Finding

Satcom Value in Shipping

Sep

19th, 2016 by

Dallas Kasaboski NSR

Digital

Ship’s Connectivity Briefing recently

held at the SMM in Hamburg explored the

potential of greater data demand in the

maritime industry. The

NSR-moderated panel, entitled,

“Innovation and Evolution and the

Integration of Maritime Applications”,

focused on crew and operational

applications, and developments in big

data and IoT related traffic. Market

oversupply of HTS capacity has recently

led service providers to push higher

data plans, with built-in applications

promoted as “the next big thing”.

However, as was made clear during the

panel,

merchant

maritime end-users are not interested in

more data, but on cutting costs

on their service and their operations.

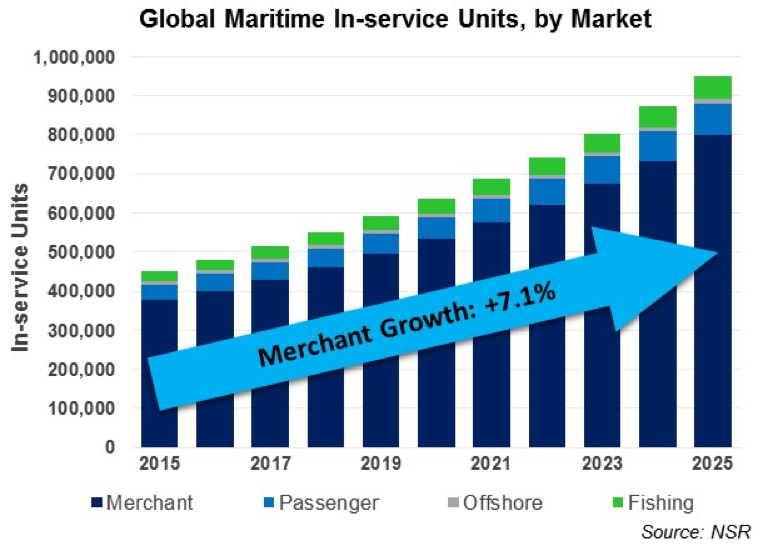

NSR’s Maritime Market Report, 4th

Edition, forecasts that of the $2.7

billion retail revenue potential in the

merchant segment by 2025, only 14% will

come from HTS service.

Narrowband

will continue to dominate the market

segment,

and even cheaper capacity is not

favoring a significant shift in VSAT

technology adoption.

There is a disparity between the

needs of merchant maritime end-users and

the increasing supply of capacity and

applications available on the market.

Service providers looking to corner

larger pieces of the pie will need to

address the following issues going

forward.

HTS vs. FSS

As opposed

to many in the satellite industry,

maritime players do not seem concerned

with the contest between HTS and FSS.

Ship owners

simply want something that works,

period. Where and when they need it, at

an affordable price are key drivers and

for service providers, they want that

process to be as easy as possible to

ensure “sticky customers”.

For them, networks are not an

“either/or” between FSS and HTS,

but

rather a combination.

In order to reach more customers, and

handle the wide range of needs between a

merchant ship and a passenger vessel,

they have built “capacity ecosystems”,

VSAT networks that use both FSS and HTS

capacity. In the end, users should not

be concerned with the type of capacity,

and it is the job of the service

provider to seamlessly switch between

beams when the ship’s location or needs

demand it.

“Smart Data, not Big Data”

Despite

announcements for HTS and services,

merchant maritime users seem content

with the amount of data they currently

have access to.

While crew welfare applications are

viewed as important for fleet operations,

and these applications generally come

with a higher data demand, the priority

in merchant shipping is not in streaming

media, but in calling loved ones.

Crew

calling, email, VoIP are driving crew

data demand,

and they do not represent a

significantly greater increase in data

usage.

Services involving M2M and IoT are

viewed skeptically.

Applications of this type have existed

for some time, and

unless the

application can be easily proven to save

the fleet owner money,

there is little incentive to adopt it.

Before end-users outfit their ships with

more sensors and applications to analyze

and predict problems onboard, end-users

demand focus in making it easier for

fleet managers to work with many ships

who have different sensors, different

types of data, and different network

capacity.

Who Manages the Applications?

Service

providers have begun moving down the

value chain, offering unique value-added

services in an attempt to increase

revenues and differentiate themselves in

the market. Applications for network

configuration, telemedicine and

e-Learning are just some of the revenue

and capacity opportunities service

providers are using to “monetize the

bytes”.

However, there is a

growing

divide between some end-users and

service providers.

Many fleet operators would rather a

third party, more in tune with maritime

needs and concerns, create and manage

the applications, while service

providers feel best-suited to manage

applications on their network.

Issues such as cyber-security, legal

concerns, proprietary knowledge and

specific fleet operation all must be

understood and handled appropriately,

and there is strong reluctance from the

end-user to accept that service

providers can manage their applications

accordingly.

The Bottom Line

An

analysis of merchant vessels reveals

data

demand and satcom spending are among the

lowest in maritime,

a trend which is expected to continue

unless service providers can find ways

to close the gap by offering more value

and incentives for adopting broadband

services.

Merchant maritime fleets tend not to

change unless regulation or finances

demand it. While cheaper capacity has

spurred some VSAT adoption,

shipping fleets seem content to keep

things as they are.

The fleet manager’s primary need when

choosing a satcom service is to cut

costs, through paying less for the

service, improving the operational

efficiency of their fleet, or preferably

a combination of the two. Since cutting

costs is so important to fleet

operators,

the only way

to make merchant spending go up is not

by adding data, but by adding value.

In a

sector that has seen huge losses,

valuable applications such as container

tracking, reefer management, and fuel

optimization may be the way forward

both for service providers and fleet

owners. These applications have to be

easy to adopt, comply with all the

necessary regulations, be compatible

with current ship operations, and

demonstrate clear cost savings.

The Connectivity Briefing was a

valuable experience, offering refreshing

perspectives of the maritime satcom

value chain from some of the key players

involved. The concerns expressed by

merchant end-users are not new, but this

panel provided an opportunity to bring

them into the spotlight and help drive

the conversation, and service offerings,

going forward. There is still work to be

done on the “integration” of merchant

maritime applications, namely that

service providers need to focus on

applications which improve fleet

efficiency, and turn operational savings

into spending on satcom. Whether these

applications should be managed by

service providers, end-users, or third

parties is still up for debate, but the

conversation should continue in order

for merchant fleets and service

providers to get the most out of

maritime satcom services.