The Last DTH

Frontier

Jul 23rd, 2013

by

Blaine Curcio, NSR

Sub-Saharan Africa will

provide tremendous

opportunities for DTH

platforms over the coming

years. These opportunities

will be driven by: 1) very

low TV household penetration

rates currently, 2) economic

development and population

increases, and 3) the

current hole in the market

where a low-cost,

low-margin, almost

“India-esque” operator

should be. For these

reasons, Sub-Saharan Africa

may be primed for a period

of considerable growth in

the DTH industry.

NSR’s most recent DTH

study, Global

Direct-to-Home (DTH)

Markets, 6th

Edition, estimates

Sub-Saharan Africa’s current

regional TV penetration rate

is just under 47%. However,

this does not tell the whole

story; 35 of the 46

countries included in

Sub-Saharan Africa have TV

penetration rates of lower

than 50%, with these

countries’ combined

population exceeding 500

million. Furthermore, there

are over 71 million

households in Sub-Saharan

Africa without a television.

As economic development and

falling TV prices lead to an

increase in TV penetration

throughout the continent,

the addressable market for

DTH operators—namely, homes

with TVs, will increase

dramatically from a

relatively low starting

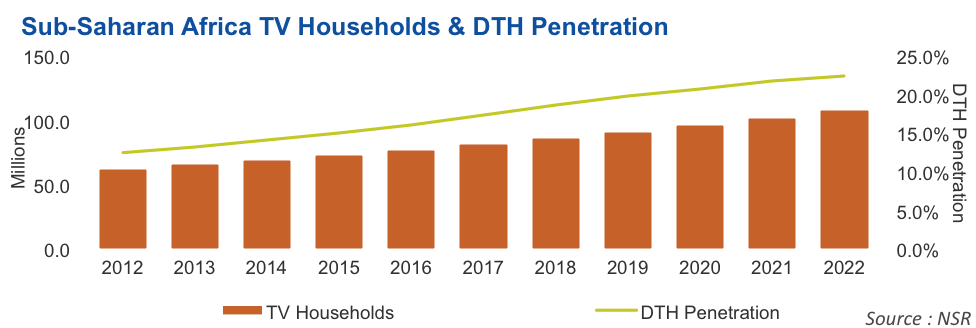

point. NSR predicts TV

households in SSA will

increase from 63M in 2012 to

108M by 2022, and continue

to increase moving forward.

In addition to growth

through existing households

acquiring their first TV,

Sub-Saharan Africa will also

experience rapid population

growth. Between now and

2022, Sub-Saharan Africa’s

population is projected to

increase by roughly 200

million people, to around

1.1 billion. Further,

looking long-term, the

region is expected to be

home to 1.5 billion people,

or an increase of 600

million from today, by 2035.

This continued explosion in

population is particularly

noteworthy when considering

other developing countries

(Indonesia, Bangladesh, and

to a lesser extent India, to

name a few) are experiencing

declining birth rates—and

thus declining population

growth.

However, no matter how

many people or TV households

come to be in Sub-Saharan

Africa, there is still an

absence of one crucial

thing—consumers with the

disposable income to support

DTH platforms, and platforms

that cater to those

consumers’ needs. This is

where there has been an

inherent disconnect in

recent years. For example,

comparing Nigeria, SSA’s

largest country with over

170 million people, to

India, one notices that

their per capita income is

nearly equal, with Nigeria’s

being 4% higher than India’s

(~$1,650 compared to $1,600

per year, according to the

IMF). However, the

lowest-cost DTH package in

Nigeria costs over $6.20US

per month, whereas the

lowest-cost packages in

India cost less than $3.

Therefore, average Nigerians

are being asked to spend

nearly 5% of their monthly

income on DTH services,

whereas in India the number

is less than 2.5%. With

several Indian operators

recently turning a profit,

and showing that the

“high-volume, low-ARPU”

business model can be a

viable one, there is every

reason to believe this can

be achieved in Sub-Saharan

Africa.

In summation, all the

ingredients are present in

Sub-Saharan Africa for a DTH

boom—currently low TV

penetration rates that are

increasing rapidly, a large

and fast-growing population,

and a general trend of

foreign investment and

economic development. To

cater to this rapidly

emerging market, a truly

low-cost operator is needed,

along the lines of those

currently present in India.

Bottom Line

While Sub-Saharan Africa

remains largely undeveloped,

there is a perfect storm

brewing that will spell

immense opportunities for

DTH platforms, provided they

attack the correct market

segments. While the upper

and middle classes are

already relatively

well-served by operators,

the continent lacks a

serious offering for the

lower-class, which will make

up the bulk of population

and addressable market

growth moving forward.