Capturing the Terabit Backhaul Opportunity

The mobile industry has evolved at an extraordinarily rapid pace, with mobile broadband creating a massive surge in data traffic and backhaul needs. At the same time, the satellite industry has lagged in offering appropriate broadband backhaul solutions, and wireless backhaul via satellite remains generally relegated to a last resort 2G solution. Can HTS change this story? Is the satellite industry ready to join the mobile broadband data traffic explosion?

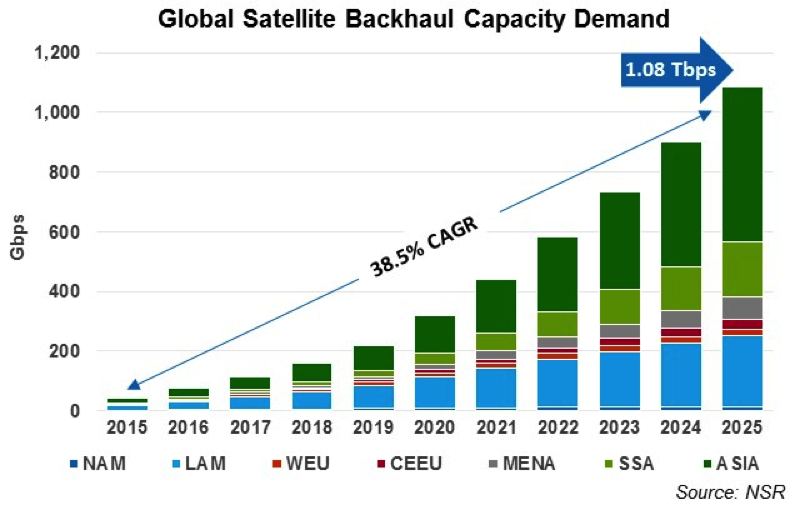

NSR believes new HTS capacity price points will expand the addressable market for satellite backhaul into broadband 3G/4G services, fostering a tremendous rise in capacity demand. In NSR’s Wireless Backhaul via Satellite, 10th Edition report, satellite capacity demand is forecast to grow at CAGR 38.5% over the next ten years, entering the terabit era by 2025.

Forecasting backhaul growth at a 38.5% CAGR over a ten-year period might seem extravagant for an established industry such as satcom. However, HTS brings a transformational force to the industry, opening significant growth opportunities. The capacity to penetrate the mobile broadband market is key to capturing these growth opportunities. Looking into these growth prospects from the mobile industry perspective, one could say this forecast is even conservative as Cisco forecasts mobile data traffic to grow at a 53% CAGR between 2015 and 2020.

The great majority of satellite backhaul sites still reside on 2G networks. However, there are positive signs of a rapid transition towards 3G and 4G services as satellite capacity prices decline. Projects such as the rollout of 4G services by Gilat and SoftBank, a pioneer providing 3G networks via satellite, in Japan, and also through its subsidiary Sprint in the U.S., demonstrate the interest for these services in developed countries. Latin America, where still 10% of the population lives outside of mobile broadband coverage, leads the emerging markets in the deployment of 3G and 4G sites with developments like the partnership between Entel and Hughes to set up over 500 Broadband terminals. Bandwidth provisioning per site for 3G and 4G services can be several orders of magnitude larger than for 2G sites. This transition leads to an exponential evolution of data traffic demand.

Matching ground network capacity growth rates seems an excellent opportunity for the satellite industry, but it hides some risks. According to GSMA forecasts, data traffic for the mobile industry will grow at 53% in the next 5 years; however, mobile operator revenues will grow at just 3.1%. This growing data traffic vs. revenue squeeze for mobile operators means the price per Mbps of satellite capacity will also need to decline rapidly to remain competitive with ground networks.

Backhauling Data-Hungry 3G/4G Sites

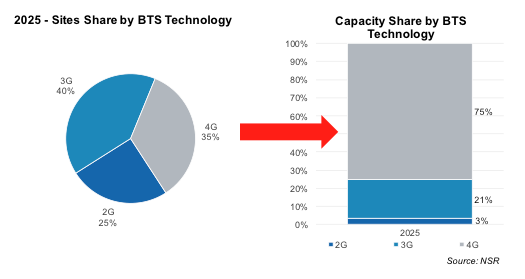

NSR forecasts moderate site growth for wireless backhaul via satellite, below the double-digit rates of the past. However, this trend hides a highly dynamic market with profitable opportunities. With the transition to 3G and 4G services, capacity demand will explode as these sites consume large amounts of bandwidth. By 2025, with just about 1/3 of the backhaul sites being 4G, they will represent 75% of the total satellite backhaul capacity used.

It is obvious the largest opportunities in the backhaul market are in attracting the demand for 4G sites. Needless to say, these sites will need the promise of much lower pricing and higher efficiencies of HTS to take-off. Fierce competition among the different HTS architectures is expected. GEO-HTS-Ka and non-GEO-HTS could challenge the initial advantage of Ku with lower capacity prices. New technologies like ACM and new data traffic patterns could favor the cheaper bands and architectures. With larger data provisioning per site, it could be possible to still offer voice services (more critical for the Mobile Network Operators and regulators) while sacrificing data traffic in instances of heavy rain attenuation.

Expanding the Addressable Markets

As discussed in a previous NSR Bottom Line article Cannibalization or Growing the Pie?, broadband markets tend to be highly elastic and demand grows rapidly when prices decline. Backhaul won’t be different and the lower capacity prices offered by HTS are expanding the addressable markets for the satcom industry. On one hand, mobile operators can further expand into locations where ARPU levels are lower. On the other hand, broadband sites can now be served economically using satellite backhaul, and the satellite link becomes more competitive in villages closer to the fiber backbone where microwave links usually take away business from satcom.

The satellite industry has an attractive value proposition for the mobile operators if it can serve broadband sites affordably. Mobile operators increasingly rely on monetizing the demand for data services to keep healthy margins and revenues growing. The flexibility and speed of deployment of satellite backhaul can’t be matched by ground infrastructure, and in many instances being the first mover to gain market share is critical for mobile operators. While ground networks require large investments, network expansion through satellite backhaul is a low-CAPEX, low-risk solution that is very attractive to test and expand service coverage. The expansion of ground networks is slowing down, and in many occasions it is economically unfeasible to further expand the fiber backbone footprint. In these instances, satellite backhaul is vital to continue adding new subscribers, and hence keep expanding market share and revenues.

All in all, NSR assesses in the Wireless Backhaul via Satellite, 10th Edition report the potential number of sites that could be expanded economically using satellite backhaul from current levels of coverage. The opportunity is massive, surpassing one-half million base stations for broadband services.

Bottom Line

New HTS capacity price points are changing the drivers for satellite backhaul demand from a last resort, regulatory driven, 2G type of demand to a kind of service driven by economical return for broadband sites. The transition to 3G and 4G sites will create large opportunities for capacity demand growth.

The biggest opportunity in the satellite backhaul market is in capturing these data-hungry broadband sites. A fierce competition between the different frequencies and architectures is expected, which will eventually bring capacity prices down. With lower capacity prices, the addressable market for the satcom industry is expanding, and the opportunity for capturing new sites is becoming more attractive.