Will China Compete with OneWeb and SpaceX for Global Satellite

Internet Domination?

by Blaine Curcio, Founder of Orbital Gateway Consulting

Up to this point, the overwhelming

majority of companies looking to launch LEO broadband satellite

constellations have come from the United States, and to some

extent Western Europe. This includes the two frontrunners—SpaceX

and OneWeb—as well as several other serious contenders for

regionally focused programs, or programs targeting specific

niches, i.e. Telesat, LeoSat, and in the longer-term,

potentially players like Boeing.

However, an emerging space power with

ambitions spanning launch, satellite manufacturing, further

development of its own space stations, and a plethora of other

aerospace industries, is likely to enter the LEO satellite

broadband race sooner rather than later. The emerging power I

refer to is, of course, China.

China’s space

program has evolved rapidly over the past few decades. As the

chart at right showing launches per year implies, China’s space

program as recently as the early 1970s was about as potent as

that of universities such as Caltech. How times have changed,

and China is now arguably the second-strongest space-faring

nation in the world behind only the United States.

The country has likewise developed a more

commercial attitude towards space. No longer simply a scientific

research field, the Chinese space industry has, over the past 12

months alone, sold (and also financed) communications satellites

worth hundreds of millions of USD each to, among others,

customers in

Nigeria,

Indonesia, and

Cambodia. These

GEO satellites are increasingly capable and the payloads are

increasingly large.

Mid-2017 saw China launch its first

high-throughput satellite (HTS).

Most notably for the LEO players, though, multiple Chinese

companies have announced plans for LEO broadband constellations,

begging the question of what might a world with a Chinese and a

US LEO broadband constellation look like?

China’s LEO Ambitions

Given that China’s CASIC and CASC (two

government-owned companies that combined are basically

combination of Boeing, Lockheed Martin, Northrop Grumman, and

NASA) have announced plans for a LEO broadband constellation

(link in Chinese), it appears clear that the government is in

favor of developing this technology. In addition, numerous

private companies, most notably Beijing Xinwei—a company best

known for having agreed to buy Israel’s Spacecom just weeks

before the latter company’s Amos-6 satellite blew up on the

launch pad—have announced plans for LEO broadband constellations

as well (though admittedly, this is likely more talk than action

at the moment). Like most major infrastructure projects coming

out of China today (lest we forget, Internet is also

infrastructure), these projects have a number of motivations,

including financial, geopolitical, technological, and possibly

psychological. Also like most major projects coming out of China

today, there is likely a fairly well-defined long-term plan,

even if that plan is not readily apparent right now. China’s LEO

constellation ambitions will likely involve the following:

·

Significant tie-in to One Belt, One

Road (OBOR). This highly nebulous phrase is used shockingly

frequently in Chinese media, conferences, and everyday

conversation. In short, it refers to a massive infrastructure

plan across much of Eurasia, however the program ultimately

appears open to basically any country except the US, Japan,

India, and a few other allies. OBOR has been used as

justification for many projects already, and it is likely that

any LEO constellation would have OBOR written all over it. An

article I published last year goes into more detail on China’s

OBOR ambitions as it pertains to space in general.

·

Significant degree of government

control. This may make it significantly more difficult for an

eventual “winner-take-all” scenario in terms of global LEO

broadband services. Even if, as I’ve speculated in this article,

SpaceX and OneWeb manage to have some sort of partnership, it’s

unlikely that the Chinese government would allow something as

sensitive as provision of Internet access involve a foreign

entity. China currently heavily censors its Internet, and it’s

unlikely to cede market access to western companies in this

industry. It should be noted that this is in sharp contrast to

the outcome in China’s ride-hailing wars, whereby Didi Chuxing,

China’s national champion, and Uber, the US’s national champion,

laid down their arms and agreed to cooperate rather than

continuing to burn through billions of dollars per year in

subsidies. Takeaway: ride-hailing is not as critical as

Internet.

·

A direct competition with SpaceX

and OneWeb? If China launches a LEO-HTS constellation, it will

almost by definition need to be more or less global in coverage,

this due to the nature of LEO orbit. Unless China plans on being

extraordinarily wasteful and simply utilizing capacity over

China while capacity over the other 96% of the earth’s surface

is idle, capacity will be sold abroad. If LEO broadband becomes

a viable way of connecting the unconnected, look to China to

move into many different markets selling this service. The most

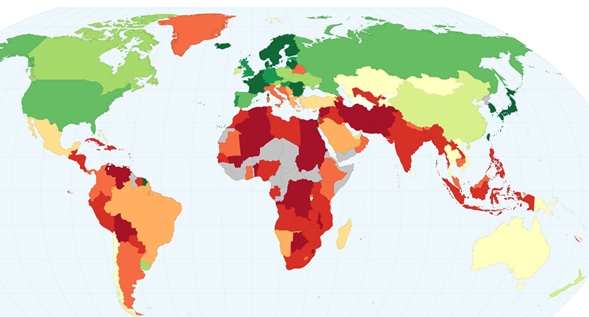

obvious suspects would be OBOR countries. As the map below

shows, many of the countries that fall within OBOR’s scope are

the very same countries with poor Internet access. Deep-pocketed

China could see a compelling opportunity to provide a hugely

critical piece of infrastructure to countries that it is already

trying to bring into its orbit. What better way to become an

indispensable ally to a given developing country than to

provide

Internet infrastructure to its unconnected? As anyone reading

this article can attest, once you’ve become accustomed to having

it, Internet is basically in the same league as food and water

as it pertains to daily necessities. Providing Internet to a

meaningful percentage of a population would put China in a very

strong position in many of these

provide

Internet infrastructure to its unconnected? As anyone reading

this article can attest, once you’ve become accustomed to having

it, Internet is basically in the same league as food and water

as it pertains to daily necessities. Providing Internet to a

meaningful percentage of a population would put China in a very

strong position in many of these

countries,

and potentially enable them to control access to the Internet

for tens or hundreds of millions of people outside its borders

(which might be an appealing/subsidy-worthy goal in itself).

countries,

and potentially enable them to control access to the Internet

for tens or hundreds of millions of people outside its borders

(which might be an appealing/subsidy-worthy goal in itself).

Up to now, the LEO broadband constellation

plans coming out of China are decidedly more modest than those

of SpaceX and OneWeb, with China’s generally numbering in the

hundreds rather than 1000+ satellites. However, the rapid growth

in China’s space industry in general, and specifically in

manufacturing, launch, and HTS capabilities, mean that if LEO

broadband starts to look like a viable way to connect tens or

hundreds of millions of people, China would likely jump into the

ring. Under the guise of the country’s massive infrastructure

initiatives, there could be an aggressive land-grab phase for

market access across the developing world.

This should

be considered a warning to the SpaceX’s and OneWeb’s of the

world—this is a dangerous game to play. If the LEO broadband

business model fails spectacularly, then you lose. If LEO

broadband looks like a winner, then you will have precious

little time to establish a presence across a variety of markets,

before China Inc. comes knocking. Just ask Uber in their

secondary home turf, Mexico.