The Elasticity Question

One of the hottest topics in satellite telecommunications is the concept of elasticity of demand. As HTS payloads with tenfold or more increases in throughput (as compared to traditional satellites) are placed into orbit, the market will see lower prices and to a large degree, exponentially lower prices not seen in decades. This concept has been resisted but largely accepted as fact by most in the industry today.

As such, the question of revenue and earnings growth comes down to a combination of growing demand, which is a function of elasticity and lowering the CAPEX cost component that is a function of cost to orbit per Mbps, Gbps, MHz, etc. We will examine the former, i.e. elasticity of demand, taking data from NSR’s Satellite Capacity Pricing Index, Q1 2016 Edition (SCPI), and Global Satellite Capacity Supply & Demand, 12th Edition (GSCSD) studies to show how HTS demand has evolved over the past 5 years as compared with capacity pricing, and thus consider the proposition: has HTS historically “grown the pie”? Finally, we will address whether this will likely remain the case moving forward, and how the demand curve may respond to further drops in price.

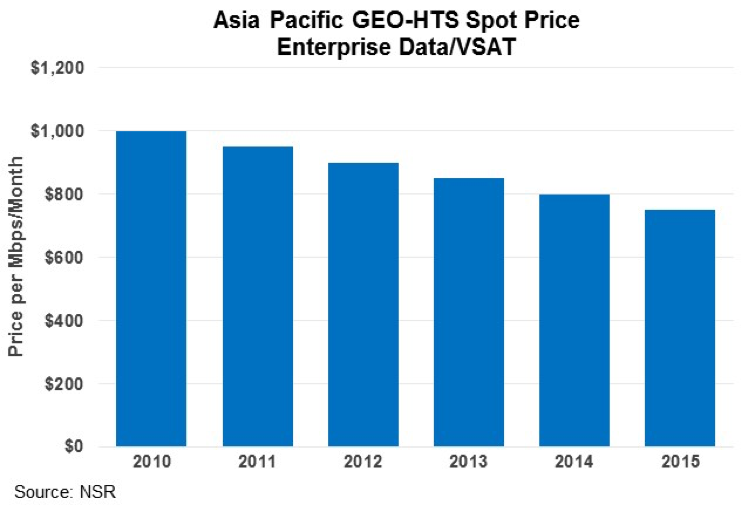

Pricing Trends

HTS pricing and the economics behind the HTS business model are foremost still being developed and vary widely across platforms, by customer, and from contract-to-contract. However, at a macro level, the trend of lower pricing in the industry has been led by HTS, where prices have seen stronger pressure than FSS capacity due largely to the more stable video markets on FSS and the more competitive data markets on HTS. Taking data from NSR’s recently released SCPI study, we see pricing for GEO-HTS capacity in the Asia-Pacific is believed to have declined at a rate of around 5% per year to 2015. This downward pressure is being felt in other regions as well, and there has been some spillover to FSS pricing, though the impacts have thus far generally not been as large.

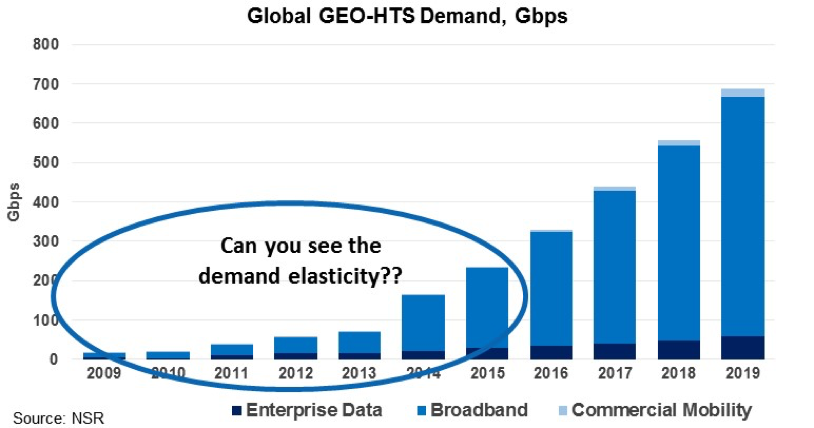

Demand and Revenue Trends

Over the past 5 years, we have seen HTS demand skyrocket. The total demand for the three main drivers of HTS capacity revenues—Consumer Broadband, Enterprise Data, and Commercial Mobility—has seen a more than tenfold increase since 2010, with the total lease capacity figure rising from less than 20 Gbps in 2010 to nearly 240 in 2015. Clearly as pricing has come down, there has been significant uptake on the demand side, and moving forward, NSR expects this to continue, with demand expected to increase to nearly 700 Gbps by 2019. With extremely large amounts of capacity launching in the coming years, NSR does expect pricing to continue to fall, which means the above demand growth will need to outpace the rate of pricing decline.

So Are We Growing the Pie?

The short answer is that today, we continue to grow the overall revenue pie despite the lower pricing brought on by HTS. That is to say, thus far demand has proven to be elastic, and the market has grown as pricing has come down. Over the past 5 years, traditional FSS revenues have actually seen decent growth, with total revenues increasing from $10.02B in 2010 to $12.7B in 2015. Therefore, obviously the additional revenues brought on by HTS—even at lower price points—helped contribute to net growth in the market over the past 5 years. Moving forward, FSS revenue growth will slow to 1-2% per year and eventually plateau, and in the medium term will likely start to decline as contracts are renewed at prices that reflect the market dynamics of an HTS world. GEO-HTS revenues are expected to increase from around $650M today to over $1.5B by 2019, a net increase of around $800M. Taking the above ~$13B revenues from traditional FSS, this implies that traditional FSS capacity could be re-booked at a discount of 6-8% relative to today’s pricing in order to maintain the total market size.

Bottom Line

It is undeniable that GEO-HTS has impacted the pricing dynamics of the satellite telecommunications industry over the past 5 years, in a way that will likely pale in comparison to the impact to be had over the coming few years. As more GEO-HTS payloads are launched, we will see increasingly downward pressure on pricing, which will spur strong demand increases. The net outcome thus far has been strongly positive growth, with the industry maintaining traditional FSS revenue growth, and with GEO-HTS seeing revenues increasing at easily double-digit rates in recent years.

Moving forward, the situation will become more challenging as the markets mature. In short, we have seen in recent years HTS systems like Thaicom’s IPSTAR recording great successes, with the company generally reporting >US$100M in total IPSTAR revenues (incl. service revenues) per year. However, these systems have in some instances operated in an isolated market (for example, IPSTAR was for many years the only HTS capacity in APAC, a region of 4+ billion people), and moving forward, this is a dynamic that is sure to change. The combination of increased competition among GEO-HTS players, and the re-booking of FSS contracts at pricing reflective of GEO-HTS in the marketplace, will be the two biggest contributing factors to whether the pie grows, or whether there are some left hungry at the table.