Avanti, announced a conditional placing of 26,785,714 Ordinary Shares with new and existing institutional investors to raise approximately £73.8 million (net of expenses). The Placing is to enable Avanti to fully fund the cost of the design, construction and launch of HYLAS 3.

HYLAS 3 will be a “hosted payload”, flown on a new European Space Agency (“ESA”) satellite which will

also have a scientific purpose. HYLAS 3 would provide Ka band services, as with HYLAS 1 and 2. Under

the terms of the programme, Avanti would retain ownership and operational control of the HYLAS 3

hosted payload.

Avanti has been selected by ESA to be the hosted payload partner after a competitive tendering process

which was conducted by ESA in 2011. Final contractual terms with ESA are expected to be agreed and

contracts signed in March 2012. Avanti and ESA have worked together successfully in the past on

projects: in particular ESA and Avanti collaborated on ESA’s first Public Private Partnership which led to

the successful launch of HYLAS 1.

The Placing is conditional, inter alia, upon the passing by Shareholders of resolutions to give the

directors power to allot additional Ordinary Shares, and to allot the Placing Shares on a non-pre-emptive

basis.

Background to and reasons for the Placing

Avanti has established an advantage in the fast developing market for Ka band satellite services by

financing the build, launch, insurance and operation of two satellites which, together, will serve Europe,

the Middle East and Africa. Avanti’s first satellite, HYLAS 1, launched in November 2010. HYLAS 2 is

currently on track for a June 2012 delivery date and Avanti has notified Arianespace, its launch service

provider, of its intention to launch within a one month window from 30 June 2012. HYLAS 1 launched

on the first day of its launch window.

The sales of capacity on HYLAS 1 and pre-sales on HYLAS 2 to date, demonstrate that demand for Ka

band satellite capacity is evident at the expected prices. Recent trends in market development, including the sale of £8.7 million of Ka band capacity in December 2011 and £14.0 million in January 2012 encourage the Company to expect that it will sell-out the capacity on HYLAS 1 within three years of service launch. In the light of the demand the Company is experiencing, it has also accelerated the

guidance previously provided for the sell-out of HYLAS 2, from five years after service launch to four

years (HYLAS 2 is three times the size of HYLAS 1 in terms of bandwidth capacity). Presently, the backlog of firm orders for each satellite, together with the weighted pipeline of customer contracts in

negotiation and (for HYLAS 2) government options, is already equivalent to more than 50 per cent. of

the capacity on each satellite at the time of its target fill date (April 2014 for HYLAS 1 and September

2016 for HYLAS 2). It is therefore expected that the level of new business to be identified and signed in

the intervening period will meet the Company’s objectives. In the Board’s opinion, the highly flexibly nature of Avanti’s satellite technology and coverage design, its unique patented products and its focus

on resilience, encryption, security and quality is enabling Avanti to find application markets and

customers who are buying on the basis of quality and technology features and benefits and not merely

by reference to price. Therefore, the Company is confident that its capacity can be filled at the expected prices.

The Company sees strong demand for further Ka band capacity across the globe but in the current

climate does not intend to pursue further equity fund raisings for satellites in addition to HYLAS 3.

Subject to suitable market conditions the Company intends to seek a premium listing on the Official List

of the London Stock Exchange in 2013.

The Placing, which will provide the Company with the resources necessary to fund the cost of HYLAS 3, is conditional, inter alia, upon the passing by Shareholders of resolutions to give the directors power to

allot additional Ordinary Shares and to allot the Placing Shares on a non-pre-emptive basis. Accordingly,

the General Meeting is being convened for the purpose of considering the Resolutions which will give

the directors the necessary authorities.

The HYLAS 3 Project

HYLAS 3 will have up to 4GHz of Ka band capacity. This will be configured across eight beams within a

single steerable antenna that can provide coverage of an area equivalent to a region the size of

Southern Africa and can be moved throughout the life of the satellite. The satellite will be positioned in

one of Avanti’s orbital locations with an earth view covering Africa and the Middle East. Delivery into

orbit is expected in 2015.

Avanti expects to experience strong demand for the capacity on HYLAS 3 for the following reasons:

- the flexibility of coverage provided by the steerable beam will be of interest to some institutional and international customers who would see benefits from being able to move the coverage across a large geographic area depending on their needs;

- the Company’s existing customer relationships, developed through the sale of capacity on HYLAS 2, have given it insight into the business plans that underpin demand in certain countries for this amount of capacity;

- the additional capacity would provide greater credibility to Avanti’s existing offering and a path to growth for existing customers; and

- as demand develops in different markets, Avanti would have the ability to move the capacity between regions so as to maximise price and also to manage fleet efficiency in future.

Following the launch of HYLAS 3, 80 per cent. of Avanti’s capacity will address the emerging

telecommunications markets of Africa and the Middle East.

