|

|

MSS SNG – A Steady Opportunity amidst a Changing Market

Feb 12th, 2014 by

Brad Grady, NSR

A recent study of American news programming by the Pew

Charitable Trust found that on the three large 24/7 U.S. cable

news networks (Fox News, CNN, and MSNBC) 2007 – 2012 saw a

steady decline in the overall amount of ‘live event’ coverage

for daytime TV. Instead, packaged content such as footage

recorded from a remote crew transmitted back to the news room

saw a steady increase. Meanwhile, amateur footage from

YouTube captured on mobile phones with grainy, shaky video have

come to symbolize truly ‘breaking news.’ Similarly, webcam

based interviews have become almost commonplace for news

programming. This all begs a key question for MSS-based

SNG applications…. If mobile phone video capture is

acceptable, does that limit the market for the higher quality

delivered from an MSS terminal?

For markets with robust terrestrial infrastructure (including

access at a remote reporter’s hotel room for a webcam

interview), there might not be a need to burn MSS airtime.

With less ‘live at the scene’ footage, more crowd-sourced

footage, and better terrestrial infrastructure,

MSS-centric SNG could have tough times ahead… or do they?

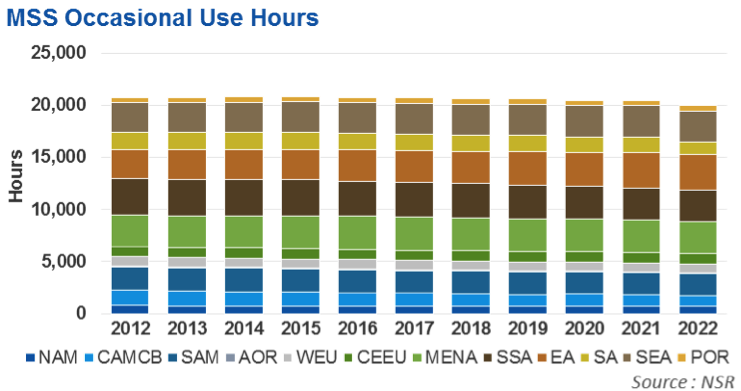

According to NSR’s latest study on SNG markets, Contribution

and Occasional Use TV Markets, MSS SNG/OU hourly uptake

will decline only slightly on a global basis for the foreseeable

future. At the same time, there is a slight

uptick in the number of In-service units.

Just as terrestrial services have impacted the larger VSAT-based

SNG market in terms of utilization, cellular access has

impacted the per-unit utilization of MSS SNG services.

Additionally, emerging regional news programming continues to

increase the number of media outlets, crews, and reporters.

With more demand for content from more places, there

continues to be demand for high quality footage from breaking

news events. These are locations where

terrestrial infrastructure is either non-existent, or not

practical. Mobile coverage of disasters

continues to be a heavy-consumer of MSS SNG airtime, as well as

forward-deployed reporters in hostile environments for the

developed media markets.

In emerging markets, having an on air personality at major

regional events can be a significant differentiator in a highly

competitive, rapidly developing market. Looking forward,

as consumers continue to demand more bandwidth to their personal

mobile devices, it is easy to imagine a scenario in a highly

dense or bandwidth-constrained location where terrestrial

wireless streaming is simply not an option for news crews –

where MSS SNGs are the only option for a small, highly mobile

production crew. Even leading cellular based news

broadcast equipment still typically can easily interface with

MSS SNG terminals, further support for the MSS SNG sector.

Bottom Line

MSS SNGs continue to be a part of the ‘go-bag’ for breaking

news crews, and will continue to see steady yearly in-service

unit figures. Largely immune from even-odd year trends

found in the VSAT-based SNG/OU markets, MSS SNG services

will continue to be a steady corner of the SNG market –

not posting significant global growth, but not seeing the peaks

and valleys found in the VSAT SNG/OU market. Bottom line,

the MSS SNG market will continue to ride-out the changes in news

programming, content acquisition, and video quality.

|

|

|