|

Will Community Wi-Fi Bridge The

Digital Divide?

March 8, 2021 by Vivek Suresh

Prasad | NSR

Internet access is an integral part

of the human necessity, owing to its immense impact on

social and economic developments in a region or

community. However, approx. 50% of the world’s

population still do not have Internet access, creating a

greater digital divide across regions. This inequality

is significant between developing and developed regions,

where World Bank data shows only 35% of population in

developing countries have Internet access versus 80% in

developed countries. It is estimated that Internet

access to 75% of population in all developing countries

will cumulatively add USD $2 Trillion to GDP and 140

Million jobs. The Broadband Commission (ITU) has set up

multiple worldwide targets, with greater focus on

unserved regions, to achieve 75% Internet penetration

worldwide by 2025. While importance of Internet access

is undeniable, the challenges to upthrust Internet

penetration remain many.

Satcom for Broadband Access

Satellite-based Internet service

must be a major driver in addressing the targeted

Internet penetration as it offers ubiquitous, instant

infrastructure and a cost-effective platform compared to

terrestrial alternatives in challenging topologies.

According to NSR’s VSAT & Broadband Satellite Markets

(VBSM19), 19th Edition report, the total addressable

market for consumer broadband service is 434+ million

households with Asia, Middle East/Africa and Latin

American regions contributing 88% of the total

opportunity. Most players in the Satellite industry

target this market with plans to add massive amounts of

satellite capacity in the coming years, such as SpaceX,

Amazon, ViaSat, Hughes, Telesat, OneWeb and others. But

the major challenge that remains is pricing, and it

considerably shrinks the total addressable market –

because most users in developing countries are extremely

price sensitive. ViaSat’s average revenue per site per

month is close to $99, SpaceX offers Starlink service

during beta-testing at $99 per month, terminal cost

ranges from $300-$400 for GEO-based services and >$2,000

(without subsidy) for Non-GEO services. High service and

equipment costs have led to relatively low market

penetration in emerging economies given low disposable

income levels. Costs have decreased over time but are

still not at the level that renders affordability to

many households and individuals.

Addressing Affordability

Community Wi-Fi (or Wi-Fi Hotspots)

is one business model gaining momentum by addressing

these pricing challenges. As it is a bandwidth sharing

approach, the total cost of usage for an end-user drops

significantly- with pay-per-usage or cheaper

subscription packages & no direct equipment costs, and

at the same time service providers generate 2x-3x (or

more) revenue per site compared to a typical

direct-to-premises site. The business model is

witnessing success across emerging and remote regions,

with examples of major deployments:

Hughes Jupiter System enables more

than 42,000 community Wi-Fi hotspots across the world.

The offered bandwidth per terminal is 300+ Mbps. Major

deployments are:

Express Wi-Fi by Hughes-Facebook is

now operational across Colombia, Mexico, Ecuador, Peru,

and Chile.

Hughes, in partnership with PSN,

has deployed Wi-Fi Hotspots services connecting 2,000

villages across Indonesia.

Hughes has deployed at least 1,300

Satellite-enabled Wi-Fi Hotspot terminals across remote

areas of Russia – through regional service providers.

ViaSat connects over a million

people across Mexico using Community Wi-Fi hotspots and

is targeting progressive growth month-by-month. Offered

speed is up to 100 Mbps and subscription packages

starting at $3 MXN.

This shared business model is

extremely suitable for small communities and remote

locations with lower disposable income, and hence NSR

expects this market approach, addressing affordability

challenges, to grow organically.

Total Opportunity

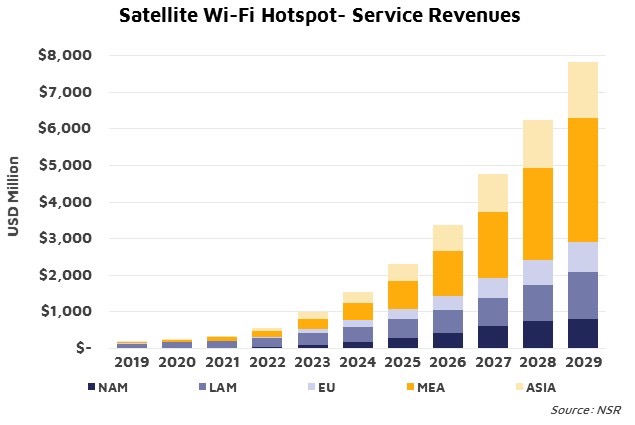

According to NSR’s VBSM19 report,

cumulative Wi-Fi Hotspot service revenue will grow from

mere $182 million in 2019 to $7.8 billion by 2029 at

astounding 45.7% CAGR. Asia is estimated to grow at the

highest pace with a CAGR of 71.6%. Middle East/Africa

(with Africa in focus) is estimated to witness maximum

penetration post 2023-2024 – with added service influx

from GEO & Non-GEO players, vectoring the regional

opportunity to $3.4 billion by 2029. Latin American

service revenues are forecasted to multiply by >10x

during 2019-2029 – owing to ongoing and future

deployments. North America and Europe also show

potential by contributing 22% of

global Community Wi-Fi service revenues during

2019-2029.

Bottom Line

Community Wi-Fi (or hotspots) is a

win-win approach for both service providers (higher

revenue per site) and end-users (lower usage cost),

addressing the key challenges of digital inequalities in

developing countries, i.e., service and equipment

pricing. The business model is not suitable for data or

bandwidth-hungry end users as it is a shared bandwidth

approach. But it is very suitable for

regions/communities with lower per capita income, and

most unconnected population/households belong to this

market section. Notably, most Wi-Fi Hotspots deployed

sites in remote or developing regions witness 250-500

devices using the network regularly – hence it can be

stated that addressability of the model to bridging the

digital divide is greater through this approach.

Fullerton (formerly

Westin) Hotel, Sydney

New Dates - 22 & 23 June 2021

|