Keep Your Feet on the

Ground

Aug 10th, 2016

by Lluc

Palerm-Serra, NSR

Satellites are the stars in the satellite

industry ecosystem. They have attracted most of the

innovative focus in recent years with the HTS or EO

constellation revolutions. However, we must be very

aware there isn’t any satellite value without a

ground terminal. As an industry, we must keep our

feet on the ground and acknowledge that ground

equipment needs to keep pace with the innovation

happening in the skies. The future applications

creating growth for the industry will only

materialize if these technological progresses in the

ground segment take shape. The good news is, the

market opportunity for ground equipment is massive.

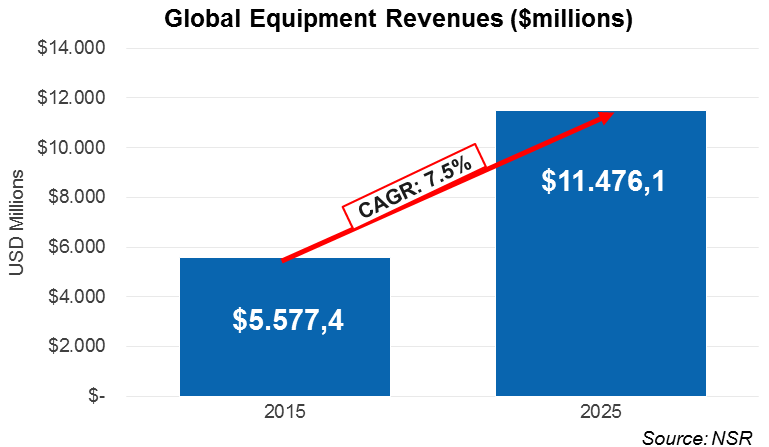

In NSR’s Commercial Satellite Ground Segment report,

global shipments for Commercial Satellite Ground

Equipment are forecast to surpass 57 million units

by 2025, generating US$11.5 billion in revenues.

In order to capture a slice of these rapidly

growing but contested market, equipment

manufacturers will need to adapt to the new

technological environment. In video markets, the

transition to HD, Ultra-HD and smart STBs will

generate most of the growth potential. On the other

hand, HTS will be the key driving force in data

markets, opening new market opportunities while

setting new technological requirements. But

what are the key

verticals attracting growth in this market

generating over $100 Billion in Cumulative Revenue

through 2025?

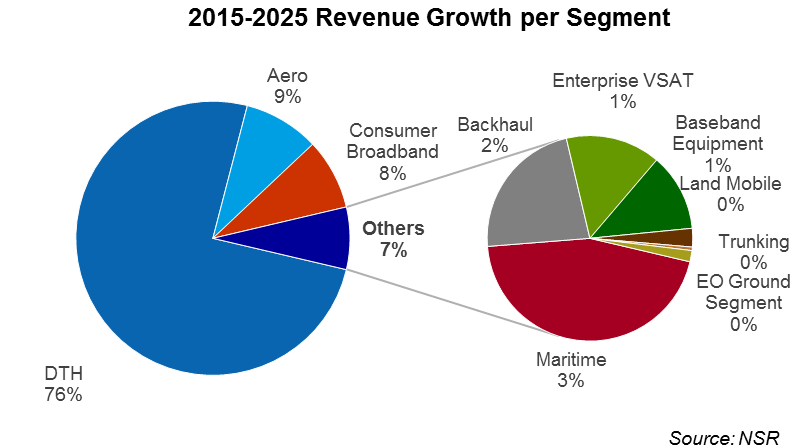

DTH and Consumer

Broadband are the only two truly mass markets for

the SatCom industry. These are the only verticals

counting global annual shipments in millions and

will attract a large chunk of the revenue growth

opportunities in ground equipment. Conversely,

highly specialized verticals like aeronautical and

maritime connectivity together with mobile backhaul

will generate a relatively small number of

shipments, but the high value associated to each

terminal and the rapid development of the verticals

will translate into a significant percentage in the

total revenue growth.

Mass Markets

Driving Growth

The market for

DTH receivers

clearly drives the majority of shipments, generating

$64 billion in cumulative revenues in the next 10

years.

However, there are differentiated trends depending

on each region. In saturated markets such as North

America or Eastern Europe, most of the shipments

will come from upgrades given the end-user

requirements for higher quality UHD and advanced

features resembling the convenience of OTT. On the

contrary, penetration in less developed markets like

Asia or Latin America is still relatively small, and

there is room to engage new customers. The focus in

these regions is still in SD slowly transitioning to

HD.

Consumer

Broadband is the second largest segment in annual

shipments.

The addressable market is massive and the

opportunity to capture new users globally is

tremendous. The challenges lie in serving these

unconnected users economically. Despite the rapid

development of the vertical, the pressure on the

cost of the terminal and finding a compelling

business model are key aspects that need to be

solved.

It is not strange that some industry players push

to develop other mass markets such as the connected

car or the Internet of Things. If these markets were

unlocked, it would bring generous growth

opportunities for both ground equipment and service

provisioning. However, given the technological

challenges and the pressure from ground networks,

NSR is

still cautious about these developments.

Connected

Everywhere

The need to keep connected

everywhere is a major driver for the satellite

industry today, and ground equipment is no

different. Lower price of capacity is opening new

markets and ground platforms should adapt to this

new environment.

Aeronautical

connectivity is among the most interesting verticals

for equipment manufacturers.

In-Flight connectivity is becoming the norm, but

penetration is still relatively small providing very

fast growth opportunities in the near future. Key

players in the vertical are reporting record

installations each quarter, with each terminal

driving several orders of magnitude more value than

equipment in other verticals. Maritime also presents

positive growth prospects. While the

narrowband market is fairly established and

continues to provide stable opportunities, the

emergence of broadband for merchant shipping and

especially for passenger fleets will drive

revenue growth

for maritime equipment at 6.7% CAGR

in the next 10 years. While small in relative terms,

backhaul

is the fastest growing vertical for equipment

revenues

forecasting growth at 15.3% CAGR.

The positive growth prospects shouldn’t be

confused with an easy market environment.

Growth

opportunities will be highly competed, and each

vertical presents its own challenges.

The aviation market has severe barriers to entry,

and terminal requirements are very stringent.

Equipment in the maritime markets needs to meet

higher bandwidth requirements while still facing the

traditional challenges of operating in a harsh

environment. The backhaul market is highly

contested, and the SatCom industry needs to adapt to

meet the technology and business model requirements

of the mobile ecosystem.

Bottom Line

Generating over $100

Billion in cumulative revenues in the next 10 years,

it is clear the opportunities in the ground

equipment markets are quite meaningful. Beyond that,

technological developments in the ground segment

hold the key to unlocking new markets for the SatCom

industry.

The massive demand generated by consumer oriented

markets such as DTH units or Consumer Broadband

terminals, together with high value verticals like

aeronautical, maritime and backhaul, hold the

largest growth opportunities. Other verticals like

SatCom Earth Stations will present some challenges,

but the players that navigate those challenges could

still witness growth.

Optimistic forecasts should not hide the

challenges that industry actors will face. HTS is

creating a whole new set of technology requirements

in terms of throughput, number of carriers, larger

bandwidth per carrier... In an increasingly complex

market, business models and partnerships will play a

role as important as technology. Finally, we must

not forget how the SatCom industry integrates in the

global IP world meeting the new trends in traffic

patterns, media or the emergence of new

applications.