Changes in the Most

Dynamic DTH Market

Aug 27th, 2013 by

Blaine Curcio, Nsr

With the recent announcement

of a proposed merger between

Reliance Digital and Sun Direct,

which would form India’s 2nd

largest DTH platform, the

world’s most dynamic DTH market

has kicked it up a notch. With 5

major platforms jostling over

1.1 billion people, the Indian

DTH market is transitioning from

being characterized by breakneck

subscriber growth to more

nuanced subscriber retention and

development.

As the market continues to

grow at a considerable clip,

there will be several key

concepts to grasp in order to

capitalize on this growth—the

fundamentally unique aspects of

the Indian market, the way in

which operators are trying to

retain existing customers, and

the future direction of the

industry following

digitalization.

The Indian DTH market is by

no means unique among developing

economies, in the sense that a

high percentage of Indian DTH

subscribers are pre-paid and

short-term. However, it is a

unique market when considering

the sheer number of these types

of subscribers, which themselves

outnumber the DTH subs in most

countries. NSR’s

Direct-to-Home Markets, 6th

Edition estimates that

there are around 40 million DTH

subscribers in India as of 2012,

making it the largest DTH market

in the world by subscribers.

However, many published articles

and press releases would put the

number at around 60 million

subscribers. This difference of

around 20 million represents a

sea of short-term, pre-paid

customers, who are currently

inactive. Moving forward, it

will be critical for Indian

operators to tap into this

customer segment and up their

retention rate, for these people

have already made the effort to

get satellite TV, and thus are

considerably more likely to be

long-term customers. Platforms

are employing an arsenal of

different tools to help retain

these customers, and eventually

grow their ARPUs.

Platforms up to this point

have used a number of

promotional strategies to lure

customers into the DTH market,

which include 3 free months of

service, buy a 1-year contract

and receive 2 months free, etc.

While these offers have helped

to boost customer retention,

subscriber churn remains the

single biggest issue among

operators, in some cases

reaching as high as 35%.

In NSR’s view, the Indian DTH

market requires further

granularity of product

offerings. In a country and an

economy as diverse as India’s,

customization is a must. This

business model has proven very

successful for other firms

within India, most notably

Samsung, who has recently

unseated Nokia in mobile phone

sales in India. A large driver

of this success is Samsung’s

diverse product offering—for

example, they sell 10 different

phones priced between $16US and

$31US, each with a few more

features. DTH operators could

and should learn from this

example, by offering a diverse

array of services allowing

customers to marginally upgrade

content for a minimal added

cost, thus helping them move up

the ARPU chain.

As the digitalization process

continues in India, nearly 100M

new households will become

digital by EoY2014. DTH holds a

geographical advantage over

cable in signing up these new

households, due to their

tendency to be located in rural

areas where cable is

prohibitively expensive to

install. However, with more lax

controls over payment and

content viewing, cable does have

a competitive advantage over

DTH, particularly among India’s

most poverty-stricken regions.

Overall, for DTH operators to

capture a large share of the

newly digitized households in

the coming years, they will need

to combine their existing core

competencies of better customer

service and quality of product

with a more diverse product

offering. This will lead to

meager profit margins for the

short-term, but place them in

better position for long-term

sustained growth in the world’s

most dynamic DTH market.

Bottom Line

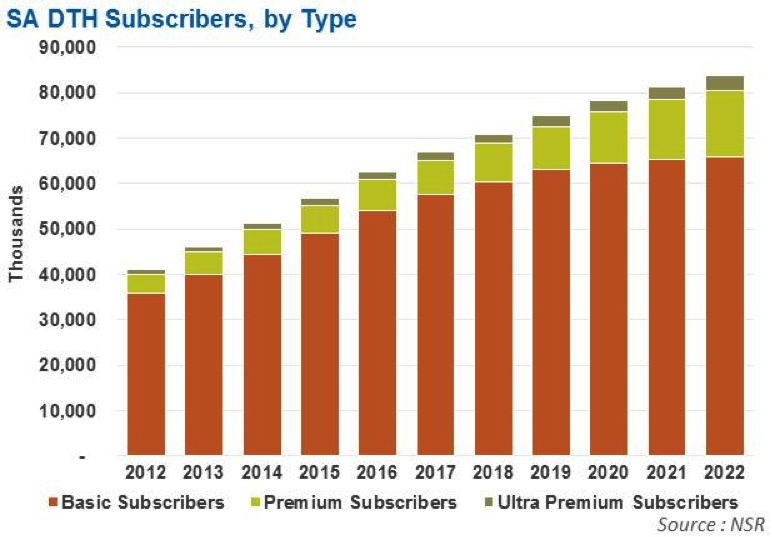

NSR’s Global

Direct-to-Home Markets, 6th

Edition projects a global

addition of just over 124M DTH

subscribers by 2022. Of this

number, nearly 45 million

will come from South Asia, of

which the overwhelming majority

will be in India. By changing

focus from customer acquisition

to building customer ARPUs, DTH

platforms are changing the

market landscape. With a variety

of options at their disposal, it

is in NSR’s view that the most

effective method of building

ARPUs will be granular

subscription options, allowing

customers to slowly and cheaply

add a few more channels. As

digitalization continues to

march across the subcontinent,

DTH platforms need to rely on

their core competencies while

also stemming the tide against

cable, particularly by

leveraging their accessibility

in rural areas. Bottom line,

growth, as well as competition,

will be fierce in the coming

years in India, and it is up to

DTH platforms to capitalize on

the development of the country

and its populace.

|