Who’s Left Hungry in Energy SATCOM?

May 3rd, 2016 by Brad Grady, NSR

Digging deeper into the elasticity question presented in NSR’s previous bottom line by Blaine Curcio, the energy vertical has traditionally been viewed as a somewhat ‘price insensitive’ market. Essentially energy customers need connectivity, and they will generally pay what they need to ensure their multi-billion dollar investments are connected. However, all of that changed in the ‘great crude collapse’. Today, energy end-users have become much more focused on the cost of connectivity and the improvements in efficiencies sophisticated communications networks bring across their organizations.

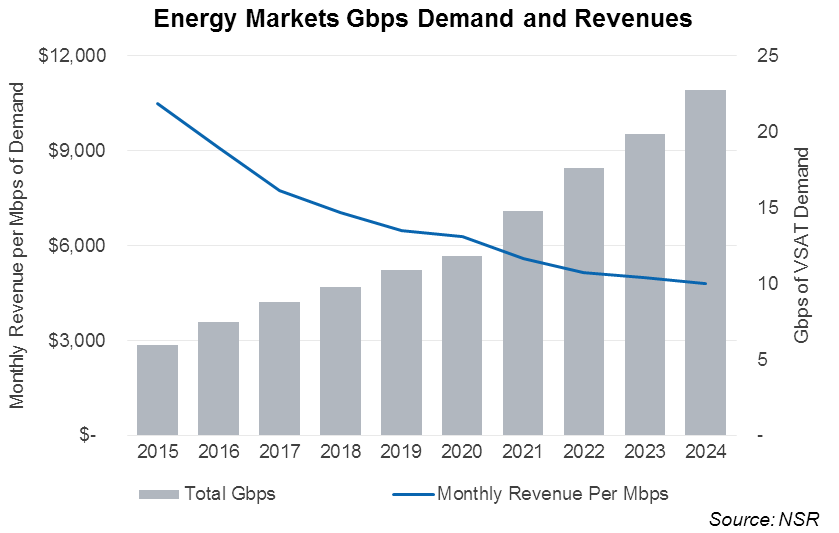

As Blaine hits on in his elasticity debate – lowering prices in the energy market is bringing more sites, and more capacity demand into the market. Using data from NSR’s Energy Market’s 6th Edition, we expect to see between 20 - 25 Gbps of VSAT demand by 2025, across both FSS and HTS capacity. In growth terms, capacity demand is growing at a rate of almost 2.5 times more than total revenues. Considering the cash-constraints facing nearly every corner of the energy market user-base, that is a clear recognition from both suppliers and end-users that prices need to lower in order to keep the pie we have right now, and continue to lower to keep the pie growing.

Where is this growth? For FSS players, one growth segment is in the mining industry. With large sites, fewer restrictions on terminal size, and long time-lines they can afford to invest in large antennas, and high-end modems to maximize throughput. For HTS players, Oil & Gas still remains ‘where it’s at’ for growth. The ‘crude crisis’ has caused a new look at how things are done, and technologies that were once approached at an arm’s length are now being adopted and introduced quicker than ever before. There is an overall trend towards moving higher-end sites into HTS networks at the loss of FSS capacity. The next few years will remain challenged for FSS-centric capacity within the energy markets.

Good news for service providers, and this is related to Blaine’s main observation at a macro-level, is that there is on-going, increasing pressure to reduce wholesale capacity costs when contracts come up for renewal. So, cost pressures are mounting for energy end-users, but service providers get to see some pricing relief in the terms of lower capacity prices. Does that make-up for the overall loss of sites which need to be connected? No – but every dollar counts in a down market.

With end-users telling satcom service providers to lower costs, and the market-rate for satellite capacity decreasing – are satellite operators the one’s left hungry? In short, the energy market is probably not as lucrative as it once was. These customers are now giving up their FSS C-or Ku-band links for HTS in C/Ku/Ka-bands – or at least expecting to pay the HTS rate on FSS capacity. Combined with fewer ‘greenfield locations’ coming online service providers themselves will need to look at fewer locations for capacity, which makes the CAPEX vs. OPEX investments of enabling HTS in core markets (such as high-density sites in the Gulf of Mexico) more tangible (fewer beams to buy.) Overall, decreasing monthly revenue per Mbps of capacity demand will the key catalyst of growing the pie over the next ten years. Lower per Mbps revenue to capture more Mbps per site will be the formula for revenue growth in the Energy satcom markets.

Bottom Line

So, what does that really mean? The pie grows through cheaper capacity to end-users. Unlike in years past when the next Mbps could cost end-users a little bit more than the last Mbps, there is a fundamental shift in the cost equation for energy end-users. They continue to demand more Mbps across both FSS and HTS networks – but in fewer locations than they were operating last year, with lower growth prospects than ever before.

|