue for the SatCom Ground

Infrastructure equipment (Baseband and

SatCom Earth Stations) surpasses $12

billion in the next 10 years. But more

importantly, these segments hold the key

to opening opportunities in other

verticals.

Skyrocketing data throughputs,

multiplying number of carriers, more

powerful beams, a leap change in the

number of terminals supported… are just

a few examples of the profound changes

HTS is imposing on ground

infrastructure. Cost of equipment cannot

scale with performance, and there is

pressure to provide enhanced performance

at the same or reduced cost.

What

are the key focus areas for the ground

infrastructure actors?

SatCom Earth Stations

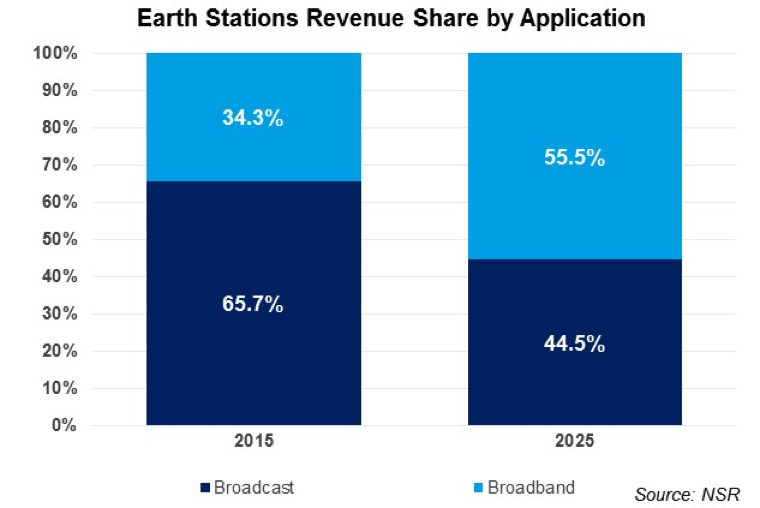

Demand for

Broadband Earth Stations, particularly

serving HTS satellites, will attract the

most demand in the vertical. Despite

flat revenue growth for Earth Stations

in the next 10 years,

revenues for Broadband stations will

continue to grow at over 4% CAGR,

mitigating the drop in demand for Video

Stations. Growth in new DTH platforms in

emerging regions and transition to

UltraHD still provides some

opportunities, but

the real

growth story for Earth Stations is

centered on systems serving the HTS

boom.

These

Broadband Stations will progressively

capture a larger share of revenues in

the vertical.

HTS poses a new set of requirements

for teleports. With more powerful

satellites, together with more efficient

and powerful amplifiers on the ground,

the need for large antennas is

diminishing. The traditional 36 MHz

transponder is no longer generally

applicable, and electronics need to

adapt to efficiently saturate the new

larger transponders. Obviously, new

frequency bands require adapted antennas

and electronics, but also new levels of

redundancy with multiple access points.

The applications served also change the

way ground infrastructure is planned. A

proliferation of IP applications, better

backbone connectivity in developing

countries and regulations or simply the

convenience of landing traffic locally

is growing the demand for Earth Stations

in emerging markets.

Baseband Equipment

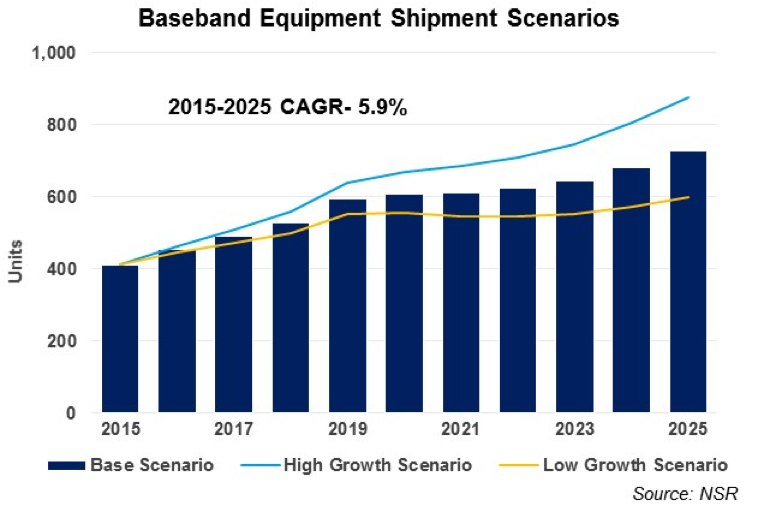

New

Broadband services on HTS satellites

will have a deep effect on Baseband

Equipment. On one hand HTS is the clear

growth driver for the segment. But at

the same time, the new architecture is

transforming technological requirements

for Baseband systems. While shipments

for FSS networks will progressively

decline,

the sustained

demand for networks in newly launched

HTS satellites will drive shipment

growth at 5.9% CAGR in the next 10 years.

A typical investment in Baseband

Equipment for an HTS system

is

slightly below $1 million per Gbps. With

next generation (Ultra)-HTS satellites

already on the drawing boards, the cost

per Gbps needs to change dramatically.

The capabilities per rack are increasing

exponentially, while prices tend to

remain constant.

Similar to what is happening to Earth

Stations, performance requirements need

to adapt to the new architecture.

Baseband equipment needs to be able to

manage a larger number of terminals, a

greater number of carriers (as the

number of beams continues to grow),

wider outbound carriers adapted to the

new transponders, larger bandwidth per

terminal… the technological challenges

are varied, and all these demanding

features need to be met with the

aforementioned

budgetary

constraints.

Business Models are also changing

with the advent of HTS. Satellite

operators increasingly incur the

investment in ground infrastructure and

provide managed services. This means

that the same platform and Baseband

Equipment needs to serve a wide variety

of applications.

From Consumer

Broadband, Corporate Networks, Backhaul

or Mobility,

the terminal

is now the differentiating factor for

the application, while the Baseband

Equipment needs to be flexible enough to

be competitive in all those markets.

Furthermore, the high levels of

investment required is increasing the

sensitivity to risk, and many players

prefer

to pace

investment in ground infrastructure. The

capacity to invest in a scalable chassis

is a key selling proposition for

Baseband Equipment.

The nature

of traffic is also evolving, and

connectivity to the Internet with its

subsequent implications increasingly

plays a greater role.

Support of

bursty traffic, dynamic bandwidth

allocation, routing, acceleration,

compression, encryption, smart cache…

all are features that will differentiate

Baseband Equipment in the future

ecosystem.

Bottom

Line

The SatCom

Ground Infrastructure (Baseband

Equipment and Earth Stations) has a

vital role to play in the growth

development for Satellite Broadband

markets. The revenue opportunity itself

is attractive but more importantly,

these are key enabling elements for the

whole ecosystem.

With the advent of HTS, technology

requirements are changing. From

performance requirements (power, number

of carriers, transponder bandwidth), to

Business Models (managed services,

flexible applications, scalability), or

traffic nature (IP traffic,

acceleration, encryption, media, bursty

traffic), the challenges are wide and

varied. Additionally, it’s important not

to forget the cost component.

It comes as no surprise to NSR that

Eutelsat recently created a new

Terminals and Systems division to drive

the development of ground

infrastructure.

A lot of focus has historically been

placed on developing the next generation

satellites, but ground segment and space

segment elements must work together to

truly foster the Satellite Broadband

revolution ahead.