|

Back in 2007, NSR viewed the longer term outlook in the maritime segment likely to “benefit products in Ku- and C-band ultimately and provide stronger competition to L-band services...”, recognizing that VSAT flat monthly fees with Mbps data rates provided a more predictable return-on-investment than the traditional MSS pay-per-byte model. Then Inmarsat on July 1, 2011 announced new rates that seem to go counter to this view and could drive a growing base of the smaller boat community towards the flat, predictable VSAT service fees.

What happened on July 1 is indeed a change in the way charges will be levied by Inmarsat for its Fleet Broadband. As announced on the Stratos website, a subsidiary of Inmarsat: “As of July 1, 2011, Inmarsat is introducing a minimum usage fee”, which some blogs in the yachting community indicated would result in “existing small time users….suddenly looking at much larger annual airtime bills regardless of their actual usage.” Even with lower per minute voice and streaming charges introduced in April 2011 for smaller pocketbooks, Inmarsat still warned of “high out-of-bundle charges for background IP service.”

“The writing is on the wall – commercial and leisure mariners continue their move to VSAT service in response to Inmarsat’s slow data rates,” trumpeted KVH industries on July 18, 2011 as it announced new rate plans for its mini-VSAT product line. KVH also added that L-band services “cost too much”, and customers are increasingly frustrated with the Inmarsat rates of earlier in the month.

Thus it appears that the smaller boat community (recreational and perhaps the fishing community), which Inmarsat is trying to address awkwardly with these new rates, is courted heavily by KVH. Inmarsat will need to concentrate on what made it successful in the higher end markets, where Fleet Broadband is growing fast and presents much lower rates across the board, even for over-allotments, if it wants to fully address this growing market segment.

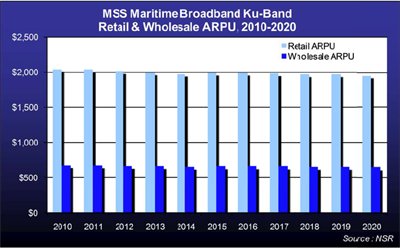

Since KVH has targeted the lower end market with its mini-VSAT, it has registered a very strong take-up with ARPU generally three to four times lower than comparable L-band services. If the recent past is any indication, Ku-band maritime subscribers tripled in three years since 2008. Furthermore, competition will push down prices of equipment and ARPU by at least 10% over the next ten years, as coverage continues to grow.

Although KVH is making strong waves in the maritime broadband market, it is still well behind Inmarsat. Its mini-VSATs shipped count for less than 10% of all activated Fleet Broadband units, and the hardware is more expensive. However, it is certainly pushing hard to switch customers to its Ku-band network in the face of strong competition from Inmarsat (which plans to grow its FSS market presence).

Bottom Line

The quick expansion of coverage, the surge in hardware similar to the mini-VSAT, the distribution deals signed and the thirst for more bandwidth are convincing arguments that the maritime market is sailing onwards to VSAT services. Even if still mostly a regional play, there is no doubt that the writing is indeed on the wall for MSS players, and that many maritime markets are moving towards predictable VSAT services.

|