|

Japan--Rise of

Commercial Space in the Land of the Rising Sun

by Blaine

Curcio, Founder at Orbital Gateway Consulting by Blaine

Curcio, Founder at Orbital Gateway Consulting

The Japanese

space sector is one that can sometimes go

under-the-radar. With a rapidly growing China just next

door, and with many of Japan’s missions involving

playing a supporting role for missions being led by NASA

and others, the country’s space industry has,

historically, been relatively quiet about marketing

itself. Part of this can be chalked up to cultural

differences—we have all seen the maddeningly complex

slides that can seem indecipherable, whether in English

or Japanese—but part of it is because until relatively

recently, Japanese commercial space was a small, and in

many cases academia-focused endeavor.

This is starting

to change, as Japanese commercial space companies are

raising much larger sums of money, and from a wider

variety of funding sources. A country like Japan, with a

high savings rate, with no shortage of large financial

institutions, and a huge number of talented engineers

and scientists, has all the ingredients for a thriving

commercial space ecosystem. And over the past few years,

we have started to see the beginnings of one emerge.

Astroscale

and the Nintendo Founding Family

In late 2021,

Japanese space debris mitigation startup Astroscale

completed a US$109 million round of funding—its

largest ever—that brought the company’s total funds

raised to US$300M. The company calls themselves “Space

Sweepers”, planning to launch spacecraft that can remove

orbital debris, and as a result keeping orbit safe and

clean for future generations. The company has a glossy

website, a senior management team that combines Japanese

and non-Japanese executives, and importantly, not a

single maddeningly complex slide deck in sight (though

they do have some great slide decks).

The funding

round for Astroscale included a variety of financiers,

including Japan Growth Capital Investment Corporation,

Seraphim Space Investment Trust, Chiba Dojo Fund II

Investment Limited Partnership, and, perhaps most

notably, the Yamauchi-No. 10 Family Office, listed last

on the list of financiers in the press release.

Having

never heard of this family office, but with the Yamauchi

name sounding vaguely familiar, I did some digging, and

found on the family office’s website that the Yamauchi

family is the founding family of Nintendo Corporation.

And what a website it

is, unquestionably the most unforgettable

family office website that I have ever seen (admittedly,

that may not be saying much). For anyone reading this

online, I suggest you take a moment and go check out the

website, we will wait here.

Figure

1

The Homepage for the Yamauchi No10 Family Office

For those who

did not just make the quick trip over to

www.Y-N10.com,

a short summary: the website looks like a video game

crossed with something from the mind of Timothy Leary.

It is so overwhelming and bizarre upon first landing

that one almost feels the need to close your browser

immediately. But then digging a bit deeper into what the

heck this family office is all about, one starts to

realize that the Yamauchi No. 10 Family Office is

absolutely serious about their ambitions to invest in

innovative Japanese startups. How so?

By invoking the

spirit of Hiroshi Yamauchi, the Third President of

Nintendo, and a man who ruled over the company from 1949

to 2002. The website notes that Yamauchi was “one of

those people who possessed truly unique creativity and a

pioneering mindset, along with a foresight and the

understanding of what users wanted”, while also pointing

out that “Japan was once globally renowned for

its people’s quality of unique creativity teamed with a

pioneering mindset…. but that golden era has long

gone. It seems that the quality Japanese people

once possessed is overshadowed by worry and fear”.

The Yamauchi

Family Office is the embodiment of what makes Japanese

space unique. The family office website looks like a

whimsical video game but becomes pretty darn deep and

serious when you start reading their mission: “Our goal

is to use our investments to drive innovation in Japan.

By being more proactive in the companies we invest in,

we can achieve the kind of reforms needed in this

country to popularize the idea of taking on new

challenges to generate innovative new ideas, products,

and services”.

As with the rest

of the world, the commercial space sector in Japan has

been limited until recently. And as with Japan in many

other industries, the country began to see traction in

commercial space soon after the US, and before its East

Asian neighbor China. Today’s leading Japanese

commercial space companies were founded in the late

2000s to early 2010s, around a decade after the start of

companies such as SpaceX and Blue Origin, and around 5-7

years before commercial space companies began emerging

in China. These companies are choosing interesting and

noteworthy verticals, and are developing in ways that

reflect Japan’s historical tendencies and priorities in

the space sector.

