|

A recent agreement to build a submarine cable by 2012 between two Islands, (Vanuatu and Fiji) emphasizes a clear trend: remoteness of a territory is not a barrier for cable connections as long as the market is valuable. Another announcement from the ITU on the sharp decrease of fixed broadband prices (50% between 2008 and 2010) with the 10 countries in the world with the biggest relative change in price all located in Africa illustrates the effect of the many cable projects that were completed recently in Africa, formerly the last satellite IP trunking stronghold.

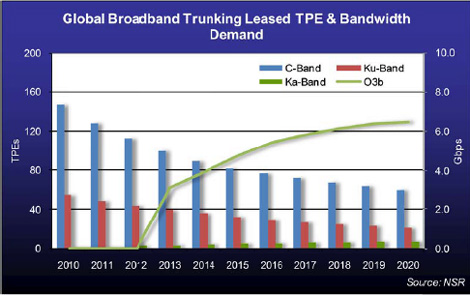

Despite these confirmations of the apparent general decreasing trend for satellite IP trunking, one should not forget the intrinsic advantages of satellite platforms. Satellite IP trunking offers low CAPEX, which is perfect for low density areas, and a system flexibility adapted to fast installation even in remote areas. Satellite IP trunking therefore keeps its “last mile” advantage even if its strength is decreasing with the growth of many broadband markets and the lowering of cable cost. Considering territories, especially in Africa, with a low population density, a lack of infrastructure and located within a huge continent, this will translate into the persistence, for years, of a market for classical satellite IP trunking in both C- and Ku-bands despite the strength and speed of cable deployment.

Those considerations will also secure a market for O3b-based IP trunking services. With a higher CAPEX than IP trunking but a much lower OPEX, O3b becomes economically valuable for higher population density areas when compared to classical satellite IP trunking. With a lower CAPEX than cable systems but a higher OPEX, O3b can’t compete in cities and generally in high population density areas but can address markets that cable systems cannot. This position may give O3b a “niche market” in middle-sized cities and middle population density areas.

At the same time, NSR expects O3b’s enabling of low(er) broadband prices to increase the number of users and thus the size of the market, which will eventually accelerate the transition towards cable. This trend will be particularly clear with O3b Tier 1 sites (several tens of Mbps) that are not expected to last for long; their starting size is already close to the point where cable systems become the best solution. This is the primary reason why NSR doesn’t expect global O3b leased trunking bandwidth to grow above 6.2 Gbps, with a large part of it coming from Sub-Saharan Africa and the Middle East & North Africa regions; the latter benefits from its weather, which is perfect for O3b’s Ka-band beams.

Bottom Line

NSR does believe that IP trunking will be a positive market for O3b, albeit a minor one. But O3b, whose operations should start in 2013, cannot afford any delay in deployment. The cost of deploying a cable is ever decreasing, and now that Africa’s coastal areas are well served, the marginal cost to deploy cables further into the continent is also decreasing, speeding up further deployments into the continent. Demand for satellite IP trunking is and will continue to decrease, and this will likely limit the IP trunking market opportunity for O3b in the next 10+ years.

|