|

|

HTS in Energy Markets: A Zero-Sum Game?

Aug 13th, 2014 by Brad

Grady, NSR

As more High Throughput Satellites (HTS) launch,

arrive in orbit and become operational in the next 12 to 18

months, many in the industry are asking, “How will HTS affect

[insert market here]?” For consumer markets in North

America, and Europe to a lesser extent, HTS can and does have a

role to play in consumer broadband access. For

“Enterprise” applications, there is definitely a role for HTS.

And, for Mobility. And, for…But will this mean it’s a

zero-sum game between FSS and HTS players?

In Energy markets – Oil & Gas, Mining, and

Electrical Utilities – HTS will not in-itself be a ‘revolution,’

but rather a continuation of what fixed satellite service (FSS)

providers know and are already providing: CIR-based

offerings with strong SLAs. HTS will be add fuel

on the capacity fire but that fire was already started before

due to real-time video monitoring reaching everywhere and

anywhere, business operations becoming more sophisticated, and

crew services a key service. Combined, all these applications

were already driving demand in this market..

As NSR found in its

Energy Markets via Satellite, 4th Edition,

HTS-based services will not be a ‘year-zero’ adoption, but

rather a steadily growing opportunity as end-users become more

familiar with the technology. End-users continue to care

more about making their network work than adopting the latest

and greatest technology… or even price for some sub-markets

within the energy vertical.

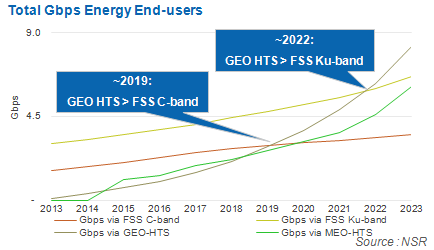

FSS users in C- and Ku-bands will continue to

require more Gbps to end-users through 2019, the year of the

inflection point between GEO-HTS and FSS C-band…but not the

death knell for FSS C-band. Instead, it is where end-users

and service providers will see the uptake of GEO-HTS services

surpass a flattening demand for FSS C-band. 2022 will be

another key point in the curve, where GEO-HTS uptake in terms of

Gbps of demand from end-users will surpass FSS Ku-band.

Put another way – by 2023 more than 50% of total

capacity demand in Gbps from Energy End-users on VSAT networks

will be delivered by HTS-based services (both in GEO

and MEO orbits.)

For MEO-HTS, the story is fairly simple – lower

latency and higher throughputs are an appealing value

proposition, but it all comes down to three things as in real

estate: location, location, and location. End-users

located in the sweet-spot of announced coverage for MEO-HTS

offerings (+/- 45 Degrees) AND with enough real estate for a

couple of 1.2M+ VSATs AND with significant capacity demands will

find MEO-HTS offerings an appealing service. Those more

mobile or those with less space or those with lower capacity

demand will face a less attractive cost-benefit analysis.

One thing is clear though for MEO-HTS offerings, ignoring all

other aspects: lower latency definitely has a place.

GEO-HTS is another story. With different

frequencies, technologies, “Open vs. Closed” ecosystems, etc. it

is harder to pick specific ‘winners and losers.’ However,

at a macro-level HTS will be a key enabler for delivering and

powering the on-going digitization of and connected-devices in

the Energy markets. Each GEO-HTS offering will have a role

to play within the energy market – enabling ‘office’

connectivity at remote locations, or global mobility, or

backwards capability. One thing is clear amongst all of

the GEO-HTS offerings, a focus on CIR-based services with high

SLAs will be key to getting energy end-users to adopt the

technology. And, only time will allow the ‘proof’ that

most sub-markets within the energy industry require to be made.

So, with the promise of lower cost per bit, and/or

lower latency from HTS-centric offerings… what does FSS continue

to bring to the table? Within the emerging ‘middle

bandwidth’ markets for SCADA + video monitoring sites (such as

pipeline compressor stations, or utility sub-stations) the

advantage of lower prices is relatively moot. As equipment

and services comprises a larger share of the pie relative to

straight capacity expenditures, and a lengthy process to get

technology certified to operate either with grid operators or in

hazardous conditions there remains plenty of life left for FSS

in these volume-based markets.

In higher bandwidth markets such as Offshore E&P,

reliability and availability is paramount. Meaning,

end-users will continue to leverage FSS C-band offerings in

areas with higher incidents of rain-fade… rather than risk

downtime. For these end-users, it will not be an either or

solution, but rather a hybrid approach to maximize throughput

AND availability, while managing costs at the same time.

Bottom Line

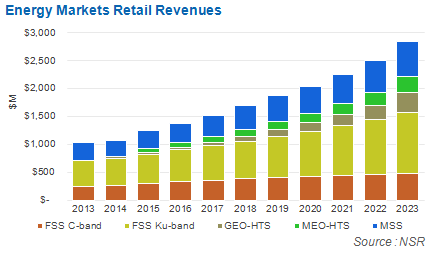

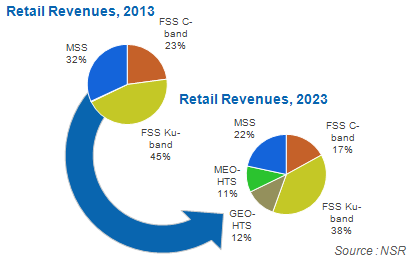

With over three-quarters of capacity demand coming

from the Oil & Gas Exploration and Production over the next ten

years in the Energy markets, the satellite industry will need to

keep looking at advances in real-time drilling, sub-sea

technologies, and crew welfare trends to continue to match the

right technology to the right problem. GEO-HTS or MEO-HTS

is not the “everything, everywhere, everyone” solution for

Energy markets. FSS C-band and FSS Ku-band will continue

to have their place in the “HTS era,” but it is not a zero-sum

game.

|

|