Background of

Japanese Space

Japan has the

region’s most long-established space sector, having

completed its first space flight in 1955. In the ~65

years since, the country has developed a comprehensive

space program, including a variety of EO, comms, and

navigation satellites, space exploration missions, and a

major module on the International Space Station (ISS),

the Kibō Module.

Historically,

most of Japan’s major space projects have been motivated

by government policies and decisions related to research

& development (R&D), rather than commercial

considerations. This is partly a reflection of broader

Japanese economic policy, namely a state-led development

policy that has prioritized technology development,

oftentimes in order to keep pace with the west, leading

to top-down projects that are more reflective of

government priorities than commercial applicability.

This has also historically meant that a small number of

conglomerates with close ties to the government have

tended to dominate the national space sector.

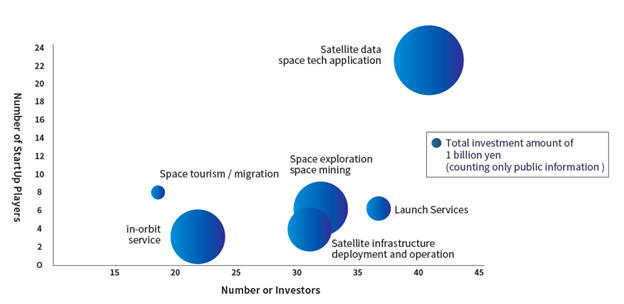

Figure

2

Funding, Number of Companies, and Number of Investors

per Vertical. Source: ESPI Report, New Space in Asia

As a result of

this top-down development model, Japan’s space program

has led to a lot of technological innovations that have

been applied to other sectors, but has led to relatively

low utilization of Japan’s actual in-orbit space assets.

For example, while Japan’s EO satellite programs have

led to a variety of new technologies, the utilization of

the data generated by the satellites is lower than, for

example, LandSat.

More recently,

this has begun to change, with the Japanese government

taking specific actions to invigorate its space sector.

This includes the Basic Plan on Space Policy, first

published in 2009 and most recently revised in 2020. The

Plan calls for, among other things, “realizing economic

growth and innovation for which space is the driving

force”, while also emphasizing that the global space

sector is becoming more commercial, and that Japan must

follow suit. Within the 2020 revision is a goal to

double the size of Japan’s space economy from $11

billion in 2020 to more than $20B by the early 2030s.

In addition to

policies, the government has offered more tangible

support, most notably a ¥100B fund created in 2018 for

commercial space companies. Other tools Japan is using

to develop a commercial space sector include a variety

of government accelerators and programs, with this

including S-Booster (startup contest for space

companies), S-Net (platform to match entrepreneurs and

government officials to better utilize space

infrastructure), and S-Matching (platform to match space

entrepreneurs and investors). Finally, similar to NASA,

Japan’s JAXA has been gradually moving from a model of

building/owning space infrastructure to a model of

hiring more contractors (implicitly private space

companies) for assistance on projects.

Japan’s

Government Space Program

Japan’s space

program is administered by the Japan Aerospace

Exploration Agency (JAXA), the nation’s space agency,

which was created in 2003 as a merger of the National

Space Development Agency of Japan (NASDA), the Institute

of Space and Astronautical Science (ISAS), and the

National Aerospace Laboratory of Japan (NAL). JAXA’s

budget for FY21 was ¥212B, or around US$2B, with this

figure representing around half of Japan’s total space

budget (the remainder largely goes to the Cabinet

Secretariat and the Ministry of Defense).

The Japanese

space industry has traditionally been dominated by a

handful of industrial conglomerates, including

Mitsubishi Heavy Industries (MHI), Mitsubishi Electric

(MELCO), NEC, and Hitachi. These companies are the prime

contractors for many of Japan’s major space initiatives,

with MHI developing the H2 and H3 launch vehicles, MELCO

developing most of Japan’s large satellites, and with

NEC and Hitachi, among others, contributing as partners

to the aforementioned Kibō module on the ISS. In most of

these projects, JAXA would act as the integrator,

orchestrating a consortium of private companies.

Today, Japan’s

space program places major emphasis on satellite

navigation (3x more QZSS satellites planned by 2023), EO

(several Information Gathering Satellites--IGS--launched

in the next few years), and satcom (multiple X-band

milsatcom satellites having been launched). Moving

forward, defense and self-sufficiency are expected to be

major themes in the development of Japan’s space

capabilities, with the regional geopolitical/security

environment justifying increased expenditure on

defense-related projects.

