|

When The UK Government announced support to finance half of SSTL’s newest radar satellite, it confirmed a trend NSR has seen cropping up in recent times: smaller satellites are gaining ground in both optical and now in SAR markets.

As more manufacturers are looking to address this market with finer ground resolution and smaller satellites at a lower cost (£200 million for four 300 kg. SSTL radar satellites), the effect is likely to be a reduction in the cost of data at the end user side.

In the optical realm, small satellites weighing 300 kg today can offer 70% to 80% of the capabilities of a traditional commercial EO satellite. These can also offer download speeds and an onboard memory of a 1-ton satellite launched for ten years. It is a well-known fact in the industry that imagery prices fall at the same time as resolution gets better. For example, the cost of 2 meter PAN optical data has decreased by more than half since 2001. Even if radar data is still more expensive, the decrease is already showing in the low and medium resolution end of the market.

This is now a global requirement as reports surfaced late in 2011 about a contract signed between Japan and Vietnam to use NEC Corporation’s 500 kg ASNARO platform to build for the Vietnamese two SAR satellites and a ground station for 46 B ¥ (around $590 M).

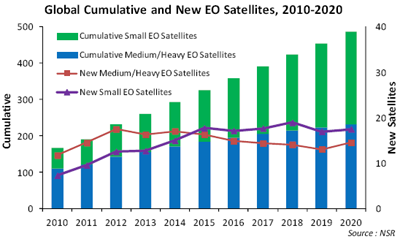

With an influx of new capacity on the market with these satellites, the overall price of radar data should decline even further. In its recently released Global Satellite-Based Earth Observation, 3rd Edition report, NSR indicated that as small satellites (less than 500 kg) are getting cheaper to produce and launch, their numbers are expected to surpass medium and heavy satellites in the next ten years.

What NSR considers is a trend in lower mass and more performing spacecraft is a commoditization of satellites that offer higher resolution imagery at a lower price. The barriers to entry for countries and operators that want their own infrastructure are thus coming down slowly and increasing the market pie. At £45 million (roughly $70 million), not only is the SSTL SAR satellite priced much lower than what the market is used to, but it has advanced performance as well. The highest resolution of SAR images with such a platform is six meters at a swath of 12 to 20 km. Just to compare what that means in terms of evolution, the current RADARSAT 2 satellite, launched in 2007 at a cost of over $500 million CAN offers 3 meter resolution for a 20 km swath (albeit at a higher altitude).

Bottom Line

The aim of the British Government is openly stated: bring down the cost of data to reach a wider set of potential customers with smaller and cheaper satellites, and it starts at the hardware level. The end result is that a game changing process could well be underway in the EO market with manufacturers such as SSTL, IAI, NEC, and MDA who address this issue. If they are successful, it will mean that mass is part of the equation for the EO data market to expand.

|