|

"Australia’s USO

Wrangling Hits New Intensity"

Queensland quietly deploys

Starlink to First Nations communities, as rain fade

debate rages

The Queensland government has been

quietly deploying a so-called Rapid Low Earth Orbit

Deployment Project which has already connected ten First

Nations communities in the state with Starlink dishes.

One of the installations provided

potentially life-saving communications for some 300

people dislocated by a tropical cyclone last December,

even as opinions differ as to whether the technology

works effectively during rain.

The low proϐile

project is being run jointly by the Queensland

Government Custom[1]er

and Digital Group and the Local Government Association

of Queensland, which is overseeing council applications

and distribution of funding for the Starlink satellite

dishes.

What is most notable about this

initiative is its value for money. The government has

allocated just $1.25 million to the program, which aims

to provide improved digi[1]tal

infrastructure for an interim period while larger

infrastructure projects are deliv[1]ered

to increase digital inclusion.

“Funding of $45,000 has been

allocated for each community—more for the Torres Strait

region—which will provide approximately ϐive satellite

dishes for each loca[1]tion,”

the state government said. The project guidelines

suggest the funds also cover 36 months of service.

This suggests that upwards of 27

communities will beneϐit from the program, with a

cumulative total of nearly 140 dishes.

A spotlight was shone on the

project for the ϐirst time in a submission by the Qld

local government group to the Federal Department of

Communications’ current con sultation on the Universal

Service Obligation.

“The Rapid LEO Deployment Project

is a great pilot project that demonstrates what beneϐits

could be achieved for remote communities if the federal

government were to support further roll-outs,” the local

gov’t association said in its submission.

The association cited two speciϐic

examples of deployments under the project.

The first, for the Wujal Wujal

Aboriginal Shire Council, saw instant deployment of

Starlink connectivity after 300 residents were impacted

by Tropical Cyclone Jasper on 13 December last year.

The second is intended to provide

transformative broadband connectivity for the sole

accommodation facilities on Mornington Island, enabling

online bookings and providing secure income for the

owner, Mornington Shire Council.

The strong endorsement of LEOsat by

Queensland authorities comes at a time there

opinions are mixed as to whether the technology should

become a key part of the USO mix. The major ϐlashpoint

appears to be the performance of LEOsat during weather

incidents such as rain.

As CommsDay reported yesterday,

peak rural comms lobby, the Regional, Rural and Remote

Communications Coalition, said several of its 21 members

had noted “rain fade and service failure during

bushϐires on both NBN Sky Muster and Starlink

connections.” The user lobby group Better Internet for

Regional, Rural and Remote Australia said there was a

lack of public data on the reliability of satellite

services, and nominated two speciϐic examples of

individual user experiences with Starlink:

one of whom experienced around 50

minutes of downtime during a day-long storm, the other

experiencing around three hours downtime during a

week-long period.

By contrast, a trial Telstra

conducted of Starlink services across the equivalent of

644 customer days found overall service reliabil[1]ity

of 99.8%, higher than the 99.6% overall performance of

ϐixed networks.

Significantly, LEOsat reliability

during heavy rain fall events was 99.4%, deϐined as 1mm

of rain every 15 minutes. Telstra, which took the

measurements over the last summer, said heavy rain was

recorded less than 0.75% of the time.

This implies that Starlink would

suffer service unavailability during rain for less than

40 minutes per year. Average Starlink dropouts from rain

resolved in under five minutes, according to Telstra.

Anecdotal evidence from the

Starlink Australia Facebook group, which has around

80,000 members, is that most users typically experience

dropouts of a few seconds and rarely more than a minute

during rains of up to 60mm per hour. A common ob[1]servation

is that speeds drop during heavy rains but not to

unusable levels.

The 2023 report of the Federal

Government’s LEOsat Working Group noted that the

availability metric for LEOsat services may be slightly

lower than copper mostly due to rain fade, but that all

other metrics would be improved and the difference in

availability would be negligible.

There is surprisingly little

academic literature on LEOsat rainfade, with most work

Telstra’s Starlink trial

| Seven services measured over

combined 644 days

| 99.8% uptime

| 99.4% uptime during rain ( above

1mm every 15m)

| Average dropout time of 5 mins

during heavy rain

| Compared to 99.6% overall ϐixed

network uptime

employing theoretical modelling as

opposed to real world test results. A recent study on

candidate ground stations for Telesat in Africa when

measured against rain data found that three of six would

only be unavailable for 53 minutes per year while a

fourth would be unavailable for about four hours per

year. The other two would be unavailable for around two

days, due to rain.

Starlink said in March that it now

had over 200,000 customers in Australia. With NBN Sky

Muster now servicing around 87,000, the combined number

across the two satellite services has passed the 285,000

customers served by the USO-funded Telstra rural copper

network.