Emergence of

Commercial Space in Japan

While the

national space program remains the largest component of

Japan’s space industry, the country has seen a vibrant

commercial space sector emerge over the past ~10 years.

Compared to the west, Japan’s commercial space companies

have been more focused on applications, rather than

developing industrial capabilities. This is partly due

to the semi-protected nature of verticals such as

launch, and partly due to the lack of a sufficiently

large domestic market to justify commercial investment

into projects such as heavy-lift rockets.

With that being

the case, Japanese commercial space companies have

focused on emerging applications, and have created

partnerships with some of Japan’s leading companies

partly through helping these companies make use of space

here on earth. Others have utilized lower launch costs

to create new opportunities in orbit.

The most

apparent example of collaboration here on earth is

between Axelspace and Mitsui Fudosan. Axelspace is a

leading Japanese earth observation company, founded in

2008. The company has integrated and launched several EO

satellites with various partners. Mitsui Fudosan, a

major conglomerate, has partnered with Axelspace for EO

data to be used in Mitsui’s logistics and real estate

businesses, while also helping to build a new

headquarters for Axelspace, and participating in

multiple company funding rounds.

Another example

is SAR satellite operator Synspective, which has raised

more than US$100M since its creation in 2018, with

funding coming from Mitsubishi UFJ Trust and Banking

Corporation and Shimizu Corporation, among others.

Shimizu, noteworthily, has very long-term lunar

ambitions, and in the more immediate term would have

certain requirements for SAR data due to its

construction and engineering business. Moving forward,

Japan’s large trading houses, industrial giants, and

other pillars of the national economy are likely to

become more involved with the country’s commercial space

sector, leading for more opportunities for space

startups.

Looking towards

orbit, in the field of space robotics, startup Gitai has

raised more than US$20M to build low-cost, reliable,

efficient robots to be used in space. In September 2021,

the Government of Japan announced that Gitai had created

the world’s first general-purpose “astrobot” for space

stations, using AI control & teleoperations. The

prototype robot was launched to the ISS in August 2021

and is currently undergoing testing on the space

station. Other startups in the Japanese space sector

that are among the leaders in their respective fields

include Infostellar (TT&C), WARPSPACE (optical comms)

and Skygate Technologies (TT&C).

Finally, Japan

is home to several of the most ambitious billionaires in

the space sector. Masayoshi Son, CEO of Softbank, is

well-known within the industry as one of the original

backers of OneWeb, and as a continued advocate for

global internet connectivity to enable an IoT-dominated

future. As is the case with companies like Gitai (albeit

at a smaller scale), Son is, at least in part, counting

on lower launch costs to enable significantly more

satellites to be launched.

Yusaku

Maezawa is perhaps less well-known in the west, but the

billionaire fashion designer is likely to become very

famous in the space sector over the coming years, having

booked a Starship trip around the moon for ~2023

timeframe. The mission, nicknamed #dearMoon by Yusaku,

is planned to be an art project and media stunt, with

Yusaku scheduled to be joined by a team of artists and

designers. While it is not clear what demand will exist

for Moon-related fashion and art, the creativity and

audacity of the plan is nothing if not impressive.

Conclusions--Where to Next for Japan’s Commercial Space

Sector?

Despite being a

major contributor to international missions, and despite

having arguably one of the top 5 space programs in the

world, the Japanese space sector has flown

under-the-radar for years. This is partly due to it

being a sector that has historically been dominated by

very big companies that do big things well but have a

certain culture that is less international, and partly

due to structures put in place by the government. This

is starting to change, as Japanese commercial space

companies have begun to play a bigger role in emerging

verticals and in their country’s space sector more

generally, with support from the government and private

players.

We have seen

over the past 5-10 years the emergence of a handful of

leading Japanese commercial space companies, and this

trend is just getting started. These companies have done

things differently, and in some cases, have created, or

are starting to create, completely new markets,

everything from cleaning up low earth orbit to making a

Moon mission into a global publicity stunt. These

companies can draw from a pool of experienced technical

talent, with a supportive government and conglomerates

that are looking for new growth avenues.

Whether it’s a

startup with an international founding team, or the

Yamauchi Family of Nintendo fame pouring millions into

startups to help invigorate the Japanese culture of

innovation, we should expect to see great things from

the commercial space sector in the Land of the Rising

Sun over the coming years.

SAVE THE DATE -

Australasia Satellite Forum 2022

14 & 15 June 2022

|

|