When is the Music Over in IFC?

When GoGo’s CEO stated in a recent article that when the music stops, “only two or three companies (read service providers) would be able to survive,” he pointed to scale in the aero connectivity market to make it profitable. But is it the main concern for consolidation to start? Looking at addressable markets and bandwidth may give a different answer.

A lot has been said about satellite in-flight connectivity as unprofitable for service providers (SPs) with capacity cost often cited as the key restraint to growth. This leads many to postulate the market is too small and there are too many players. How it is likely to unfold remains a big question for a market with so much promise. The article noted above cited the need for 1,000s of aircraft on the network for SPs to avoid an ‘exit’ because major airlines are all expected to pick their suppliers soon. Looking closer at the potential customer base (i.e. contracted aircraft), it is yet to be fully tapped, and bandwidth prices might be more of an ‘on-switch’ for consolidation.

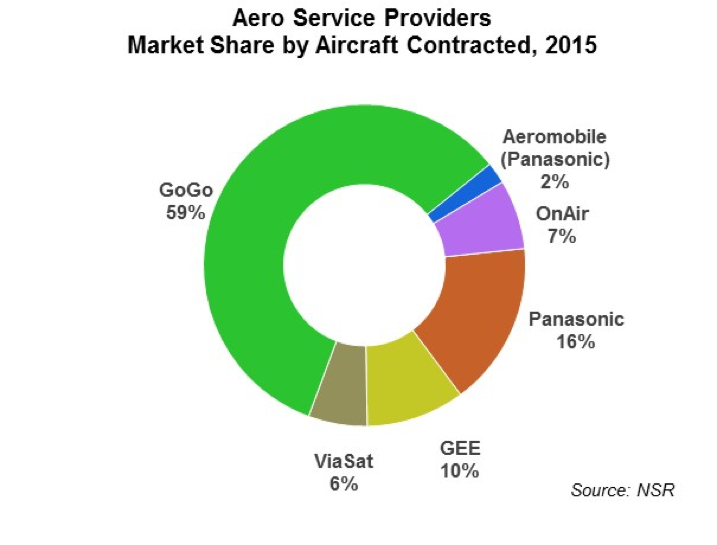

The more than 30 airlines signed up for satellite connectivity total over 5,200 aircraft committed in 2015, a jump of 23% over the previous year. Of these, about 2,000 were active and more are outfitted today such that the year-on-year growth in 2016 is expected to be over 40%. But in its recently released Aeronautical Satcom Markets, 4th Edition, NSR considers the total addressable market for commercial IFC to be around 25,000 airframes and growing every year. Simply put, about 25% of aircrafts are committed to satellite SPs, with a majority on medium haul (i.e. narrowbody), the fastest growing airframe market. Thus, there seems to be a long way to go before the market saturates. While many SPs have reached the milestone of 1,000 aircraft under contract, most can aim at that number and more as many airlines have not made the decision yet for fleet-wide installations. Furthermore, some are on GoGo’s ATG services, while others are using lower capacity L-band systems from Inmarsat. Both are ‘targeted’ by FSS or HTS capacity providers as the recent spat over American Airlines showed, and this offers even more potential for quick upgrades.

On the other hand, falling capacity prices have proven to be a boon for the SPs, and everyone seems to be getting a good deal. The idea to consolidate could mean a rationalization of these deals, and with it, fewer clients for operators. But with IFC still in the early years (some say ‘proofing” stages) and with the jury still out if it provides 'fat' or 'muscle' for airlines in the long run, the merging with entities outside the aero business (such as was the case for the ITC/Panasonic and EMC/GEE mergers) to leverage this capacity makes for another logical outcome.

But how can this be a positive for satellite operators, especially since most have now embarked or launched lower cost per bit HTS that they will have to sell to get the promised ROI? With more negotiating power and scale in new merged entities, will SPs ask for the same ‘early-bird’ specials obtained from the likes of SES, Intelsat and Eutelsat in recent months and years? The question of market sustainability comes into play here, and the satellite business is seeking right now a way to some stability amidst bandwidth costs expected to fall by at least 5-10% annually over the next decade. So it may be worth noting that aero HTS contracts are a small part of the total supply that will be in orbit in the next 5 years, and operators will have other markets to ‘look after’ where capacity demand is far higher (VSAT Enterprise, just to name one). This may lead operators to bring back the ‘market’ rate card for future deals, and which would of course raise prices despite recent trends…and could be the ‘trigger’ for the consolidation to start. However, this is anything but certain.

The Bottom Line

There is much ‘runway’ left for service providers to win new commercial aircraft deals for satellite connectivity, before the music is over. Thus most SPs will be in position to have 1,000s of aircrafts in their customer pool in the coming years. However, as the early special rates on HTS run the risk of being slowly stopped, it may bring the music volume down and signal the start of some consolidation in the industry.