FPAs: The Key to the Connected Car?

Apr 21st, 2016 by Prateep Basu, NSR

Satellite technology has been relatively insulated from direct consumer facing markets in the past, owing to their high cost of access. But recent industry innovations, especially in Flat Panel Antenna (FPA) technology, combined with the need to remain connected on-the-move, has opened the doors to many such markets that satellite technology had been unable to address properly in the past. The Connected Car is one such market that is buzzing in the M2M/IoT sphere, promising to create new opportunities for satellite communications.

In a previous article, it was stated how NSR believes the commercial land-transport market will drive M2M/IoT via satellite revenues for operators, but with the ‘connected car’ remaining a cellular-industry play in the foreseeable future. NSR confirmed its findings that the development of reliable FPAs is critical for this potentially big market to click, especially for broadband two-way communications. However, in addition to questions on economics and operational reliability of FPAs in all-weather conditions, technical issues associated with new FPA technology have to be sorted out: software-defined side-lobe cancellation, optimization of the radiated far-field pattern for beam steering, averting adjacent satellite interference, adhering to regulatory norms, and safe radiation levels in the vehicle environment for the proposed small antenna form factor. These are all issues to be resolved before FPAs start making an impact in this market.

That said, satcom definitely has a role to play as remote area communications will not be served by LTE (or upcoming 5G services). Even in urban areas, the load on cellular networks due to high numbers of subscribers using data services constrains the amount of terrestrial spectrum that can be dedicated for connected car services. Satellite technology can ultimately address these gaps, but NSR expects the ‘connected car via satellite’ business model to evolve towards narrowband communications, as high-priority connected car applications like predictive vehicle diagnostics and maintenance, safety and security, and telematics do not consume much bandwidth, and the premium for 24*7 coverage via satellite dish is low enough to be paid by the auto-owner as part of the annual contract. Vehicle entertainment, a high bandwidth consuming application, is however a low priority application in the connected car world, and should be limited, if at all, to luxury vehicles as an ‘add-on’ option service.

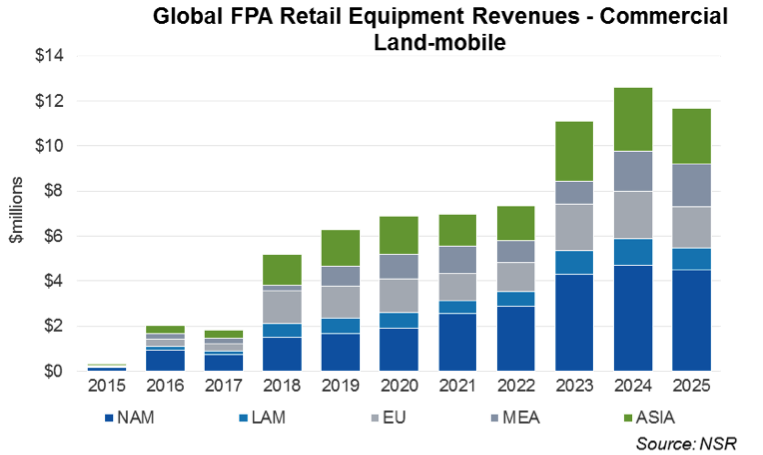

Keeping all these points in mind, NSR expects some satellite play to happen in the connected car sphere, but it is wishful thinking that revenues for FPAs will boom in the near term, as the commercial viability of providing satellite connectivity to cars remains a ‘wish’ rather than a need for drivers. And even then, it will be mainly to offload data that require mostly narrowband capacity.

Bottom Line

As NSR noted in the recently released Flat Panel Satellite Antenna Analysis report, FPAs are definitely a bright spot on the satcom industry’s technology curve, and will assist in the diversification and penetration of markets addressed by satcom services currently. However, FPA technology is not able to unlock all addressable markets, as it not exempted from the physics and the problems faced by regular satellite dishes. Still, they are well-placed to take satcom services to the masses by enabling connectivity on-the-move through air, sea, and land. Nevertheless, a comparison of satcom connectivity’s value proposition over oceans with that on land is incorrect, as cheaper terrestrial alternatives will continue to be the first choice. NSR expects FPAs to play a pivotal role in diversifying the customer base for satellite operators in the coming years as the world goes mobile, but caution remains.