2014 Afghanistan Pull-out

Effects on Satcom

Jan

22nd, 2014 by

Jose

Del Rosario, NSR

One of the most highly anticipated

events for 2014 is the full withdrawal

of U.S. and allied troops from

Afghanistan. The drawdown that began in

2011 has led to diminishing

growth in the global land mobile satcom

market given the lower number

of troops, vehicles and other assets

that needed to be supported by a variety

of satellite-based solutions. With

the impending or planned full pull-out

of U.S. and allied troops, the natural

inclination is to regard key programs

and solutions such as Blue Force

Tracking (BFT), and Netted

Communications to be adversely affected

globally.

In the mix is a potential

wildcard to the demand outlook, which is

the Bilateral Security Agreement (BSA)

that permits foreign forces to stay in

Afghanistan beyond 2014. It is a

wildcard as Afghan President Hamid

Karzai may or may not sign the

agreement. A signed security pact means

that about 8,000 U.S. troops will remain

until 2024, while an unsigned pact

translates to a very light footprint of

perhaps less than a thousand U.S.

personnel by January 2015.

In its latest market study, Land

Mobile & Handheld Satellite Markets,

NSR forecasted growth in

narrowband solutions supporting military

operations in the Middle East/Africa

region to exhibit flat to negative

growth, reflective of trends

over the past three years.

In terms of the overall land

mobile market, however, NSR foresees a

positive outlook, albeit at

lower levels compared to the run-up to

2011, where growth in revenue terms

displayed robust rates. In essence, the

troop withdrawal has been factored in,

given expectations over the past three

years such that a scenario of a signed

or unsigned BSA should have little to no

effect on the overall market. Here’s

why:

- The U.S. DoD has a new

contract with Iridium based on

unlimited use. This means

that even if the number of U.S.

troops were to remain at 8,000 based

on a Karzai-signed security pact or

all troops are completely pulled out

should Karzai refuse to sign the

agreement, the revenues generated

should be at fairly equal levels for

netted communications, handheld

satphones as well as other

applications the U.S. Military

decides to run on the Iridium

network as usage is not just

contracted for Middle East/Africa

but for the entire globe.

- For other services or programs

such as the BFT, a signed

pact means only slightly increased

growth overall given that

the bulk of BFT units will likely be

re-deployed to other regions such as

Asia in support of the pivot

strategy as well as the U.S. to

support military, homeland security,

border patrols, drug interdiction

and other civil missions.

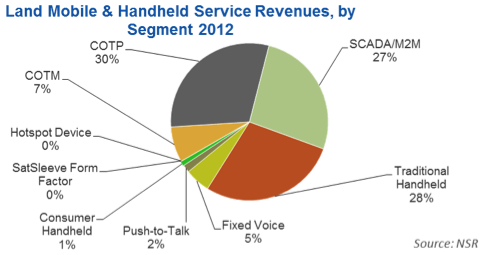

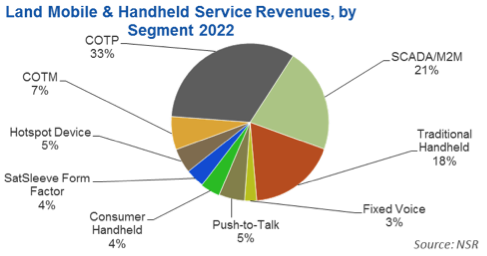

- Lastly, the key market

segment is Comms-on-the-Pause (COTP)

and to a lesser extent, Comms-on-the-Move

(COTM). In 2012, COTP

accounted for 3% of in-service units

yet accounted for 30% of service

revenues. Usage of COTP (and COTM)

is predominantly military in nature

such that a low number of units

supporting between 1,000 to 8,000

U.S. troops in Afghanistan post-2014

should still translate to a healthy

market over the long term. Indeed,

by 2022, NSR foresees COTP service

revenues improving market share

further by 3% compared to 2012

levels due to increased usage

despite the lower number of troops

and other key personnel that need to

be supported. COTP and COTM

combined are forecasted to account

for 40% of service revenues by

2022. Usage of COTP and COTM are of

course not relegated solely to

Afghanistan and Iraq as new

deployments and re-deployment

similar to BFT and satphones should

take place in other regions such as

Asia and the U.S. However, given the

continued volatility of the Middle

East/Africa region, it is NSR’s view

that a large percentage of COTP and

COTM equipment will continue to be

deployed in this region over the

long term.

Bottom Line

Afghanistan and Iraq have been key

markets for the land mobile segment over

the past decade. With U.S. troops

returning home or staying at reduced

levels, narrowband solutions are

likely to remain flat or even diminish

in revenue terms for the Middle

East/Africa region but remain positive

in the aggregate when other regions are

included in the demand mix.

Broadband solutions,

specifically COTP, should continue to be

stable given that a vital

component to the U.S. presence in

Afghanistan, whether less than a

thousand troops or 8,000 personnel

post-2014, is to continue to provide

small-scale support to local forces as

well as mount Special Forces missions.

The Special Forces component will be

key, as missions will require high

bandwidth solutions, specifically COTP

and COTM services.