Grahame Lynch

USO copper lines now subsidised

$800 each per year as Telstra argues for wireless,

satellite reset

Telstra has revealed that it is now

servicing just 285,000 copper line connections, from the

$230 million in annual subsidy it gets from universal

service funding: costing over $800 per connection and

rising. It has also reported that its tests of LEOsat

services showed that the notion that they suffer from

rain fade is a myth.

The revelations came in a

submission to the federal government where it called for

major changes in the universal service obligation, not

least, an end to the requirement for it to maintain a

copper network in non-NBN fixed network areas until

2032.

The 285,000 footprint appears to be

declining fast according to varying data points: Telstra

was estimated to supply over 600,000 such services in

2018.

Telstra argued that it is now time

for technology neutrality in USO delivery.

“Different technologies have

different strengths and weaknesses, and none is perfect.

However, the recently launched

fixed wireless and Low Earth Orbit satellite

technologies are better able overall to provide

consistent, high-quality connectivity to premises in

areas that have not been connected to NBN Co's fixed

line network,” it argues.

“In addition to supporting high

quality voice, the data performance is generally much

better than legacy technologies such as copper-based

ADSL.”

The submission argued that concerns

that alternate technologies to fixed line are inferior

are unfounded.

A trial Telstra conducted of

Starlink services across the equivalent of 644 customer

days found service reliability of 99.8%, higher than the

99.6% performance of fixed networks. LEOsat reliability

during heavy rain fall events was 99.4%, defined as 1mm

of rain every 15 minutes.

“Heavy rain can impact the fixed

network via the flooding of network assets and cable

wash-outs, and these can often take days to repair which

in turn reduces aggregate availability. In addition, the

average duration of LEOsat service dropouts was under

five minutes, meaning that when a dropout occurred the

connectivity was typically re- established very quickly.

In contrast, copper outages can take hours or days to

resolve,” Telstra said.

Telstra argued: “The requirement to

use the copper network to deliver standard telephone

services to premises that were connected by copper at 1

July 2012 should be removed. Doing so will allow Telstra

to plan and execute an orderly migration of customers

from the ageing copper network to newer technologies

that are more capable of providing a high-quality

standard telephone service over time, mostly in regional

and remote areas but also at metropolitan premises not

currently served by 12,331 opens NBN CO: Plans to

streamline three consultations on high speed products

yesterday

UNIVERSAL SERVICE REGIME: Starlink,

Amazon make the argument for LEOsat offerings NBN Co.

There should be no technology-specific mandates or

exclusions.”

Telstra receives $230 million from

government, and, in part, from competitors via an

industry levy, to maintain the standard telephone

service each year.

Other major levy contributors,

unsurprisingly, have used the consultation process to

call for an end to the USO scheme as it stands.

NBN WANTS REFORM IN FAVOUR OF LEO:

NBN Co wants reform, namely the streamlining of the

Telstra-delivered USO and the mainly NBN-delivered

Statutory Infrastructure Provider regime into a single

service obligation.

“For approximately 97-98% of the

population covered by NBN’s fixed-line and fixed

wireless networks, the baseline network would be NBN or

other non-NBN SIPs,” NBN Co argued.

“For the remaining 2-3% of the

population, a LEO satellite network could be used to

provide baseline broadband and voice services in

regional and remote Australia via a LEO-based SIP,

provided government, industry and consumers are

satisfied that appropriate technical, commercial,

operational and security arrangements are in place to

reliably deliver those services to Australian

end-users.” it said.

Other telcos think it is time for

an end to the USO, with satellite able to adequately

take up the slack.

OPTUS WANTS EFFECTIVE USO REPEAL:

Optus said that since 1992, it had paid Tel[1]stra

more than $1.2 billion in USO levies, which it could

have invested in its own mo[1]bile

network.

“This has resulted in Optus’ mobile

network being almost one million square kilometres

smaller than it could otherwise have been,” it claimed.

“As currently administered, the USO

remains an economically inefϐicient subsidy of out

of-date technologies that ultimately serves to reduce

the level of private infra[1]structure

investment in regional and remote areas and entrenches

Telstra’s network dominance. Rather than ensure that

consumers in non-commercial areas receive modern

telecommunications services, the current USO regime

enables Telstra to “sweat” its copper assets – to behave

as a monopolist,” it said.

Optus recommended that the

government immediately repeal the USO from all areas

where there are at least three networks, including

mobile and satellite networks, capable of supplying

voice or voice equivalent services to a fixed location.

It also warned the government away from picking a

particular satellite solution “winner”, saying that GEO,

MEO and LEO may all play a role in a “system of

systems.”

TPG SAYS SIP CAN REPLACE USO: TPG

said it wants an immediate transition away from existing

Telstra contractual arrangements. “The USO is no longer

required where the Statutory Infrastructure Provider

regime compels wholesale providers to provide a voice

service. Any residual concerns regarding consumer

safeguards can be dealt with by imposing obligations on

NBN Co, as the default SIP,” it argued.

It said that should there be a

requirement for an ongoing industry levy to fund the

USO, it should be expanded to “OTT providers” and be

based on profits and not revenues.