The advantage of entering into a joint venture agreement with ESA is that Avanti reduces costs relating

to the satellite platform, launch vehicle, insurance and project management. These savings would mean

that Avanti would benefit from a satellite project cost per GHz that is over 40 per cent. cheaper than

HYLAS 2. In addition, under the terms of ESA’s proposals, Avanti would not be liable for any potential

cost over-runs relating to the construction of the satellite bus (chassis). Given the overlapping

geographic coverage of HYLAS 2 and HYLAS 3, there would be no additional operating expenditure

relating to its HYLAS 3 hosted payload.

The advantage of pursuing the development of HYLAS 3 in this manner is that it would provide

additional capacity at a lower risk and considerably lower price than the capacity derived from both

HYLAS 1 and HYLAS 2 and that no further debt would be required for HYLAS 3.

The availability of finance had the highest level of weighting factor for ESA in its final selection criteria.

As part of its successful final submission, and based on confidence from the experience of working with

ESA on many projects, Avanti committed to raise the capital required in advance of final contract

signature. Following the Placing, it is expected that final terms will be agreed and contracts signed in

March 2012.

Current trading and prospects

Avanti has today announced its interim results for the six months ended 31 December 2011. These are

available separately but key highlights are set out in this section.

Revenue recognised in the 6 months to December 2011 of £5.1 m (December 2010: £ 1.2 million) shows

a steady acceleration over the £5.5 million recognised in the 12 months to June 2011. With a significant

proportion of operational costs being non cash in nature the loss from operations of £6.8 million

(December 2010: loss £6.3 million) shows only a £1.2 million outflow of cash from operations before

working capital movements (December 2010: outflow £5.8 million).

The balance sheet remains strong, even though there is no carrying value for our orbital slots and

frequency assignments. At 31 December 2011 the Company had drawn $227 million (June 2011: $190

million) of the HYLAS 2 debt facility. The full facility is $328 million which can be drawn over the next 12 months. The launch vehicle is fully paid and only one milestone remains on the satellite. The balance of expenditure on the HYLAS 2 project is the ground stations and the final instalment of the launch

insurance premium.

Sales momentum for HYLAS 1 and 2 is building strongly, with £8.7m of sales booked in December 2011

and £14.0m in January 2012. This gives the Company confidence that it will fill both satellites within the timescale announced: three years from service launch for HYLAS 1 and the reduced term of four years for HYLAS 2. The Company expects HYLAS 3 to launch as it enters the final year of HYLAS 2’s approach to full utilisation, providing the Company with the means to continue to serve the growing demand of its customers.

For the year ended 30th June 2012, the Company has clear visibility on revenues of £17 million for the

year. It is bidding on contracts or they are under negotiation which could increase revenues materially.

Avanti is well positioned to benefit from demand growth and market adoption of new satellite technology and it is particularly fortunate to have over 80 per cent. of its fleet capacity now dedicated to emerging markets which are experiencing high underlying economic growth.

Details of the Placing

The Company has conditionally raised approximately £73.8 million (net of expenses) through the issue

of the New Ordinary Shares at the Placing Price, which represents a discount of approximately 2 per

cent. to the closing middle market price of 285.5p per Existing Ordinary Share on 3 February 2012, being

the last practicable date prior to the publication of the circular. The New Ordinary Shares would

represent approximately 24.0 per cent. of the Company's issued ordinary share capital immediately

following Admission. Application will be made to the London Stock Exchange for the Placing Shares to

be admitted to trading on AIM. It is expected that Admission will become effective and that dealings in

the Placing Shares will commence on AIM at 8.00 a.m. on 23 February 2012.

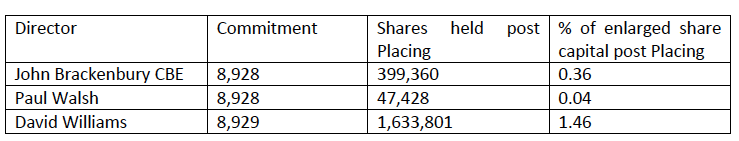

The following Directors have committed to subscribe for New Ordinary Shares under the placing:

M&G Limited (“M&G”) and Caledonia Investments plc (“Caledonia”), which own Existing Ordinary Shares

representing approximately 14.72 and 14.99 per cent. respectively of the existing issued share capital of

the Company, have committed to subscribe for 9,282,833 and 2,425,000 New Ordinary Shares

respectively under the Placing. The commitment in relation to the Placing by M&G and Caledonia

constitutes a related party transaction under the AIM Rules. The Directors of the Company consider,

having consulted with Cenkos, that the terms of the transactions with both M&G and Caledonia are fair

and reasonable insofar as the Company's shareholders are concerned.