Ericsson Report Means

HTS Poised to Benefit

Oct 31st, 2013 by

Jose Del Rosario, NSR

In the latest Ericsson

Mobility Report, key statistics

and future forecasts were

presented, which should provide

satellite technology,

specifically High Throughput

Satellites (HTS), with highly

promising short term

opportunities.

As of Q2 2013, 105 million

mobile subscribers were added to

the global total, which stands

at 6.5 billion mobile

subscribers, representing a

penetration level of 91%. By the

end of 2018, Ericsson expects

mobile subscriptions to reach

9.1 billion and for 60% of the

world's population to be covered

by Long Term Evolution (LTE)

technology.

The additional subscription

base of 2.6 billion in four

short years as well as the

deployment of LTE translates to

requirements for higher

bandwidth where all solutions

(including satellite-based

platforms) should begin to

support 3G and eventually 4G.

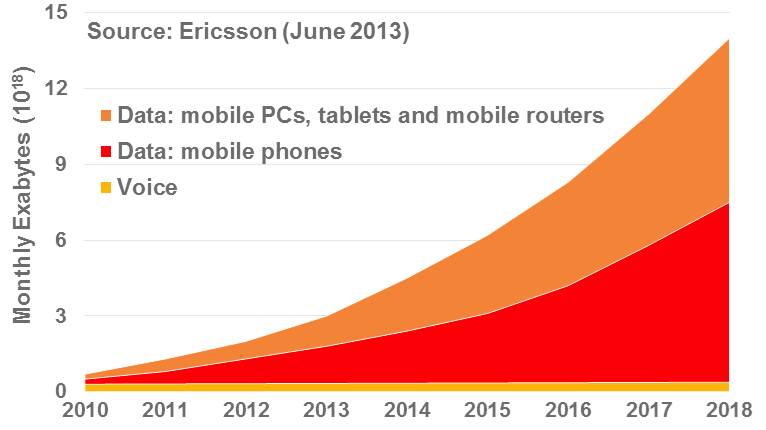

Ericsson further forecasts that

mobile data traffic will

grow by 12 times between 2012

and 2018.

Global

Mobile Traffic: Voice and Data,

2010-2018

Source:

Ericsson

In examining which satellite

platform works best to support

the upcoming surge in traffic

where a stable trend of data

growth means mobile data

subscriptions will grow

strongly, capacity cost

will undoubtedly be a key metric

in the solution mix.

In NSR’s view, HTS

platforms should emerge as the

preferred satellite solution

as they will not only serve as a

“better costing platform,” but

also help drive subscriptions as

they address the continuous

increase in the average data

volume per subscriber.

Data traffic is highly

asymmetrical compared to voice

where efficiencies can be gained

in terms of converting hertz to

bits. With the expected

continued explosion of data

traffic, satellite

capacity that runs on 3G and

even 4G platforms can be

supported with a reasonable ROI

using HTS.

Indeed, recent deals have

begun to reflect this. In August

2013, Intelsat and Japan-based

SoftBank Mobile announced the

successful trial of a

cost-effective, rural 3G mobile

phone service in Kenya. Intelsat

supported the demonstration

through capacity on Intelsat 10;

however, the demonstration is

aimed at delivering a managed

VSAT-based 3G solution through

the allocation of capacity via

the operator’s upcoming

EpicNG HTS platform for

the upgrade of networks from 2G

to 3G, and eventually to 4G via

satellite. In June 2013,

HTS operator O3b signed

a deal with Maju Nusa to provide

ultra-high speed 3G Backhaul

services across rural Malaysia.

Worth noting is that the deal

helps reduce CAPEX costs with

the aggregation of 111 sites

over Peninsular Malaysia into 20

customer terminal locations.

This does not mean,

however, that traditional FSS

capacity no longer has a play in

wireless backhaul. Even

if data is expected to outpace

voice traffic by leaps and

bounds, voice will continue to

be essential in provisioning

cellular and/or wireless

service. VoIP is certainly

available; however, quality of

service issues may lead to HTS

being restrained in terms of

growth prospects. A

solution may be to co-locate HTS

for data traffic and Traditional

FSS to serve voice in a single

terminal site.

Bottom Line

HTS solutions that

have the ability to support high

levels of data with lower cost

structures stand to benefit

tremendously from the

trends outlined by the Ericsson

report. In NSR’s view,

short-to-long term

projections of data usage can

only be achieved with the

participation of satellite

systems, given the high

levels of additional subscribers

being forecasted within a

four-year period and high levels

of data subscribers will demand.

Terrestrial networks cannot

wholly handle this upsurge in

both subscribers and data

traffic given wireless

spectrum is already at the

breaking point in many

countries.

Ericsson noted as well that

video traffic in mobile networks

is expected to grow by around

60% annually through 2018.

In NSR’s view, an

emerging backhaul application

may be to “offload” mobile video

in order to help decongest

terrestrial networks.

An emerging “video offload”

application could be a

substantial game changer for the

industry given that wireless

backhaul via satellite that has

been relegated in rural and

underserved areas may now be a

compelling proposition in

potentially decongesting urban

mobile networks.

|