VOCUS ASKS WHY A USO? Vocus Group

asked “Given that commercial services are now available

to 100% of Australian premises, it is not unreasonable

to start with the question – do we need any form of USO

at all?”

“Premises with coverage from at

least two mobile networks, as well as LEO and NBN Sky

Muster, can be considered ‘competitively served’ as they

have a range of commercial pricing options available

from a range of providers.”

“But for premises

with coverage from only one mobile operator as well as

LEO and NBN Sky Muster, the presence of only two viable

voice services should allow for endusers to receive a

subsidy to ensure they can obtain a minimum-standard

level of service at an affordable price.”

Subsidies for end-users shouldn’t

go to operators but instead be offered to end users, who

would be able to choose a preferred service.

Grahame Lynch, Commsday

Starlink wants in on Australian

universal service provision

Starlink operator SpaceX has called

for a “pro-competition” model to deliver Australian

universal service, calling for a “complete re-write” of

the existing Universal Service Obligation regime in a

submission to a consultation.

It should be replaced

with a technology agnostic scheme that has a “greater

focus on competition, multiple providers and multiple

robust service offerings for consumers,” rather than

having “a focus on a single provider of limited legacy

services, as is currently the case,” SpaceX has told the

federal government.

It said that a revamped USO could

allow customers “to choose from multiple services,

including LEO satellite broadband” and rather than a

focus on technology or particular provider be based

around minimum standards to deliver voice and other

critical services.

SpaceX said the Department of

Communications should implement a “consumer choice

model” based on a selected panel of service providers

that have shown they can meet minimum requirements:

“These competitive USO providers could include operators

of a variety of different telecommunications networks

that are capable of supplying qualifying services,

including LEO satellite networks such as Starlink, fixed

wireless networks and mobile networks, as well as new

networks that may be launched in the future. As

technology advances, the Department can periodically

increase standards.”

AMAZON WEIGHS IN: Amazon’s Project

Kuiper similarly argued that LEOsats offer an

alternative technology for universal service. However,

it cautioned that it would be “premature” to expand the

Standard Telephone Service to require direct-to-device

functionality.

Although Kuiper has not announced

its service plan, it noted that it was capable of

supporting voice products with call quality comparable

to a terrestrial network, as well as support other

carriers with backhaul services.

“Project Kuiper will operate as an

internet service provider, serving individual

households, as well as schools, hospitals, businesses,

government agencies, and other organizations,” it said.

“Although Amazon has not yet revealed the pricing for

Project Kuiper, affordability is a key principle.”

It noted that Australia’s universal

service regime developed “in an environment here supply

and demand conditions were well-established” due to

Telstra’s monopoly on services in non-commercial areas

and “conditions of relatively low technological

dynamism, where copper-based wireline access networks,

supplemented by microwave, have been the prevailing

terrestrial network solution in regional and remote

areas of Australia”.

“The supply of STS under the USG

mostly assumes a geographic dimension: the overwhelming

majority of people reliant on the statutory Universal

Service Obligation for their STS and the overwhelming

areas of net cost associated with its provision are

those inhabiting rural and remote parts of the country,”

it said.

The government has been able to

“act with a high degree of certainty” when setting out

the requirements of the STS and the geographic areas

where regulatory obligations operate. Direct-to-device

services are “subject to high degrees of competitive and

technological dynamism” and “are nascent and immature in

Australia and global[1]ly

across a range of dimensions.”

As a result it’s not possible to

define a baseline service based on direct to device, or

“identify areas in which such a baseline service might

not be commercially supplied according to the dimensions

of accessibility, availability, and affordability.” That

makes it inappropriate to consider as part of the scheme

until “supply and demand conditions have developed as

they are expected to over the short to medium term.”

Rohan Pearce, Commsday

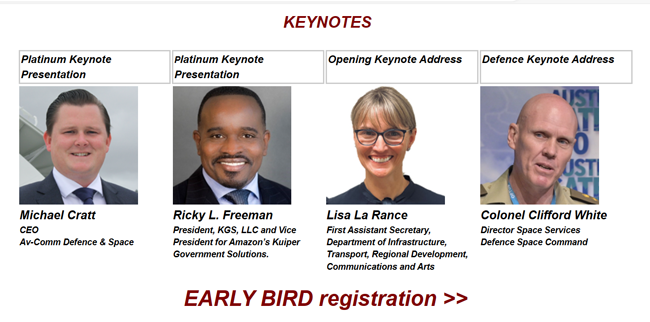

Just one of many key talking points at the

forthcoming:

Australasia Satellite

Forum 2024

Contact: kfrench@talksatellite.com

Fullerton Hotel, Sydney

3-4 June 2024

TWO FULL DAYS - Where Satellite Leaders Speak!

Over 50 Top Quality Speakers

EarlyBird Registration >>>

Fullerton Hotel, Sydney

3 & 4 June 2024

SAVE

THE DATE

|

.png)