Gigabits Galore: The

GEO-HTS Impact on Supply

Aug 1st, 2016

by Blaine Curcio,

NSR

In the 8 years since NSR coined the phrase HTS,

High Throughput Satellites have gone from being a

rarity to being commonplace. Indeed, from the time

that the first all-HTS payload—Thaicom-4/IPSTAR—was

launched in 2005, until today, there has averaged

only around 1 HTS launch per year. As we move

further into the GEO-HTS era, the industry is being

turned on its head by more capacity launching than

ever before. NSR’s recently published Global

Satellite Capacity Supply & Demand, 13th

Edition delves into this industry shift in emphasis,

with significant analysis and forecasting of current

and future capacity launches. Overall, the trend is

undeniable that the satellite industry is now

reaching the point where HTS is the norm.

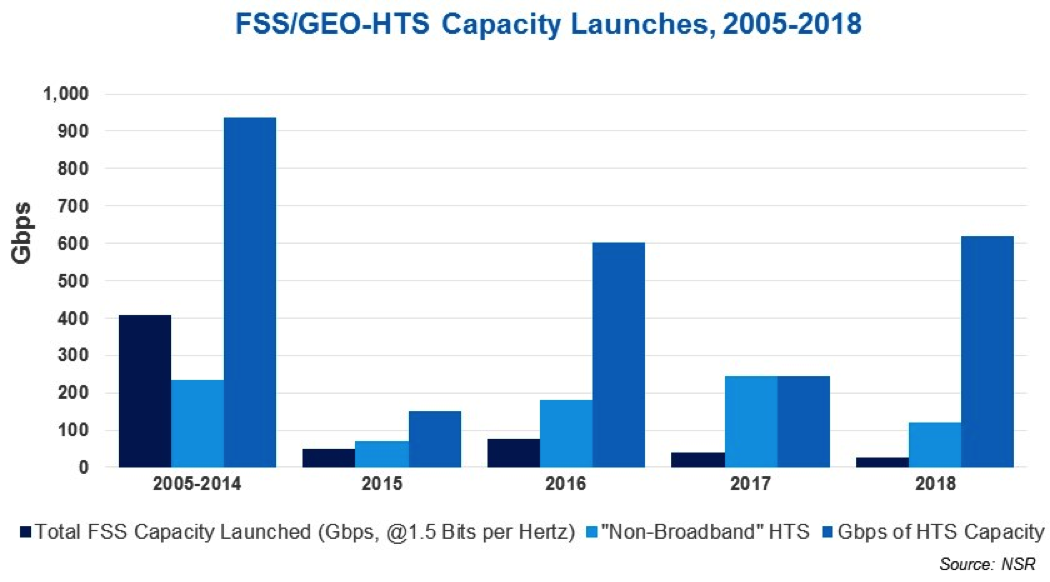

As the chart below shows, when all capacity is

converted to Gbps (with traditional FSS TPEs using a

1.5 bits per hertz ratio), the period of 2005-2014

saw around 400 Gbps of traditional FSS capacity

launched. This compares to around 950 Gbps of

GEO-HTS capacity, with the caveat being that much of

this GEO-HTS capacity is large, consumer-broadband

focused satellites, with the three biggest currently

being ViaSat-1, EchoStar 17 (AKA Jupiter-1), and

Eutelsat Ka-Sat. When taking out these high

volume-low margin satellites, NSR nonetheless counts

around 200 Gbps of GEO-HTS capacity launched from

2005-2014, or around half of the amount of

traditional FSS capacity launched.

Moving forward, however, this trend will very

clearly reverse, with GEO-HTS seeing significantly

more overall capacity launched, even when taking out

programs such as NBN Co. in Australia and

ViaSat-2/Jupiter-2 in the U.S. (which are not

included in the “Non-Broadband” HTS Capacity).

Indeed, 2015 saw around 80 Gbps of Non-broadband HTS

launched, with 2016 expected to see nearly 200 Gbps.

Thus far, there is around 250 Gbps of non-broadband

GEO-HTS capacity announced for launch in 2017, or

alternatively, more than the amount launched between

2005 and 2014.

While video markets will remain more or less

insulated from this capacity due to the real value

in point-to-multipoint via widebeam capacity, data

markets will see changes come about in a big way due

to what is an exponential increase in the amount of

supply available. NSR has for some time discussed

the pricing implications of this new capacity, and

from an operator perspective, it is a precarious yet

logical path to drive down price points in order to

expand addressable market. GEO-HTS payloads see

dramatically lower CAPEX per Gbps, which should

allow for lower pricing, and operators will need to

invest in new ways to sell this capacity moving

forward. With that in mind, in some instances, even

negative revenue growth could lead to positive

growth in operating cash, due to the aforementioned

lower CAPEX per Gbps of supply to launch. Put

another way, if a satellite operator can replace 3x

$300M FSS satellites with 1x $500M GEO-HTS satellite

on a like-for-like basis in terms of capacity and

demand profile, then lower total revenues could

still spell a solid return on investment, and

stronger cash flows.

This will, if nothing else, be a highly delicate

balancing act to be performed by operators, as

GEO-HTS becomes the norm and as price points come

down significantly. Anecdotally, Telesat referred to

this phenomenon in their recent Q2 earnings calls,

during which time Telesat referenced a recently

agreed-to contract for pre-launch capacity on

Telstar 19 Vantage, which the company noted was at a

lower price point and was for a customer that had

previously been with a competitor. Beyond this,

Intelsat’s Q2 earnings call referred to major

disruptions being brought by EpicNG pricing to

markets where Intelsat itself is a major player.

Bottom Line

GEO-HTS has been around for over a decade now,

and up until approx. last year, the technology did

not disrupt traditional FSS data markets in a very

meaningful way. However, this is beginning to

change, with 2015 being the first year since IPSTAR

in 2005 in which more “non-broadband” GEO-HTS was

launched than traditional FSS, and it is unlikely

that we will ever again see traditional FSS capacity

growth out-pace GEO-HTS in a given year. Recent

earnings calls have made it clear that pricing

disruptions coming about from this trend are here to

stay, and that operators will need to swiftly change

their business models in order to capture new market

share and maintain revenues and market positioning.